California Homeowners' Exemption Info Sheet

This detailed information sheet is essential for California homeowners seeking to understand the Homeowners' Exemption, its benefits, and application process. It outlines eligibility criteria and tax saving potentials. Use this guide to navigate your property tax savings effectively.

Edit, Download, and Sign the California Homeowners' Exemption Info Sheet

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, gather necessary documents including proof of residency and property title. Accurately complete the form with your information and submit it to the County Assessor. Ensure to check eligibility criteria to maximize your exemption benefits.

How to fill out the California Homeowners' Exemption Info Sheet?

1

Gather proof of residency and property documents.

2

Accurately fill out the form with required information.

3

Submit the completed form to your County Assessor.

4

Ensure your application is submitted by the deadlines.

5

Provide any additional information if requested.

Who needs the California Homeowners' Exemption Info Sheet?

1

Homeowners seeking tax exemptions.

2

New homeowners wanting to understand their benefits.

3

Real estate agents advising clients on tax savings.

4

Financial planners helping clients reduce liabilities.

5

Cooperative apartment residents eligible for exemptions.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the California Homeowners' Exemption Info Sheet along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your California Homeowners' Exemption Info Sheet online.

With PrintFriendly, you can easily edit this PDF to include your personal information. Use our intuitive PDF editor to modify text, add comments, or highlight important sections. Edit on the go to ensure all details are correct before sharing or printing.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is straightforward. Simply open the PDF and select the signing option to add your signature in the desired location. Enhance your document's professionalism with our seamless signing feature.

Share your form instantly.

Sharing your PDF on PrintFriendly is quick and easy. You can generate a shareable link directly from the platform. Distribute your property tax exemption information with friends or clients effortlessly.

How do I edit the California Homeowners' Exemption Info Sheet online?

With PrintFriendly, you can easily edit this PDF to include your personal information. Use our intuitive PDF editor to modify text, add comments, or highlight important sections. Edit on the go to ensure all details are correct before sharing or printing.

1

Open the PDF in the PrintFriendly editor.

2

Select the text you wish to change or highlight.

3

Make your edits using the available editing tools.

4

Preview the changes to ensure accuracy.

5

Download or share the edited PDF as needed.

What are the instructions for submitting this form?

To submit this form, mail the completed BOE-266 form to your County Assessor's office at their designated address. You can also provide it via fax or online submission as specified by your County Assessor's office. Ensure that all information is accurate to avoid delays in processing.

What are the important dates for this form in 2024 and 2025?

For the Homeowners' Exemption, it’s critical to submit your claim by February 15 each year to receive the full exemption for the fiscal year starting July 1. If you file after February 15 but before December 10, you're eligible for an 80% exemption. Claims filed after December 10 will not be accepted for the current year.

What is the purpose of this form?

The purpose of this form is to provide California homeowners with a way to claim the Homeowners' Exemption, which reduces the assessed value of their primary residence for property tax purposes. This exemption can lead to significant annual tax savings. By understanding the the application process and requirements, homeowners can take full advantage of their eligibility.

Tell me about this form and its components and fields line-by-line.

- 1. Homeowner’s Name: Enter the full legal name of the homeowner.

- 2. Property Address: Provide the address of the property for which exemption is being claimed.

- 3. Social Security Number: Include the social security number of the homeowner.

- 4. Date of Purchase: Indicate the date when the property was purchased.

- 5. Principal Residence Declaration: Confirm if the property is your primary place of residence.

What happens if I fail to submit this form?

If you fail to submit this form, you will miss out on potential property tax savings. Moreover, failure to notify the County Assessor about changes in eligibility can lead to penalties or back taxes owed.

- Loss of Exemption: If the form is not filed in time, you may not receive the tax exemption this year.

- Potential Penalties: Failure to report changes may result in penalties from your County Assessor.

- Increased Tax Liabilities: Without the exemption, homeowners face higher property tax bills.

How do I know when to use this form?

- 1. For New Homeowners: New homeowners can claim the exemption shortly after moving in.

