International Tax Documents

Cross-Border Taxation

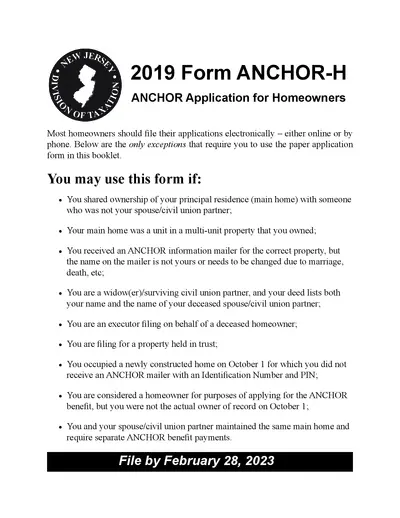

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

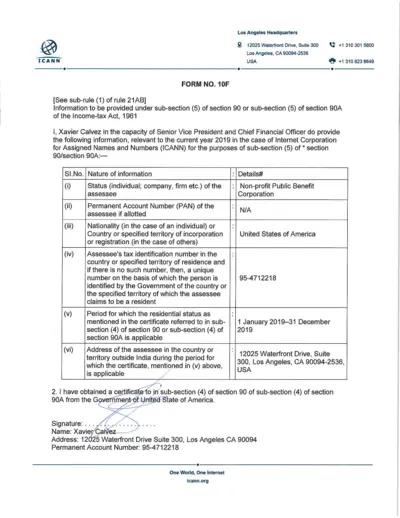

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

Cross-Border Taxation

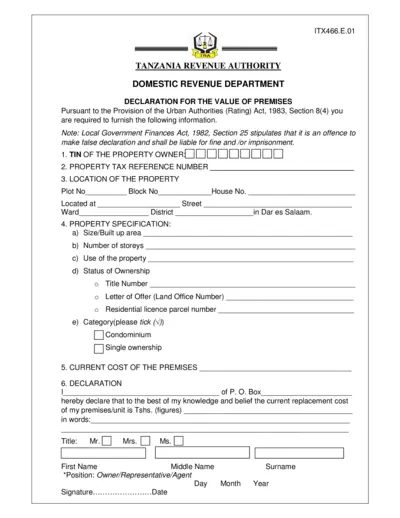

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

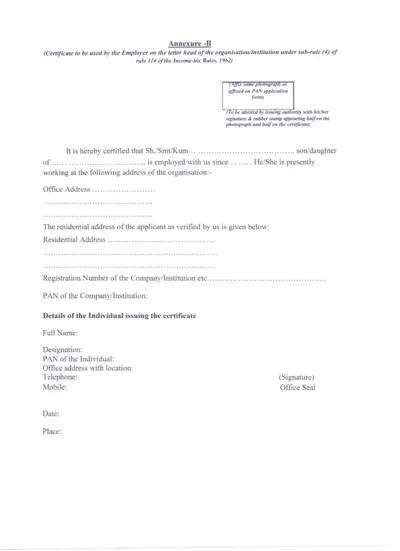

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

Cross-Border Taxation

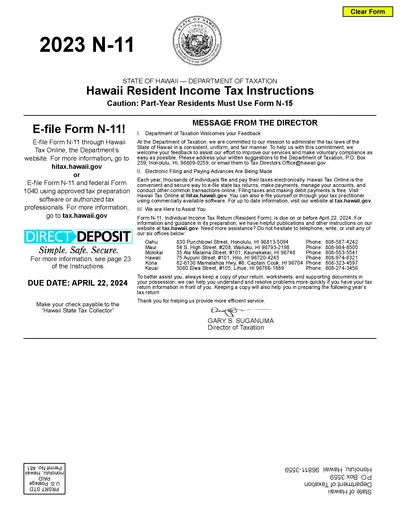

Hawaii Resident Income Tax Instructions 2023

This document provides instructions for Hawaii residents to file their 2023 state income tax returns. It includes details on electronic filing, important reminders, changes to tax laws, and more. Ensure your tax return is accurate and complete following these guidelines.

