AXIS BANK Commercial Card Application Form

Learn how to complete the AXIS BANK Commercial Card Application Form for individual corporate use. This comprehensive form is required for applicants seeking a corporate card with Axis Bank services. Ensure all mandatory fields are filled accurately to avoid processing delays.

Edit, Download, and Sign the AXIS BANK Commercial Card Application Form

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the AXIS BANK Commercial Card Application Form, start by gathering all required personal and corporate information. Carefully enter the details in each section, paying special attention to mandatory fields marked with an asterisk. Review your application for accuracy and completeness before submission.

How to fill out the AXIS BANK Commercial Card Application Form?

1

Gather all required documents and information.

2

Complete personal and corporate details as per the form.

3

Provide necessary identification and address proofs.

4

Review the entire application carefully.

5

Submit the application as instructed.

Who needs the AXIS BANK Commercial Card Application Form?

1

Corporate employees seeking a commercial card for work-related expenses.

2

New employees needing to establish a corporate expense account.

3

Human Resource departments managing employee financial tools.

4

Finance teams requiring additional credit for operational leads.

5

Existing Axis Bank customers looking to upgrade their services.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the AXIS BANK Commercial Card Application Form along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your AXIS BANK Commercial Card Application Form online.

You can easily edit this PDF on PrintFriendly by uploading it to our platform. Use our intuitive editor to modify text, images, and layouts according to your needs. Save your changes and download the revised document instantly.

Add your legally-binding signature.

Signing the PDF is simple with PrintFriendly. After editing your document, use the signature tool to add your signature easily. Once signed, you can save and download the finalized version of your PDF.

Share your form instantly.

Sharing your PDF on PrintFriendly is effortless. Once you have edited and finalized your document, you can generate a shareable link to distribute it. This feature allows for convenient access and collaboration with others.

How do I edit the AXIS BANK Commercial Card Application Form online?

You can easily edit this PDF on PrintFriendly by uploading it to our platform. Use our intuitive editor to modify text, images, and layouts according to your needs. Save your changes and download the revised document instantly.

1

Upload your PDF to the PrintFriendly platform.

2

Use the editing tools to make necessary changes.

3

Review your changes for accuracy and completeness.

4

Save the edited PDF to your device.

5

Share or print the revised document as needed.

What are the instructions for submitting this form?

To submit the AXIS BANK Commercial Card Application Form, download the completed PDF and email it to the designated corporate banking email at corporate@axisbank.com. Alternatively, you can fax your application to +91-XXXX-XXXX. For physical submissions, mail the documents to the nearest Axis Bank branch address provided on the form. Ensure that all supporting documents are included with your submission.

What are the important dates for this form in 2024 and 2025?

The application for the AXIS BANK Commercial Card should be submitted by January 31, 2024, to ensure processing by the beginning of the fiscal year. For any corporate card requests, please be mindful of submission deadlines prior to major corporate events or budget resets in 2025.

What is the purpose of this form?

The AXIS BANK Commercial Card Application Form is designed for individuals seeking to obtain a corporate card for business use. This form collects essential information to evaluate eligibility for the card and process the application smoothly. It also outlines the responsibilities of both the applicant and the corporate entity regarding card usage and compliance with banking regulations.

Tell me about this form and its components and fields line-by-line.

- 1. Company Name: The legal name of the organization applying for the card.

- 2. GST Number: The Goods and Services Tax identification number for the company.

- 3. Employee Code/ID: The identification number assigned to the applicant by the company.

- 4. PAN Number: The Permanent Account Number for tax identification.

- 5. Aadhaar Number: The unique identification number issued by the government.

- 6. Date of Birth: Applicant's birth date for personal identification.

- 7. Office Address: The corporate office address of the applicant.

- 8. Designation: The applicant’s job title within the organization.

- 9. Relationship with Axis Bank: Indicates whether the applicant is a priority or existing customer.

- 10. Number of Cards: Specifies the total cards requested through this application.

