Edit, Download, and Sign the IL-W-6 Form for Non-Residents Working in Illinois

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the IL-W-6 form, start by providing your employer's information in Step 1. Next, supply your personal details in Step 2, ensuring accuracy. Finally, sign and submit the form to your employer before your first workday.

How to fill out the IL-W-6 Form for Non-Residents Working in Illinois?

1

Complete Step 1 with employer information.

2

Fill in your personal information in Step 2.

3

Sign the form to verify the information provided.

4

Submit the form to your employer promptly.

5

Keep a copy for your own records.

Who needs the IL-W-6 Form for Non-Residents Working in Illinois?

1

Non-resident employees working in Illinois need this form to report income for tax purposes.

2

Employers hiring non-residents must utilize this form to properly manage tax withholdings.

3

Tax preparers need access to this form to assist clients accurately in tax filings.

4

Payroll departments require this form to comply with Illinois tax regulations.

5

Human resources personnel need this form for record-keeping of non-resident employees.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the IL-W-6 Form for Non-Residents Working in Illinois along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your IL-W-6 Form for Non-Residents Working in Illinois online.

You can easily edit the PDF of Form IL-W-6 on PrintFriendly by uploading the file directly on our platform. Utilize our intuitive editors to make changes as necessary. Once you're satisfied with your edits, you can download the updated PDF.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is straightforward. Simply use our digital signature tools to add your signature directly to the document. This makes compliance and submission easier for all users.

Share your form instantly.

Sharing the PDF on PrintFriendly only takes a moment. After editing, use our sharing options to send the document via email or direct link. This facilitates easy access for anyone who needs the updated form.

How do I edit the IL-W-6 Form for Non-Residents Working in Illinois online?

You can easily edit the PDF of Form IL-W-6 on PrintFriendly by uploading the file directly on our platform. Utilize our intuitive editors to make changes as necessary. Once you're satisfied with your edits, you can download the updated PDF.

1

Upload the PDF file of Form IL-W-6 to PrintFriendly.

2

Access the editing tools to modify required fields.

3

Make sure to review your changes before saving.

4

Download the edited PDF to your device.

5

Share the updated document with relevant parties.

What are the instructions for submitting this form?

To submit this form, you can provide it directly to your employer for processing. Alternatively, online submissions may be accepted depending on your employer's policies. Ensure you keep a copy for your records and consult on any specific submission methods required by your employer.

What are the important dates for this form in 2024 and 2025?

For 2024, the important dates for filing are as follows: January 31 for employers to provide W-2s, and April 15 for individuals to file state taxes. In 2025, similar deadlines will apply. Staying updated on these dates ensures compliance with Illinois tax regulations.

What is the purpose of this form?

The purpose of Form IL-W-6 is to certify the number of days a non-resident employee has worked in Illinois. This form helps employers accurately withhold state income tax based on the amount of work performed in the state. By ensuring accurate reporting, both employees and employers fulfill their tax obligations without penalties.

Tell me about this form and its components and fields line-by-line.

- 1. Federal Employer Identification Number: This is the unique identifier for the employer.

- 2. Employer name: The legal name of the employer.

- 3. Mailing address: The address where the employer can be contacted.

- 4. Employee's Social Security number: The unique identifier for the employee.

- 5. Employee's name: The legal name of the employee.

- 6. Employee's mailing address: The address where the employee can be reached.

What happens if I fail to submit this form?

Failing to submit Form IL-W-6 may lead to withholding discrepancies for your taxes. This could result in penalties imposed by the Illinois Department of Revenue. It is crucial for both employers and employees to ensure timely submission to avoid complications.

- Incorrect Withholding: Not submitting the form may lead to higher or lower tax withholdings than necessary.

- Penalties: Failure to submit could result in fines from the Illinois Department of Revenue.

- Tax Filing Issues: Without the form, tax filings may be inaccurate, affecting tax returns and refunds.

How do I know when to use this form?

- 1. Initial Employment: Use the form to report your working days upon starting a new job in Illinois.

- 2. Change in Work Location: If your work location changes, update your submission accordingly.

- 3. Extended Projects: For longer-term projects extending beyond 30 days, this form is required.

Frequently Asked Questions

How do I edit the IL-W-6 form?

You can edit the IL-W-6 form by uploading it to PrintFriendly and using our editing tools.

Can I download the edited IL-W-6 form?

Yes, after making your edits, you can download the updated IL-W-6 form directly.

Do I need to register to use PrintFriendly?

No registration is required to edit or download PDFs on PrintFriendly.

Can I share my edited form with others?

Absolutely! You can easily share your edited IL-W-6 form via email or direct link.

What types of edits can I make?

You can modify text, add fields, or change formatting as needed.

How do I sign the edited PDF?

Use our digital signature tools to add a signature to your edited PDF.

Is there a limit on editing the form?

There's no limit; you can edit it as many times as you need.

What file types does PrintFriendly accept?

