Accounting I Chapter 3 Journalizing Transactions

This file provides a comprehensive guide to journalizing transactions in accounting. It covers essential concepts, methods, and common source documents used in the process. Perfect for students and educators looking to reinforce their understanding of accounting basics.

Edit, Download, and Sign the Accounting I Chapter 3 Journalizing Transactions

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this file, start by reviewing the instructions provided. Organize your entries chronologically and ensure accurate classification of accounts. Finally, double-check your entries for accuracy before finalizing your work.

How to fill out the Accounting I Chapter 3 Journalizing Transactions?

1

Review the transaction details outlined in the document.

2

Determine which accounts are affected for each transaction.

3

Classify the accounts based on the nature of the transaction.

4

Record the appropriate debit and credit amounts.

5

Reference and attach any relevant source documents.

Who needs the Accounting I Chapter 3 Journalizing Transactions?

1

Accounting students who are learning journal entries.

2

Business educators who need instructional materials.

3

Professionals preparing for accounting exams.

4

Entrepreneurs managing their business finances.

5

Anyone needing a reference for double-entry accounting.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Accounting I Chapter 3 Journalizing Transactions along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Accounting I Chapter 3 Journalizing Transactions online.

You can edit this PDF on PrintFriendly by opening the file and selecting the 'Edit' option. This provides you with tools to modify text and adjust formatting as needed. Save your changes and download the updated document for your records.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is simple and straightforward. Access the file, select the 'Sign' option, and follow the prompts to add your signature electronically. Once signed, you can download the finalized document.

Share your form instantly.

Sharing the PDF on PrintFriendly is made easy with a simple click. Choose the 'Share' option to generate a link or share directly via email. This allows you to distribute the document efficiently with others.

How do I edit the Accounting I Chapter 3 Journalizing Transactions online?

You can edit this PDF on PrintFriendly by opening the file and selecting the 'Edit' option. This provides you with tools to modify text and adjust formatting as needed. Save your changes and download the updated document for your records.

1

Open the PDF in PrintFriendly.

2

Select the 'Edit' feature to begin modifying text.

3

Use the tools available to make necessary changes.

4

Preview your edits to ensure they meet your needs.

5

Download the edited document for future use.

What are the instructions for submitting this form?

To submit this form, please compile all completed journal entries. You can submit online via our platform or print and send to the appropriate address. Ensure to check the deadlines and follow the submission guidelines provided.

What are the important dates for this form in 2024 and 2025?

Important dates for this form include submission deadlines relevant for accounting courses or assessments. Please ensure to check your academic calendar for specific dates in 2024 and 2025 related to journal entries.

What is the purpose of this form?

The purpose of this form is to provide a structured format for recording accounting transactions accurately. It serves as a foundational tool for understanding double-entry accounting principles. Users can practice their skills in class assignments or work-related tasks.

Tell me about this form and its components and fields line-by-line.

- 1. Date: The specific date when the transaction occurred.

- 2. Debit: The amount entering the account.

- 3. Credit: The amount leaving the account.

- 4. Source Document: Reference to the document supporting the transaction.

What happens if I fail to submit this form?

Failing to submit this form may lead to incomplete accounting records.

- Missing Entries: Inaccurate accounting records due to missing information.

- Assessment Issues: Potential issues with academic assessments or professional applications.

How do I know when to use this form?

- 1. In-Class Assignments: Used to practice journal entries as part of coursework.

- 2. Business Record Keeping: Essential for maintaining accurate financial records.

Frequently Asked Questions

How can I download this file?

You can easily download the file after making your edits by clicking the 'Download' button.

Is there a limit to how many times I can edit?

There is no limit to how many times you can edit and download the PDF.

Can I print the PDF after editing?

Yes, you can print the PDF directly from PrintFriendly after editing.

What if I forget to save my edits?

Your changes can be saved at any time during the editing process.

Can I edit images within the PDF?

Currently, the editing features focus on text, but you can adjust layout settings for images.

Is it necessary to sign after editing?

Signing is optional and based on your needs for finalizing the document.

Are updates reflected in real-time?

Yes, any edits you make will reflect in real-time while you work.

Can I share my edited PDF with others?

Yes, you can share the edited PDF using the sharing features provided.

Is there a help section for troubleshooting?

Absolutely, we have detailed help sections available for any questions you may have.

What file formats can I use to download?

You can download the file solely in PDF format after editing.

Related Documents - Accounting Journal 3

Test on Transformations Form 3B - Geometry Practice

This file contains a geometry practice test focused on transformations, including reflections, dilations, rotations, and translations. Each question requires you to find coordinates, scale factors, and to classify transformations. It is intended for educational use to reinforce students' understanding of geometric transformations.