What happens if I fail to submit this form?

If the application form is not submitted correctly or is incomplete, the processing of the request may be delayed. Missing information may require you to resubmit the form, which extends the timeline for receiving the card. Ensure all mandatory fields are completed to avoid complications.

- Delayed Processing: Incomplete applications can result in longer wait times for card issuance.

- Rejection of Application: Failure to provide necessary information may lead to rejection.

- Increased Administrative Work: Errors or omissions necessitate additional processing steps that could be avoided.

How do I know when to use this form?

- 1. Corporate Expenses: To manage and track business-related expenses through a dedicated corporate card.

- 2. New Employee Onboarding: For new hires who need a corporate credit resource upon starting.

- 3. Existing Bank Customer Requests: For existing customers looking to expand their card capabilities.

Frequently Asked Questions

How do I access the AXIS BANK Commercial Card Application Form?

You can access it directly from our website and download the PDF.

What documents are required to complete the application?

You will need your PAN card, a valid photo ID, and proof of residence.

Is there any fee associated with the application?

Fees may apply. Please refer to the MITC online for details.

How can I edit this form before submitting?

Use our editing tool on PrintFriendly to modify the PDF as needed.

Can I save my progress on the application?

While you can edit and download, saving progress on the site is not currently offered.

How do I submit the completed form?

Follow the instructions provided in the form for submission via email or mail.

What if I make a mistake on my application?

You can easily edit the PDF again using PrintFriendly before resubmitting.

Are all fields mandatory on the application form?

Yes, ensure all fields marked with an asterisk are filled out.

Can I print the application once it's filled out?

Yes, after editing, you can print the final version of your application.

What happens if my application is incomplete?

Incomplete applications may be delayed or rejected, so ensure accuracy before submission.

Related Documents - AXIS BANK Card Application

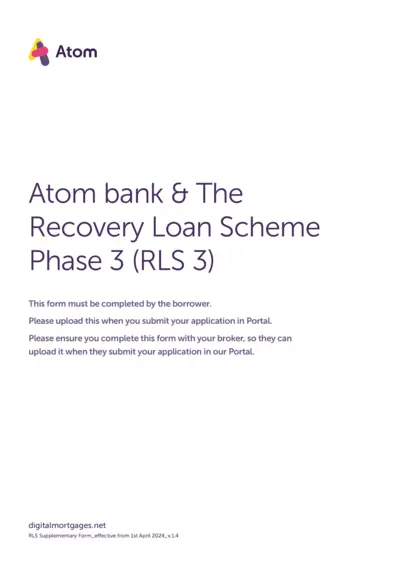

Recovery Loan Scheme Phase 3 Application Form

This file provides guidance and instructions for UK businesses to apply for secured loans under the government-backed Recovery Loan Scheme (RLS) Phase 3 with Atom bank.

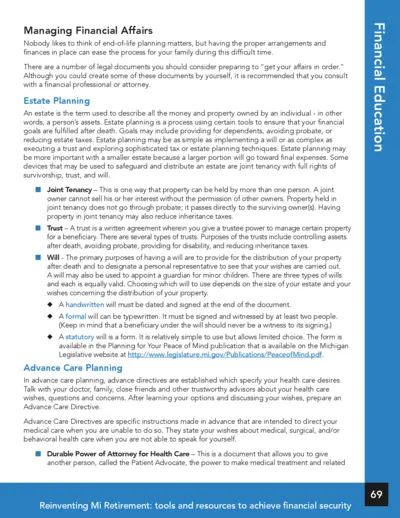

Managing Financial Affairs and Estate Planning Guide

This file provides detailed guidance on managing financial affairs and estate planning. It covers crucial legal documents and advance care planning. It also includes information on funeral planning and resources for end-of-life concerns.

