Bookkeeping Payroll QuickBooks Services Agreement

This agreement outlines the terms and conditions between F Pederson Consulting LLC and the client for bookkeeping, payroll, and QuickBooks services. It provides detailed information on services offered, fees, payment terms, and client obligations. This document is essential for clients seeking professional financial services.

Edit, Download, and Sign the Bookkeeping Payroll QuickBooks Services Agreement

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this agreement, start by providing the required client information, including your name and address. Next, review and select the services you wish to receive from F Pederson Consulting LLC. Finally, ensure all necessary fields are completed and sign the document to finalize your request.

How to fill out the Bookkeeping Payroll QuickBooks Services Agreement?

1

Review the agreement details carefully.

2

Provide your personal and business information.

3

Select the services you require.

4

Agree to the terms and conditions.

5

Sign the agreement to confirm your request.

Who needs the Bookkeeping Payroll QuickBooks Services Agreement?

1

Small business owners need this agreement to formalize bookkeeping and payroll services.

2

Freelancers require this document to outline clear terms with their accountant.

3

Corporations may need this agreement for compliance purposes with bookkeeping standards.

4

Non-profits seek this document to ensure proper financial management and reporting.

5

Clients requiring tax preparation can use this agreement to secure professional assistance.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Bookkeeping Payroll QuickBooks Services Agreement along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Bookkeeping Payroll QuickBooks Services Agreement online.

With PrintFriendly, editing this PDF is simple and efficient. You can easily adjust text, add or remove information, and ensure the document reflects your specific needs. Enjoy a user-friendly editing experience that makes customizing your agreement straightforward.

Add your legally-binding signature.

Signing your PDF document on PrintFriendly is a breeze. Utilize our integrated signature tool to sign the agreement digitally, ensuring it’s legally binding. This feature guarantees that your signed document is ready for submission without any hassle.

Share your form instantly.

Sharing your edited PDF is made easy with PrintFriendly. Once you've customized your document, share it seamlessly via email or through direct download links. This ensures that all relevant parties have access to the updated agreement promptly.

How do I edit the Bookkeeping Payroll QuickBooks Services Agreement online?

With PrintFriendly, editing this PDF is simple and efficient. You can easily adjust text, add or remove information, and ensure the document reflects your specific needs. Enjoy a user-friendly editing experience that makes customizing your agreement straightforward.

1

Open your document in the PrintFriendly editor.

2

Select the text you want to edit and make your changes.

3

Add any necessary information in the required fields.

4

Review the edited document for accuracy.

5

Download the finalized document for use.

What are the instructions for submitting this form?

To submit your completed agreement, email it to info@fpedersonconsulting.com. Alternatively, you can fax it to (123) 456-7890, or mail it to 305 S 4th St, Grand Forks, ND 58201. Ensure that all necessary fields are filled out and signed before submission to avoid delays in processing your request.

What are the important dates for this form in 2024 and 2025?

Important dates for submissions related to this agreement in 2024 include tax filing deadlines on April 15, June 15 for estimated payments, and December 31 for year-end financial reviews. For 2025, continue following the established tax schedules, ensuring accurate and timely submissions throughout the year. Being aware of these dates ensures compliance and smooth financial operations.

What is the purpose of this form?

The purpose of this form is to establish a formal agreement between the client and F Pederson Consulting LLC for bookkeeping, payroll, and QuickBooks services. It clarifies the responsibilities of each party, including fees, services provided, and obligations. Additionally, this agreement serves to protect both parties by ensuring clear communication and understanding of the terms for service.

Tell me about this form and its components and fields line-by-line.

- 1. Client Information: Includes the client's name, address, and contact details.

- 2. Services Selected: Clients must check off the services they wish to receive.

- 3. Fees Agreement: Details the payment terms and hourly rates for the services.

- 4. Acknowledgment: The client acknowledges they understand the terms outlined.

- 5. Signature: Required for the document to be legally binding.

What happens if I fail to submit this form?

Failure to submit this form may result in delays in receiving bookkeeping and payroll services. Without a signed agreement, F Pederson Consulting LLC may not be able to provide services, as clarity on terms and fees is essential. This agreement is pivotal in safeguarding both parties' rights and expectations.

- Delayed Services: Without submission, services cannot commence.

- Misunderstandings: No written agreement could lead to miscommunications.

- Financial Liabilities: Unclear terms may result in unexpected charges.

- Legal Issues: Lack of a signed agreement may complicate legal recourse.

- Non-compliance: Not having the document could lead to issues with regulatory compliance.

How do I know when to use this form?

- 1. Initial Service Agreement: To set the terms for first-time bookkeeping and payroll services.

- 2. Service Modifications: When services or terms need to be adjusted.

- 3. Annual Reviews: To review and update the agreement as needed at the end of the fiscal year.