PrintFriendly primarily works with PDF files for editing.

Can I print my edited document?

Yes, once edited, you can print the document directly from PrintFriendly.

How long does it take to edit a document?

Editing a document takes just a few minutes depending on the changes you need.

Related Documents - Form IL-W-6

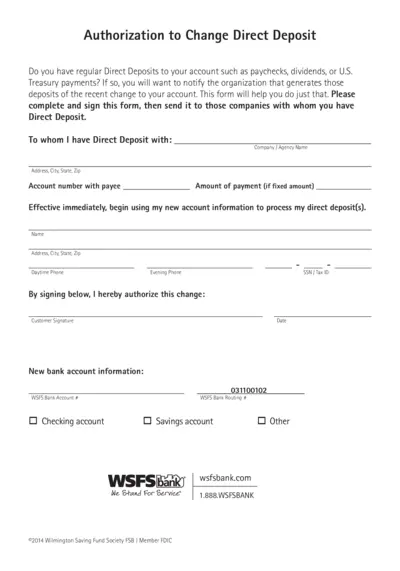

Authorization to Change Direct Deposit Form

This form is for notifying organizations of changes to your direct deposit account. Complete and sign this form and send it to the companies handling your direct deposits. The form includes sections for personal information and new account details.

Sprouts Farmers Market 2023 Annual Meeting Proxy Statement

This document contains details about the 2023 Annual Meeting of Stockholders for Sprouts Farmers Market, Inc. It includes information on the meeting date, items of business, and instructions for proxy voting. Access to proxy materials and voting instructions are also provided.

Application for Approval of Details Reserved by Condition Planning

This file is an application for approval of details reserved by condition following the grant of planning permission or listed building consent. It provides information on how to submit the necessary details for approval by the Local Planning Authority. The file includes instructions for both online and offline submission.

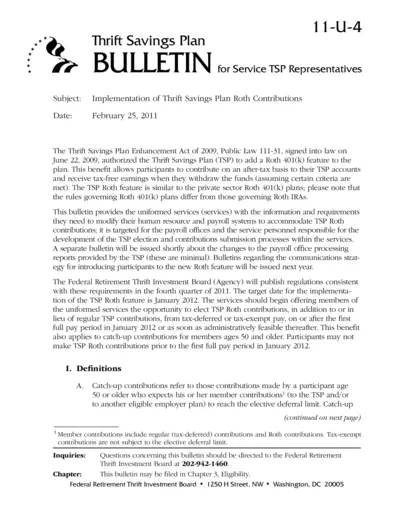

Implementation of Thrift Savings Plan Roth Contributions

This file provides information and requirements for uniformed services to modify their payroll systems to accommodate the Thrift Savings Plan (TSP) Roth contributions. It outlines definitions, rules, and procedures for TSP Roth contributions, including catch-up contributions for those aged 50 and older. The document also includes target implementation dates and contacts for inquiries.

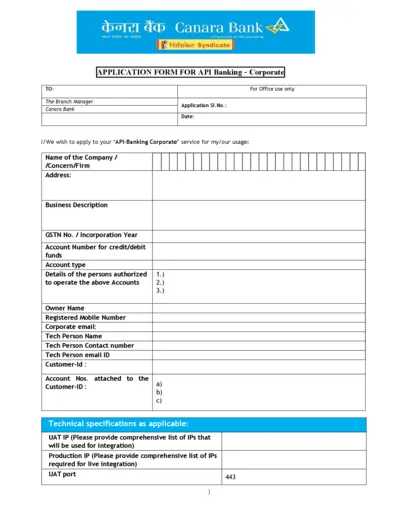

Canara Bank API Banking Application Form

This file is an application form for Canara Bank's API Banking services for corporate entities. The form includes sections to provide company details, technical specifications and authorized personnel. It requires the applicant to declare understanding and acceptance of terms and conditions related to the service.

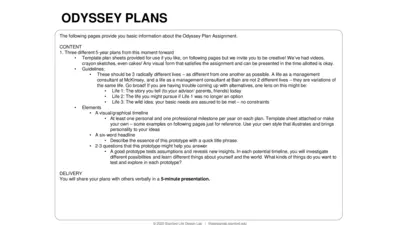

Odyssey Plan Assignment Guide: Create Your Future in 3 Steps

This file provides the guidelines and templates for creating three distinct 5-year Odyssey Plans. It encourages creative visual representations and exploration of multiple life possibilities. It is designed to help users test assumptions and gain new insights about potential life paths.