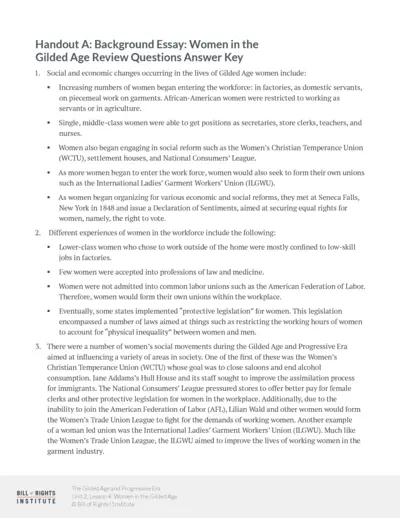

Women in the Gilded Age: Social & Economic Changes

This file provides comprehensive information about the social and economic changes in the lives of women during the Gilded Age. It reviews the key movements, organizations, and events that influenced women's rights and societal roles. This is an essential resource for understanding the historical context and progress of women's suffrage.

Understanding and Applying Fourth Normal Form (4NF) in Databases

This file provides detailed instructions on the Fourth Normal Form (4NF) in database normalization. It includes explanations of multi-valued dependencies that can cause data redundancy and how to address them. Useful for database designers and students.

Spelling Practice Printables - Fun Word Work Activities

This file contains a variety of spelling practice printables designed to make word work engaging and enjoyable. It includes activities such as Color, Roll, and Write, encouraging students to practice their spelling words in a fun way. Perfect for classroom use or at-home practice.

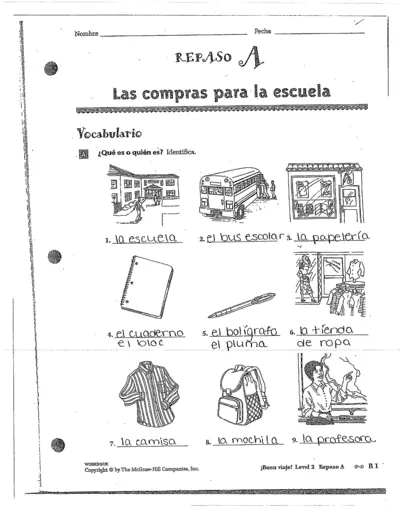

Buen Viaje Level 2 Workbook - School Vocabulary and Verbs

This file is a workbook titled '¡Buen viaje! Level 2 Repaso A' that focuses on school-related vocabulary and verb conjugation exercises in Spanish. It includes activities to identify school-related items, complete sentences based on drawings, and fill in blanks with the correct present tense verb forms. Ideal for students and educators practicing Spanish language skills.

ABC Spelling Test Form - Teacher's Grade Record

This form is used for recording spelling test grades for students. It includes spaces for the total number of missed words and bonus word correctness. Teachers can also track review words from the previous week.

CVES AIE Ticket Request Form

This file is a CVES AIE Ticket Request Form used for requesting tickets for performing arts events, museum visits, and educational enrichment programs. It includes sections for district authorization and detailed information on the event and ticket counts. The form must be fully completed for approval.

Food Order Web Application Using React

This document describes the development of a web application using React for customers to make online food purchases. It aims to create a user-friendly application by utilizing interaction design principles and usability goals. The project demonstrates the ease of use and efficiency of the application and offers suggestions for further development.

MCAT Critical Analysis and Reasoning Skills Workbook 2016

The Princeton Review's MCAT Critical Analysis and Reasoning Skills Workbook 2016 Edition is a comprehensive resource for students preparing for the MCAT exam. This workbook includes practice passages and solutions, as well as multiple practice tests with answer keys and detailed solutions. It is designed to help students enhance their critical analysis and reasoning skills, which are essential for success on the MCAT.

AIFS, AYA Medical Authorization Release Form

This file is a medical authorization release form for participants of the AIFS Foundation's Academic Year in America program. It authorizes staff, host parents, and local coordinators to consent to any necessary medical procedures for the participant. The form needs to be completed and signed by the participant's parents or guardians.

Noble Gas Envy and Ion Charges Lesson

This file provides lessons and insights on the chemical stability of noble gases, the reactivity of elements in Groups 1A and 7A, and the patterns in ion charges. Ideal for students and educators, it explores the concepts with practical examples. Each page is structured to enhance understanding of atomic electron arrangements.

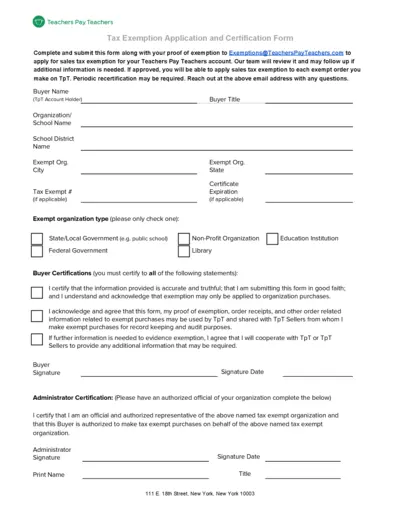

Teachers Pay Teachers Tax Exemption Application and Certification

This form is for applying for a sales tax exemption for your Teachers Pay Teachers account. Submit it with proof of exemption to the provided email. Periodic recertification may be required.