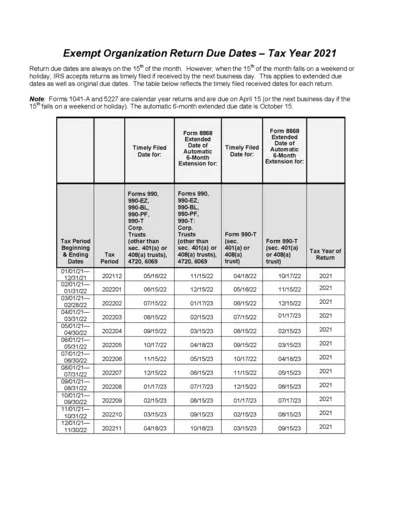

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

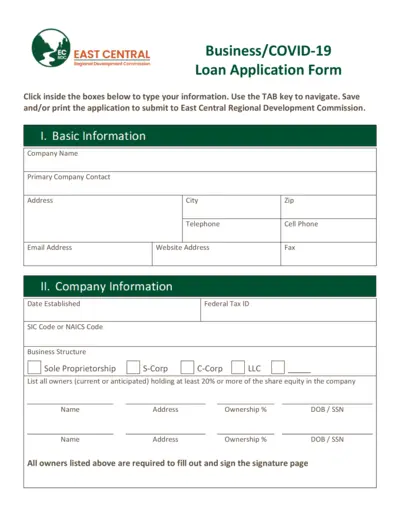

Business/COVID-19 Loan Application - East Central Regional Development Commission

This file is a loan application form provided by the East Central Regional Development Commission for businesses affected by COVID-19. It includes sections for basic information, company information, requested amount, sources and use of funds, proposed financing terms, job creation, and business profile. The application can be filled out, saved, and printed for submission.

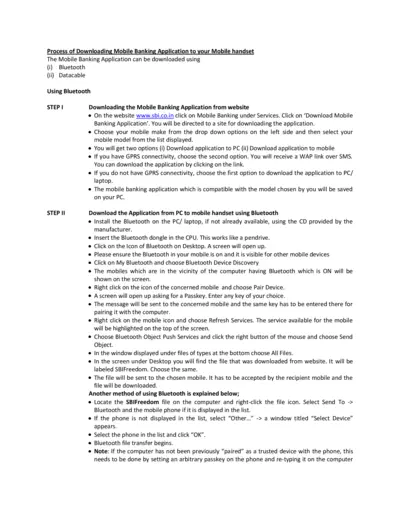

Mobile Banking Application Download Guide

This document guides you through the process of downloading the SBI Mobile Banking application to your phone using either Bluetooth or a data cable. Detailed steps are provided for both methods to ensure a smooth installation. Ensure you follow each step carefully for successful application setup.

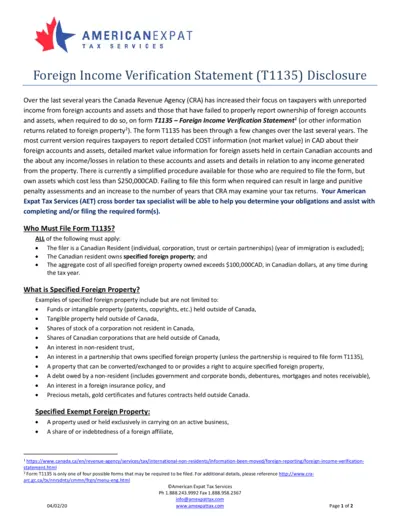

Foreign Income Verification Statement (T1135) Information

This document provides detailed guidelines about the Foreign Income Verification Statement (T1135) disclosure. It explains who must file it, what foreign properties must be reported, and the penalties for non-compliance. There are also instructions on how to file the form and how a tax specialist can assist.

The Modernization of Annuities: Insights for RIAs and Clients

This file provides detailed information on the modernization of annuities, designed for registered investment advisors (RIAs) and wealth managers. It covers types of annuities, their benefits, and how they integrate with financial planning tools. It also includes statistical insights on the use of annuities by pre-retirees and retirees.