- 4. New Client Engagement: For new clients seeking to formalize their service relationship.

- 5. Ongoing Service Maintenance: To ensure ongoing services are provided under agreed terms.

Frequently Asked Questions

How do I edit this PDF?

You can edit your PDF by opening it in the PrintFriendly editor and making changes directly.

Can I share this agreement after editing?

Yes, you can easily share your edited agreement by using the sharing options in PrintFriendly.

Is it possible to sign the PDF electronically?

Absolutely! You can use our built-in signature tool to sign your PDF quickly and securely.

What types of edits can I make?

You can change text, add new information, and remove unnecessary sections in your document.

Can I download the edited file?

Yes, once you've finished editing, you can download the updated file for your records.

Is there a help guide available?

Yes, we provide user guides within the PrintFriendly platform to assist you.

Can this document be filled out online?

Yes, you can fill out the document electronically using the PrintFriendly editor.

How do I ensure my changes are saved?

Once you've edited your PDF, download it to save your changes.

What if I need to edit again later?

You can upload the document back into PrintFriendly anytime to make further edits.

Will my edits affect the original document?

No, your edits are saved in a new file, leaving the original document unchanged.

Related Documents - Services Agreement

Recovery Loan Scheme Phase 3 Application Form

This file provides guidance and instructions for UK businesses to apply for secured loans under the government-backed Recovery Loan Scheme (RLS) Phase 3 with Atom bank.

Managing Financial Affairs and Estate Planning Guide

This file provides detailed guidance on managing financial affairs and estate planning. It covers crucial legal documents and advance care planning. It also includes information on funeral planning and resources for end-of-life concerns.

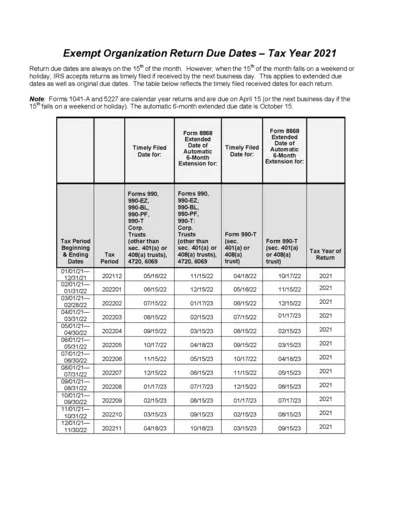

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

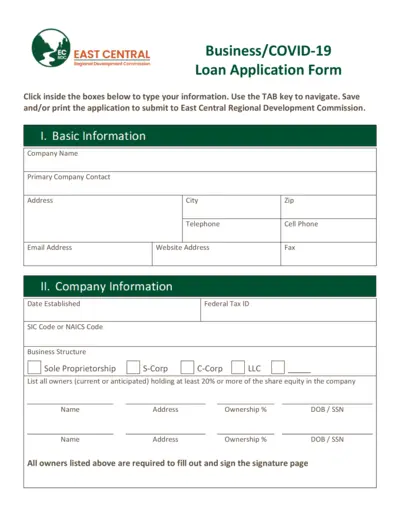

Business/COVID-19 Loan Application - East Central Regional Development Commission

This file is a loan application form provided by the East Central Regional Development Commission for businesses affected by COVID-19. It includes sections for basic information, company information, requested amount, sources and use of funds, proposed financing terms, job creation, and business profile. The application can be filled out, saved, and printed for submission.

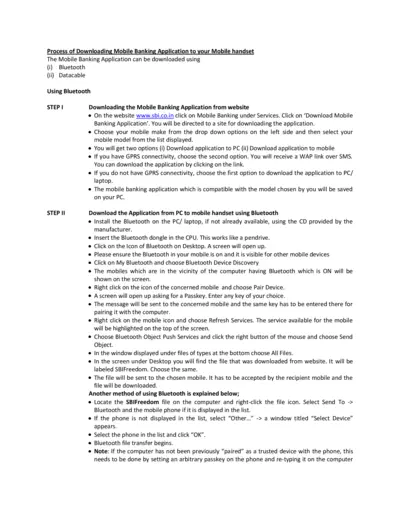

Mobile Banking Application Download Guide

This document guides you through the process of downloading the SBI Mobile Banking application to your phone using either Bluetooth or a data cable. Detailed steps are provided for both methods to ensure a smooth installation. Ensure you follow each step carefully for successful application setup.

Foreign Income Verification Statement (T1135) Information

This document provides detailed guidelines about the Foreign Income Verification Statement (T1135) disclosure. It explains who must file it, what foreign properties must be reported, and the penalties for non-compliance. There are also instructions on how to file the form and how a tax specialist can assist.

The Modernization of Annuities: Insights for RIAs and Clients

This file provides detailed information on the modernization of annuities, designed for registered investment advisors (RIAs) and wealth managers. It covers types of annuities, their benefits, and how they integrate with financial planning tools. It also includes statistical insights on the use of annuities by pre-retirees and retirees.

