Arizona Employee Withholding Election Instructions

This file provides essential instructions for Arizona employees regarding their withholding election. It outlines procedures for new and current employees to complete the Arizona Form A-4. The document also includes information for nonresidents and important deadlines.

Edit, Download, and Sign the Arizona Employee Withholding Election Instructions

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, start by accurately entering your personal information. Next, indicate your desired withholding percentage based on your tax situation. Finally, sign and date the form before submission.

How to fill out the Arizona Employee Withholding Election Instructions?

1

Obtain Form A-4 from your employer.

2

Fill in your personal information accurately.

3

Choose your withholding percentage or elect zero.

4

Sign and date the form.

5

Submit the form to your employer.

Who needs the Arizona Employee Withholding Election Instructions?

1

New employees needing to elect Arizona withholding.

2

Current employees wishing to change their withholding percentage.

3

Nonresident employees wanting to voluntarily elect withholding.

4

Employers needing to inform employees about withholding options.

5

Employees wanting to ensure proper tax withholdings based on their income.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Arizona Employee Withholding Election Instructions along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Arizona Employee Withholding Election Instructions online.

Editing this PDF on PrintFriendly is simple and intuitive. Just upload your document and use the editing tools to modify text and fields. Once you're satisfied with the changes, download the edited PDF immediately.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is straightforward. Use the designated signature tool to add your name or initials to the document. Review your signature placement before downloading the signed PDF.

Share your form instantly.

Sharing the PDF on PrintFriendly allows for easy distribution. After editing or signing, simply use the share options to send the document. You can share via email or generate a shareable link.

How do I edit the Arizona Employee Withholding Election Instructions online?

Editing this PDF on PrintFriendly is simple and intuitive. Just upload your document and use the editing tools to modify text and fields. Once you're satisfied with the changes, download the edited PDF immediately.

1

Upload the PDF file to PrintFriendly.

2

Use the editing tools to make necessary changes.

3

Add text where needed and adjust formatting.

4

Review the document for accuracy.

5

Download the edited PDF to save your changes.

What are the instructions for submitting this form?

Submit Form A-4 to your employer directly. For fax submissions, use (602) 255-3382. You may also mail the completed form to the Arizona Department of Revenue at 1600 W Monroe St, Phoenix, AZ 85007. Ensure all contact information is accurate for timely processing.

What are the important dates for this form in 2024 and 2025?

For the tax year 2024, forms should be submitted by December 31, 2024, to ensure proper withholding for the upcoming year. For tax year 2025, make sure to submit updates by the December 31 deadline as well. Annual renewal of exemptions for employees claiming them is necessary and should also be completed by year-end.

What is the purpose of this form?

The Arizona Withholding Election Form A-4 is designed to help employees manage their withholding rates for state income tax effectively. By filling out this form, employees can choose their withholding percentage or elect for an exemption. This ensures that the amount withheld aligns with their expected income tax liability for the year.

Tell me about this form and its components and fields line-by-line.

- 1. Name: The employee's full name.

- 2. Address: The employee's residential address.

- 3. Social Security Number: The employee's unique social security identifier.

- 4. Withholding Percentage: The percentage of income the employee wishes to withhold.

- 5. Signature: The employee's signature to validate the form.

- 6. Date: The date when the form is completed.

What happens if I fail to submit this form?

Failing to submit the Form A-4 can result in a default withholding rate of 2.7% applied to your gross wages. This may lead to over-withholding or under-withholding during the tax year. It's essential to submit the form to specify your personal withholding preferences accurately.

- Higher Tax Liability: You may pay more in taxes than necessary if exempt status isn't claimed.

- Cash Flow Impact: Automatic withholding could affect your monthly cash availability.

- Irregular Withholding: Failure may lead to inconsistent tax withholdings throughout the year.

How do I know when to use this form?

- 1. Starting a New Job: New employees should complete Form A-4 within their first five days of employment.

- 2. Changing Withholding Preferences: Current employees wishing to modify their existing withholding percentage must fill out the form.

- 3. Voluntary Withholding for Nonresidents: Nonresidents can use this form to elect withholding of Arizona taxes voluntarily.

Frequently Asked Questions

How do I edit the PDF?

Upload your PDF to PrintFriendly and access the editing tools.

Can I share the PDF after editing?

Yes, you can share the edited PDF via email or a shareable link.

How do I sign the PDF?

Use the signature tool to add your signature before downloading.