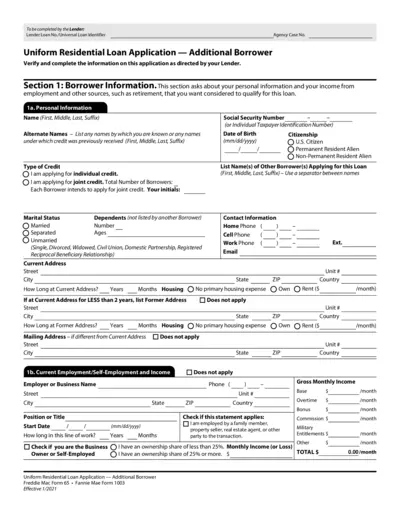

Uniform Residential Loan Application - Additional Borrower

This file is a Uniform Residential Loan Application for an additional borrower. It includes sections to fill out personal information, employment details, income sources, and other financial information required for a loan application. The file is intended to be completed by the lender and borrower.

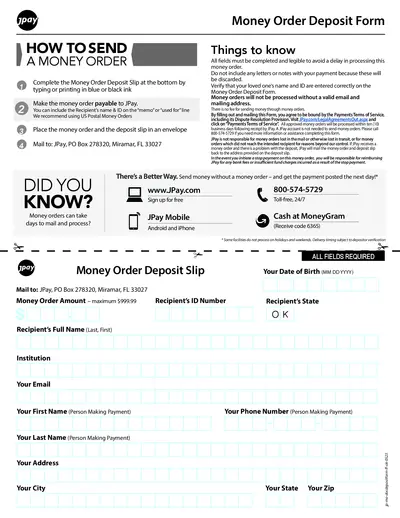

How to Send a Money Order with JPay

This document provides step-by-step instructions on sending a money order through JPay. It includes a fillable deposit slip form and important guidelines for completing and mailing your money order. Ensure all details are correct to avoid processing delays.

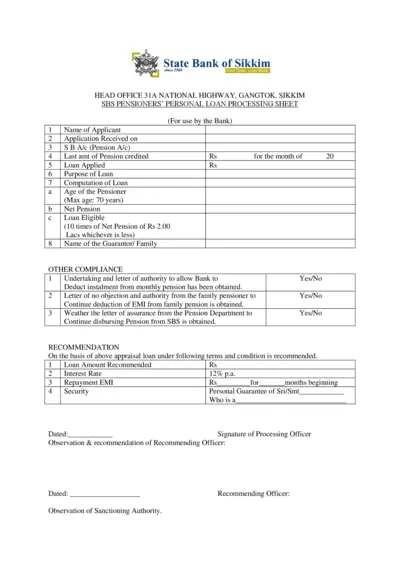

SBS Pensioners Personal Loan Processing Sheet

This document is a processing sheet for the SBS Pensioners Personal Loan for pensioners seeking loans from the State Bank of Sikkim. It guides applicants through the necessary details required for loan processing and approval. The form includes sections for applicant information, loan eligibility, and required compliance documents.

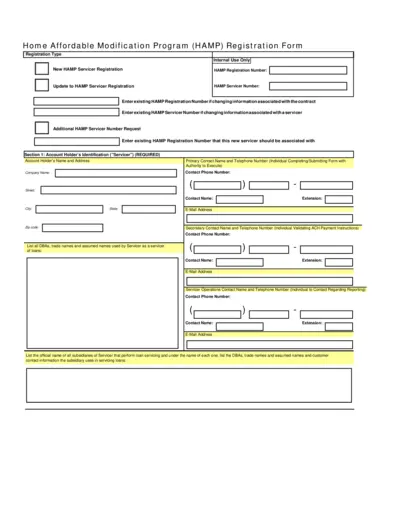

Home Affordable Modification Program Registration

This file provides essential instructions for servicers in the Home Affordable Modification Program (HAMP). It includes details about registration, ACH payment instructions, and contact information requirements. Utilize this form to ensure compliance with HAMP regulations.

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.