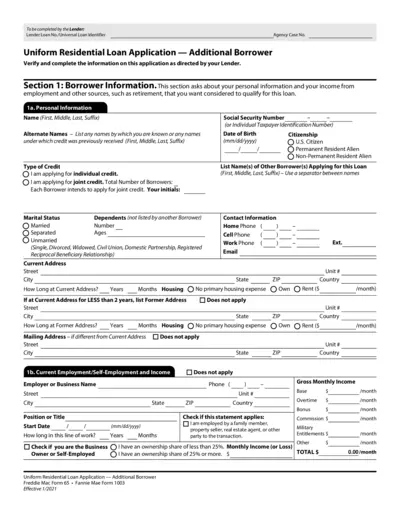

Uniform Residential Loan Application - Additional Borrower

This file is a Uniform Residential Loan Application for an additional borrower. It includes sections to fill out personal information, employment details, income sources, and other financial information required for a loan application. The file is intended to be completed by the lender and borrower.

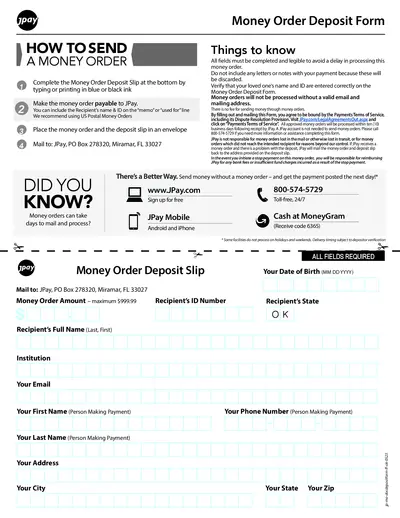

How to Send a Money Order with JPay

This document provides step-by-step instructions on sending a money order through JPay. It includes a fillable deposit slip form and important guidelines for completing and mailing your money order. Ensure all details are correct to avoid processing delays.

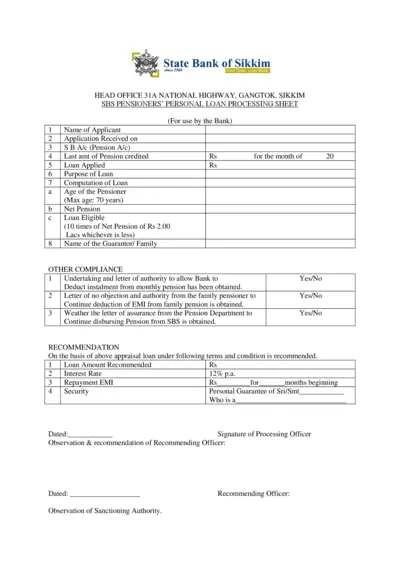

SBS Pensioners Personal Loan Processing Sheet

This document is a processing sheet for the SBS Pensioners Personal Loan for pensioners seeking loans from the State Bank of Sikkim. It guides applicants through the necessary details required for loan processing and approval. The form includes sections for applicant information, loan eligibility, and required compliance documents.

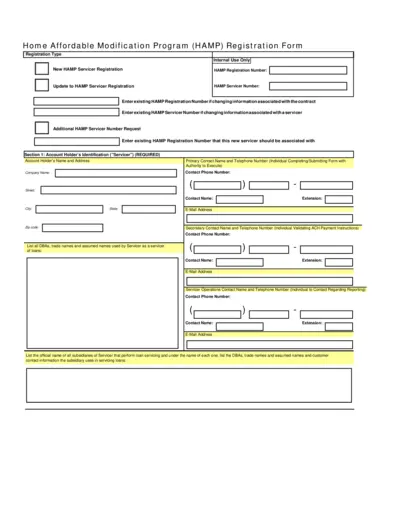

Home Affordable Modification Program Registration

This file provides essential instructions for servicers in the Home Affordable Modification Program (HAMP). It includes details about registration, ACH payment instructions, and contact information requirements. Utilize this form to ensure compliance with HAMP regulations.

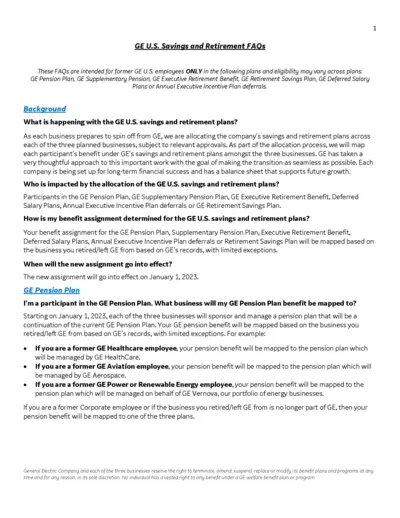

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.