Cross-Border Taxation

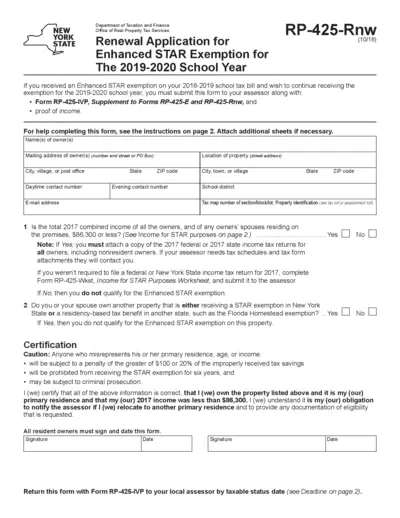

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

Cross-Border Taxation

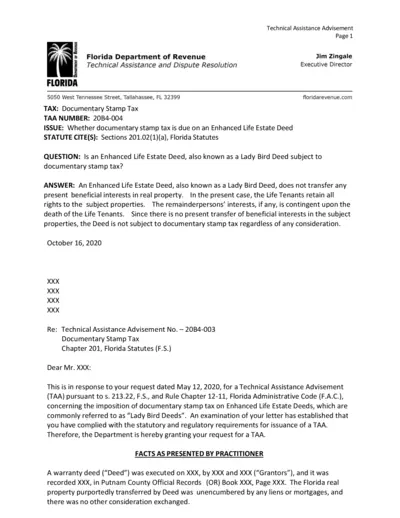

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

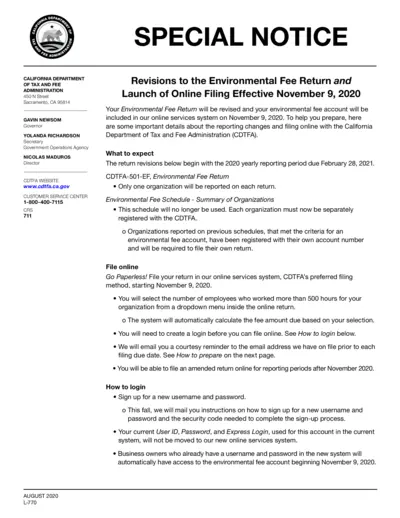

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

Cross-Border Taxation

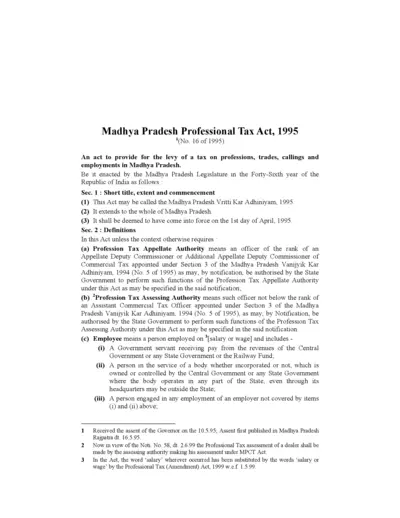

Madhya Pradesh Professional Tax Act, 1995 Information

This document provides details about the Madhya Pradesh Professional Tax Act, 1995. It includes definitions and guidelines for the levy and collection of professional tax in Madhya Pradesh. Essential for individuals and businesses affected by this tax regulation.

Cross-Border Taxation

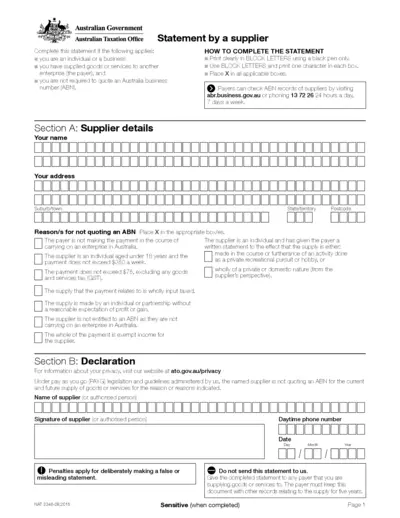

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

Cross-Border Taxation

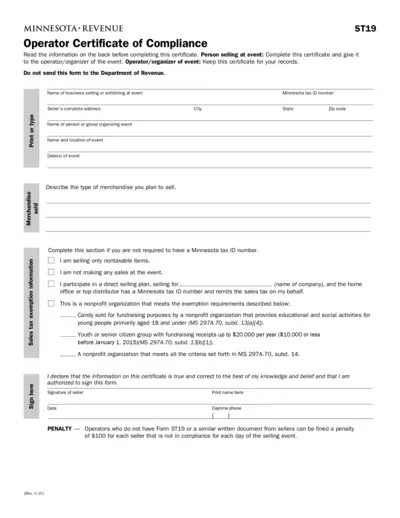

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.

Cross-Border Taxation

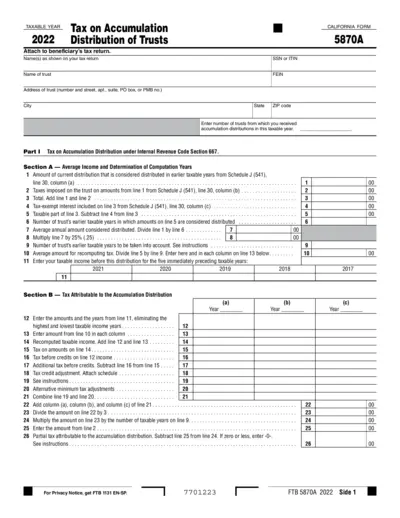

Tax on Accumulation and Distribution of Trusts 2022

This file provides instructions and fields for calculating tax on accumulation and distribution of trusts for the 2022 taxable year. It should be attached to the beneficiary's tax return. The form includes sections for tax computation, distribution of previously untaxed trust income, and mental health services tax.