- 2. Change of Ownership: This form is required if there is a change of ownership and the new owner occupies the home.

- 3. For Newly Built Homes: Use this form for newly constructed homes as soon as you occupy it.

Frequently Asked Questions

What is the Homeowners' Exemption?

The Homeowners' Exemption allows eligible California homeowners to reduce their property's assessed value, resulting in lower property taxes.

Who qualifies for the exemption?

To qualify, you must occupy the home as your principal residence and submit the form by the deadline.

How can I apply for the exemption?

You can apply by completing form BOE-266 and submitting it to your County Assessor's office.

What happens if I miss the filing deadline?

If you file after the deadline, you may still receive a partial exemption.

Can I apply if I purchased a home after January 1?

Yes, if you occupy the home within 90 days, you can apply for the exemption on the supplemental assessment.

Is this exemption available for rental properties?

No, the Homeowners' Exemption does not apply to rental or secondary homes.

How often do I need to renew the exemption?

The exemption remains effective until your eligibility changes, such as selling the home.

What information do I need to provide?

You will need to provide your social security number and details of the property.

Can corporations apply for this exemption?

No, the exemption cannot be granted to corporations or legal entities.

Where can I find more information?

Additional information can be found on the California Board of Equalization's website.

Related Documents - Homeowners' Exemption Guide

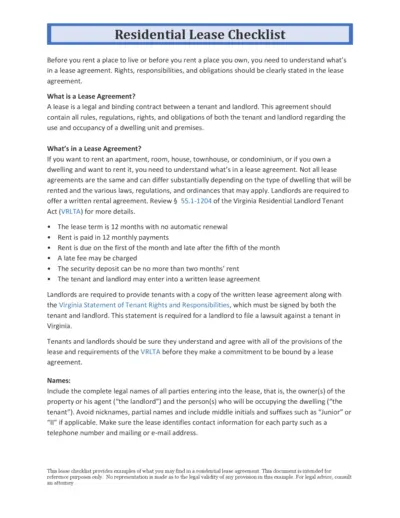

Residential Lease Agreement Checklist for Tenants and Landlords

This document provides a detailed checklist of what both tenants and landlords need to know and include in a residential lease agreement. It covers key elements such as lease terms, rent payment schedules, and maintenance responsibilities. Use this guide to ensure all rights and obligations are clearly outlined in your lease agreement.

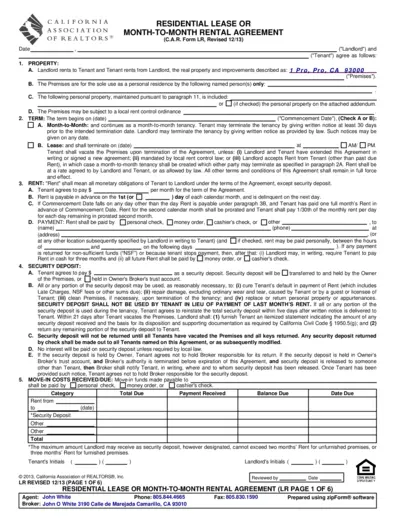

Residential Lease or Month-to-Month Rental Agreement

This file contains a comprehensive residential lease or month-to-month rental agreement used in California. It provides details on terms, obligations, and conditions for both landlords and tenants. Perfect for those seeking a standardized rental agreement form.

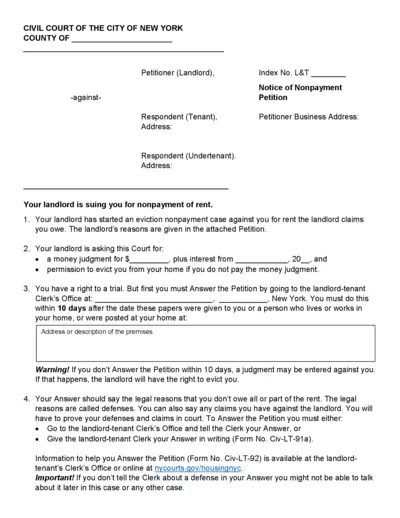

Civil Court of the City of New York Nonpayment Petition

This document is a Notice of Nonpayment Petition issued by the Civil Court of the City of New York. It details the actions that a landlord can take against a tenant for nonpayment of rent. It includes instructions on how the tenant can respond and their rights.

