Income Tax Statement Submission for FY 2023-24

This document provides the format for submitting the anticipatory income tax statement for the financial year 2023-24. Employees of Ravenshaw University are required to complete this form to calculate and submit their projected income and tax details. Timely submission will ensure correct tax deductions from the monthly salary.

Edit, Download, and Sign the Income Tax Statement Submission for FY 2023-24

Form

eSign

Add Annotation

Share Form

How do I fill this out?

Filling out this form is essential for proper income tax management. Start by gathering your income details and any applicable deductions. Follow the sections carefully to ensure all necessary information is included.

How to fill out the Income Tax Statement Submission for FY 2023-24?

1

Download the form from the university website.

2

Provide your personal information including name, post, and PAN.

3

Fill in your total salary income and applicable deductions.

4

Calculate your taxable income based on the guidelines provided.

5

Submit the completed form before the specified deadline.

Who needs the Income Tax Statement Submission for FY 2023-24?

1

Regular staff needing to declare their income for tax purposes.

2

Contractual employees who must submit income details for tax deductions.

3

Temporary staff required to report income despite their short-term contracts.

4

Finance administrators needing this data to process payroll accurately.

5

Any employee wanting to avoid tax discrepancies in their monthly salary.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Income Tax Statement Submission for FY 2023-24 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Income Tax Statement Submission for FY 2023-24 online.

Editing this PDF on PrintFriendly is intuitive. Simply upload the document to our platform, and use the editing tools to make changes. Once you’re satisfied with your edits, you can download the updated PDF right away.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is straightforward. After editing your document, choose the sign option to add your signature electronically. This ensures your form is complete and ready for submission without the hassle of printing.

Share your form instantly.

Sharing your PDF on PrintFriendly is seamless. Once you've edited and finalized your document, use the share feature to send it directly to colleagues or stakeholders. This makes collaboration easier and enhances document accessibility.

How do I edit the Income Tax Statement Submission for FY 2023-24 online?

Editing this PDF on PrintFriendly is intuitive. Simply upload the document to our platform, and use the editing tools to make changes. Once you’re satisfied with your edits, you can download the updated PDF right away.

1

Upload the PDF document to PrintFriendly.

2

Select the areas you want to edit by clicking on them.

3

Utilize the formatting tools to adjust text and layout as needed.

4

Once your edits are complete, click the download button.

5

Save the finalized document to your device.

What are the instructions for submitting this form?

To submit your Income Tax Statement, ensure you complete the form accurately and submit it physically to the Establishment Section by the deadline of March 27, 2023. Alternatively, you may also submit via email to the finance office at finance@ravenshawuniversity.edu. For any offline submission, address it to the Comptroller of Finance, Ravenshaw University, Cuttack, Orissa.

What are the important dates for this form in 2024 and 2025?

The crucial date for submitting your anticipatory income tax statement is March 27, 2023. Ensure you meet this deadline for proper salary processing. Further tax submissions may follow in the upcoming tax period.

What is the purpose of this form?

This form serves the primary purpose of gathering anticipatory income tax information from employees for the financial year 2023-24. It enables the university to accurately calculate tax liabilities and deductions from monthly salaries. By ensuring timely submissions, the university can maintain compliance with tax regulations and avoid unnecessary penalties.

Tell me about this form and its components and fields line-by-line.

- 1. Employee Name: The name of the employee submitting the form.

- 2. Post: The designation or job title of the employee.

- 3. PAN: The Permanent Account Number for tax identification.

- 4. Total Salary Income: Complete breakdown of total earnings including various allowances.

- 5. Deductions: Details about exemptions and deductions that apply to the employee's income.

What happens if I fail to submit this form?

Failure to submit this form by the deadline can lead to automatic deductions based on the last available income data. This may result in higher tax deductions than necessary, impacting the employee's monthly salary adversely.

- Increased Tax Liability: Delayed submission may result in higher monthly tax deductions.

- Compliance Issues: Non-compliance with tax requirements may lead to legal implications.

- Payroll Delays: Delays in processing salaries due to incomplete information.

- Financial Planning Setbacks: Improper tax deductions could affect personal financial planning.

- Loss of Benefits: Employees may lose out on potential tax benefits and exemptions.

How do I know when to use this form?

- 1. Beginning of Financial Year: Submit at the start of the fiscal year for proper tax estimation.

- 2. Salary Adjustments: Use when there are changes in your salary or allowances.

- 3. Tax Planning: Essential for financial planning and ensuring accurate tax deductions.

- 4. Compliance Requirements: Part of adherence to income tax regulations imposed by the government.

- 5. Avoiding Tax Penalties: Helps prevent fines due to incorrect income declaration.

Frequently Asked Questions

How do I download the PDF after editing?

After completing your edits, simply click on the download button to save your document.

Can I share the edited PDF with others?

Yes, you can easily share the PDF through our sharing options available after editing.

Is there a limit to the number of edits I can make?