What if I need to change my withholding percentage?

Complete Form A-4 to change your election as needed.

Is there a way to save my work?

You can download your edited document immediately.

What happens if I don't submit the Form A-4?

You may face automatic withholding at a default rate.

Can nonresident employees use this form?

Yes, they can elect voluntary withholding.

How do employees access Form A-4?

Employers are required to provide this form to all employees.

What is the purpose of Form A-4?

It allows employees to indicate their Arizona income tax withholding preferences.

Do I need to renew my exemption each year?

Yes, employees claiming an exemption must renew it annually.

Related Documents - AZ Withholding Election

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

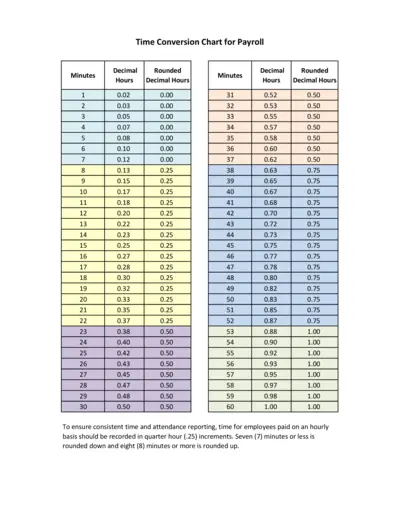

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

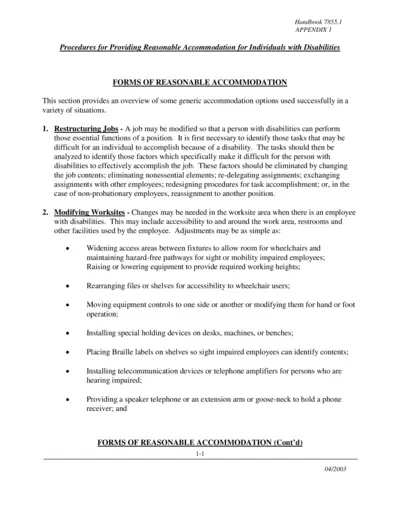

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

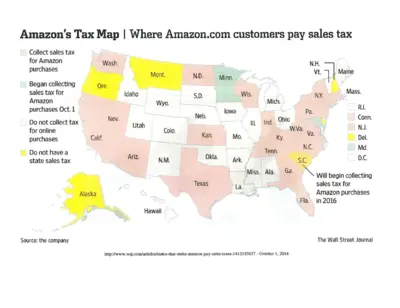

Amazon Sales Tax Map and Collection Details

This document provides a map of U.S. states where Amazon collects sales taxes and details the reasons for tax collection. It includes information on states with physical Amazon facilities, affiliate nexus laws, and states that will begin collecting taxes in the future. This is useful for understanding Amazon's tax obligations across states.