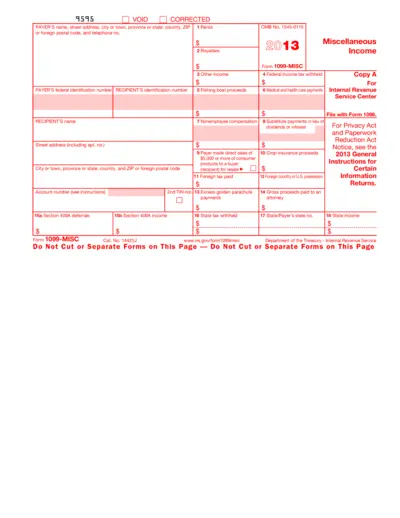

Form 1099-MISC: Miscellaneous Income for 2013

This file is a 2013 version of the IRS Form 1099-MISC used to report miscellaneous income. It includes fields for reporting various types of payments made to individuals or entities. The form is typically filed by payers to report income paid to recipients.

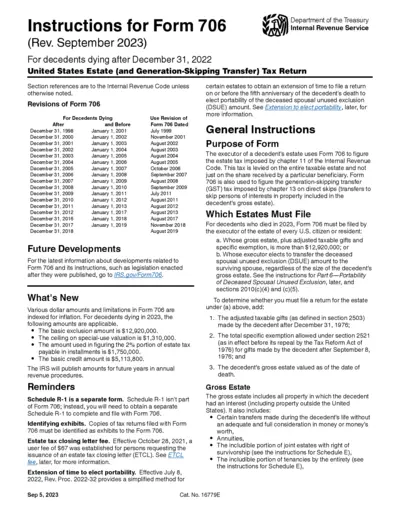

Instructions for Form 706 (Rev. September 2023)

This document provides detailed instructions for completing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return for decedents dying after December 31, 2022. It includes information on revisions, general instructions, and specific filing requirements. The instructions also cover important updates and reminders related to the form.

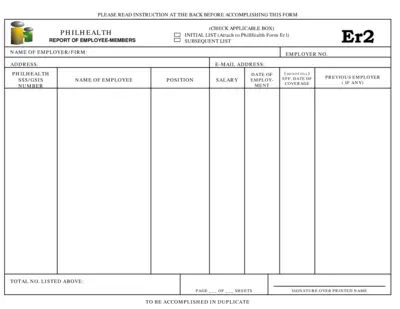

PhilHealth Report of Employee-Members Form Instructions

This file provides instructions for employers on how to fill out and submit the PhilHealth Report of Employee-Members form. It is essential for employers to report new hires to PhilHealth to ensure proper coverage. Detailed instructions and requirements are included.

Copyright Registration Form TX Instructions

This form is used for the registration of nondramatic literary works, such as fiction, nonfiction, poetry, textbooks, and computer programs. It provides detailed information on how to complete the form, including what information is required for each section and how to submit the application. Use it to ensure your work is properly registered for copyright protection.

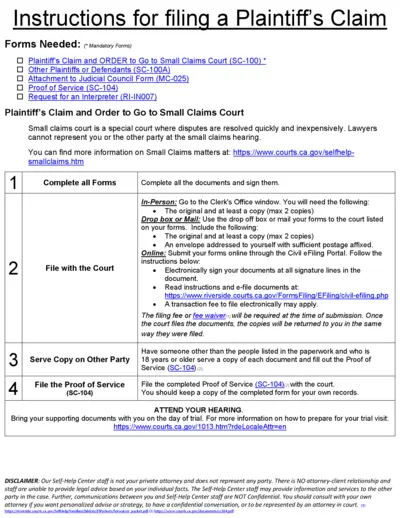

Plaintiff's Claim and Instructions for Small Claims Court

This file provides instructions and necessary forms for filing a Plaintiff's Claim in Small Claims Court. It includes details on filling out, submitting, and serving the forms. Ensure to follow the steps carefully to protect your rights.