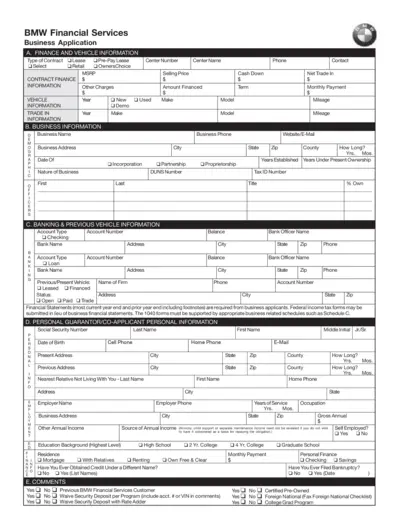

BMW Financial Services Business Application Form

This form is used to apply for various financing options through BMW Financial Services, including lease, retail, pre-pay lease, and OwnersChoice. It collects detailed information about finance, vehicle, business, banking, and personal guarantor information. Instructions and certifications required for business entities and personal guarantors are included.

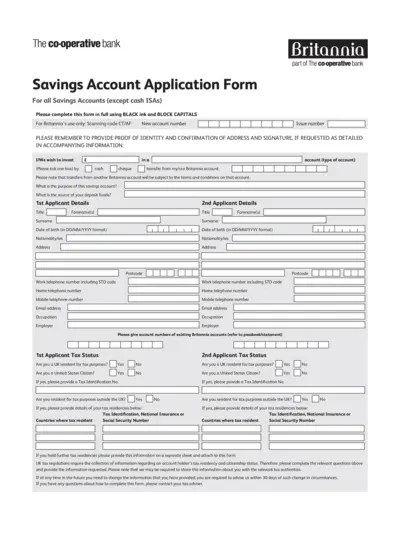

Savings Account Application Form - The Co-operative Bank

This application form is needed to apply for a savings account with The Co-operative Bank. It requires personal information, tax status, and account preferences. Follow the instructions carefully for successful submission.

Union Bank of India Simplifies Form 15G & H Submission via WhatsApp

Union Bank of India has simplified the annual submission of Form 15G & H by enabling online submission via its WhatsApp channel Union Virtual Connect in association with RBIH. This initiative aims to make the submission process easier for senior citizens and tech-savvy customers. It provides banking services in 7 different languages through WhatsApp.

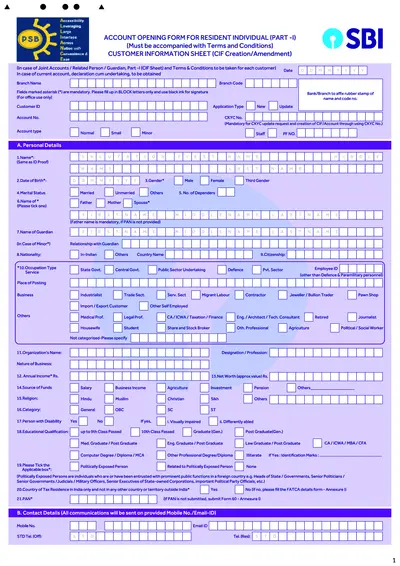

SBI Account Opening Form for Resident Individuals

This file is an account opening form for resident individuals of SBI. It includes detailed sections that need to be filled for creating a Customer Information File. The form must be accompanied by terms and conditions and is suitable for various types of accounts including saving bank, current account, and term deposits.

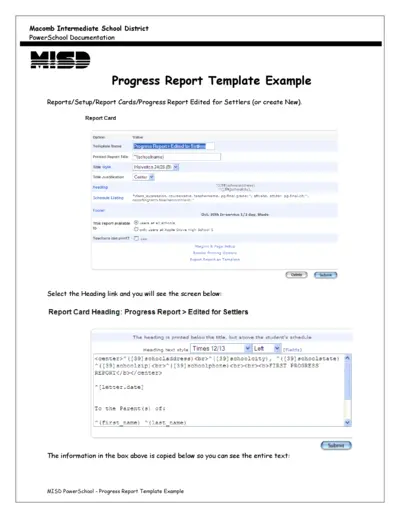

MISD PowerSchool - Progress Report Template

This file provides a detailed example of a Progress Report Template for the MISD PowerSchool system. It includes instructions on how to set up and customize the report. Users can learn how to fill in the template with student information and schedule data.

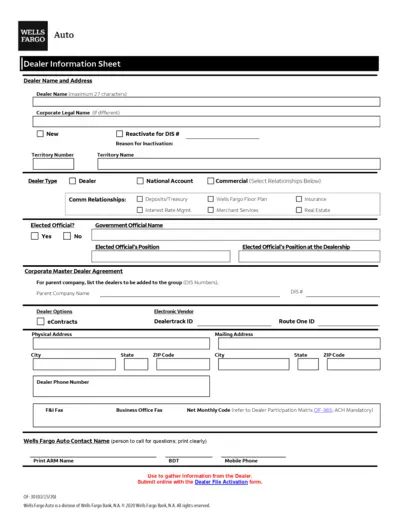

Wells Fargo Auto Dealer Profile Form

This document contains information and instructions for Wells Fargo Auto Dealers on completing the Dealer Information Sheet, ACH Profile Authorization Form, and Franchise Dealer Profile. Dealer's details, bank account information, and dealership legal details are required.