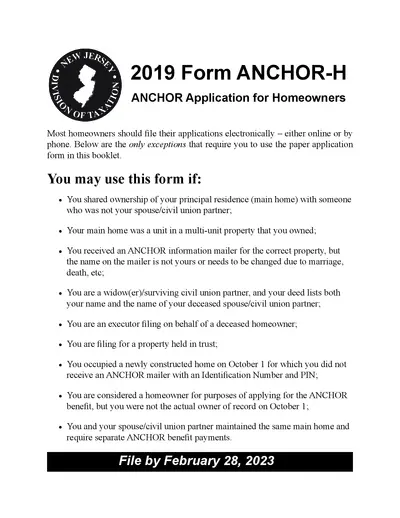

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

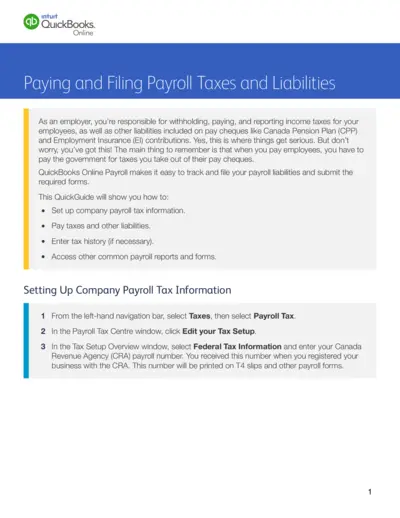

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

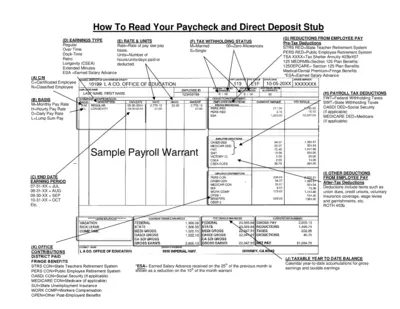

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

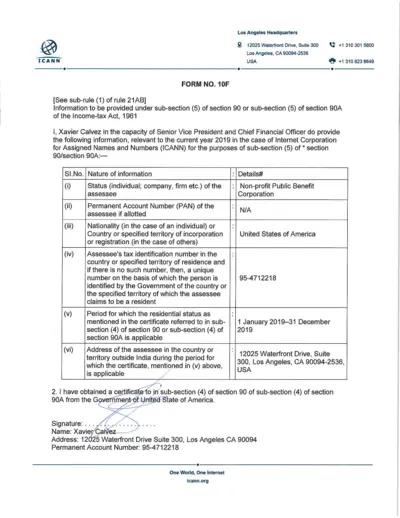

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

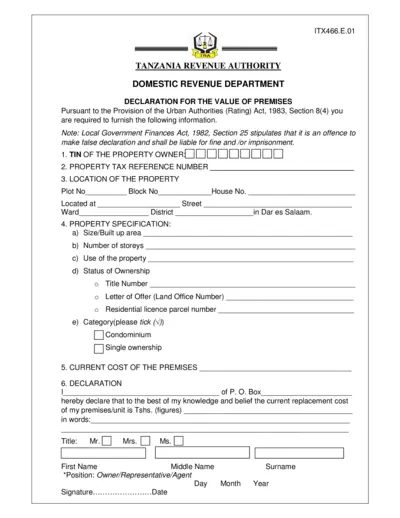

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

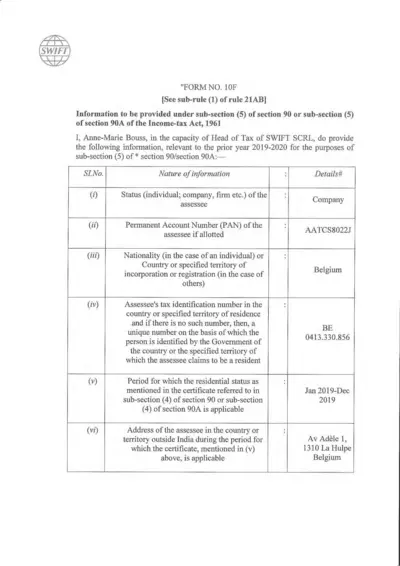

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

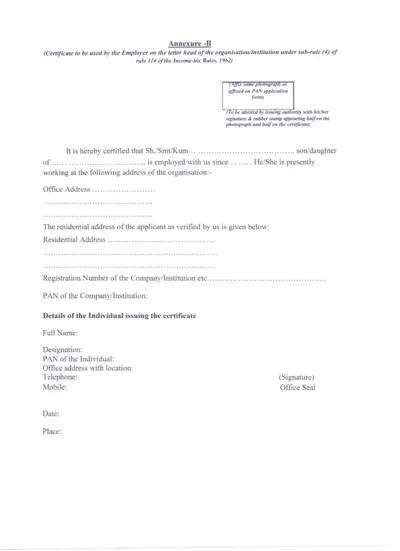

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

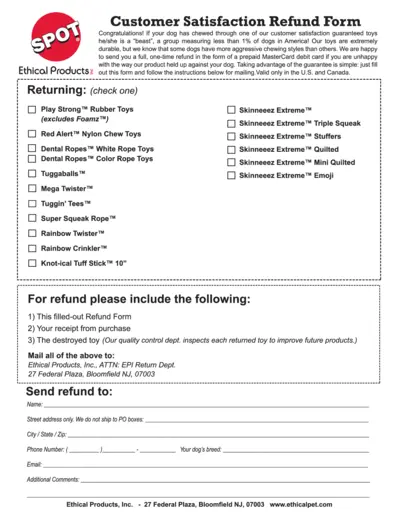

Customer Satisfaction Refund Form For Dog Toys

This file is a refund form for customer satisfaction guaranteed dog toys from Ethical Products Inc. If your dog has chewed through one of their durable toys, you can request a one-time refund using this form. Follow the instructions to obtain a refund via a prepaid MasterCard debit card.