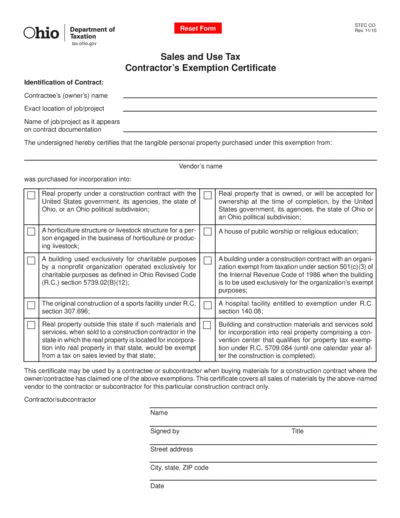

Ohio Sales and Use Tax Contractor's Exemption Certificate

This document is the Ohio Sales and Use Tax Contractor's Exemption Certificate. Contractors use this form to claim exemptions on certain taxable goods for specified exempt uses. It's crucial for contractors working with tax-exempt entities or on tax-exempt projects.

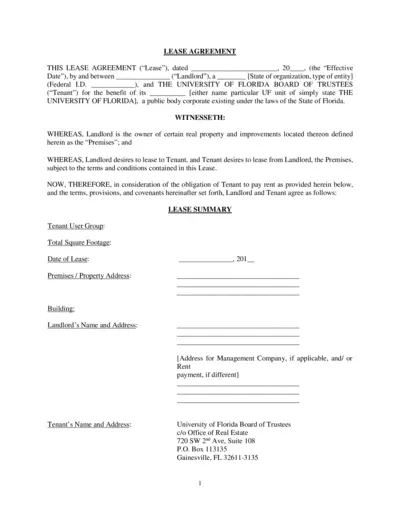

Lease Agreement for University of Florida Premises

This lease agreement file outlines the terms and conditions for renting a property owned by the Landlord to the University of Florida Board of Trustees. It covers key aspects such as lease term, rent details, improvements, and permitted use. Ideal for landlords and tenants involved in leasing agreements.

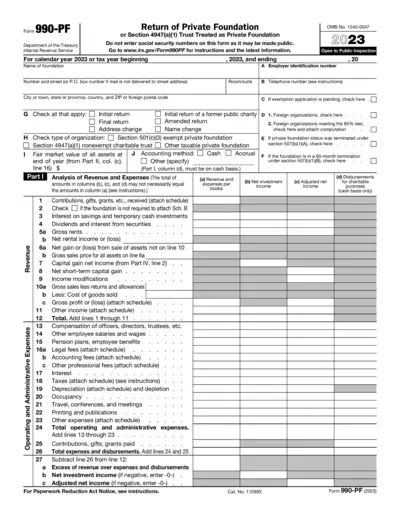

Return of Private Foundation Form 990-PF 2023

Form 990-PF is a return for private foundations required by the IRS. It includes information on revenue, expenses, and other financial details. Avoid entering social security numbers on this form.

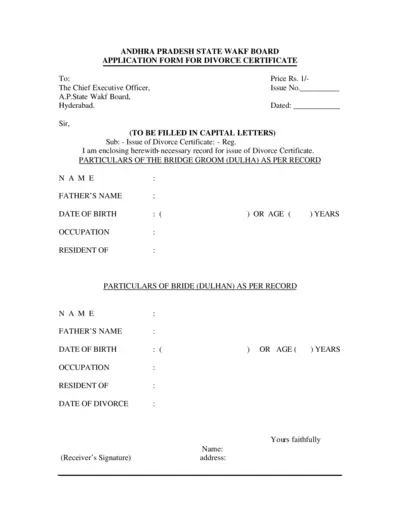

Application Form for Divorce Certificate - Andhra Pradesh State Wakf Board

This form is used to apply for a Divorce Certificate from the Andhra Pradesh State Wakf Board in Hyderabad. The form requires details of both bride and groom as per recorded information. It also includes fields for verification and office use only.