There is no limit, feel free to make as many edits as needed before you download.

Can I sign the PDF electronically?

Yes, PrintFriendly allows you to add electronic signatures effortlessly.

What file formats can I upload?

You can upload PDF files for editing and sharing.

Is user registration required for using the editor?

No, user registration is not required to edit and download PDFs.

Can I revert changes made in the editor?

Currently, there is no undo feature, so please ensure your edits are correct.

Will my data be saved after I edit?

Files edited on PrintFriendly are temporary and must be downloaded to retain changes.

What if I encounter issues while editing?

Reach out to our support for assistance with any issues during the editing process.

Can I edit forms like tax statements effectively?

Yes, our editor is designed to handle forms efficiently, including tax statements.

Related Documents - Tax Statement FY 2023-24

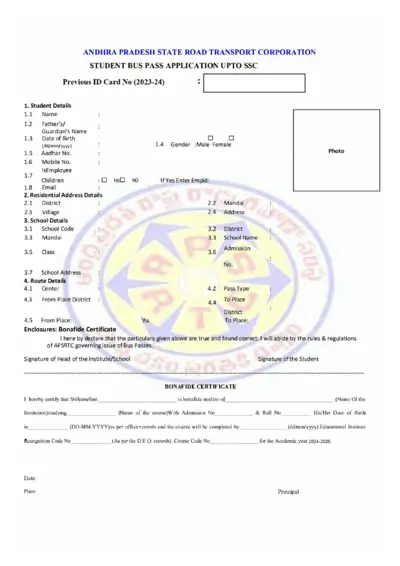

Andhra Pradesh State Road Transport Corporation Student Bus Pass Application

The Andhra Pradesh State Road Transport Corporation (APSRTC) Student Bus Pass Application form is for students up to SSC who need to apply for a bus pass for the academic year 2024-2025. This form includes personal details, school details, route details, and requires a bonafide certificate. Completing this form allows students to travel on APSRTC buses between their residence and school at a concessional fare.

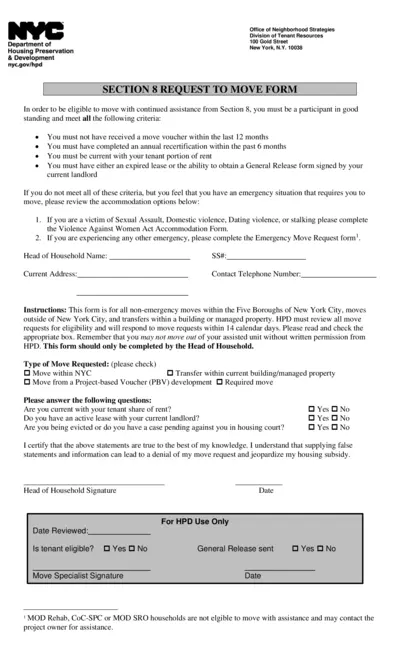

NYC Section 8 Request to Move Form

The NYC Section 8 Request to Move Form is for participants in good standing to move with continued assistance. Participants must meet specific criteria and obtain necessary approvals. The form includes options for non-emergency and emergency moves.

Cheyenne Transit ADA Paratransit Eligibility Application

This file includes the application and instructions for Cheyenne Transit's ADA Paratransit service. It details the eligibility criteria and provides guidelines on how to complete the form. The document must be filled out in full and submitted to determine eligibility for Paratransit service.

Council-Manager Government Roles and Responsibilities Guide

This file provides detailed information about the roles and responsibilities of key officials in a council-manager government structure, including the mayor, city manager, and elected officials. It also explains how residents can participate in the government decision-making process.

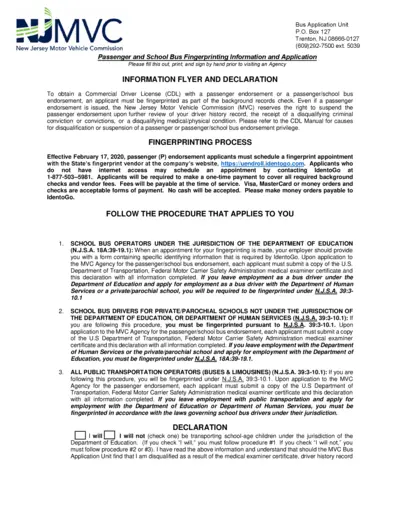

Passenger and School Bus Driver Application

This file provides detailed instructions and forms required for obtaining a Commercial Driver License (CDL) with a passenger or passenger/school bus endorsement in New Jersey. It includes fingerprinting information, medical examiner certificate requirements, and a declaration form. Applicants must complete the form, print, and sign it before visiting an Agency or the New Jersey Motor Vehicle Commission.

Facility Clearance (FCL) Orientation Handbook - March 2021

This handbook provides a comprehensive orientation to the Facility Clearance (FCL) process. It outlines responsibilities, deadlines, and guidance. It includes detailed process information and required forms.

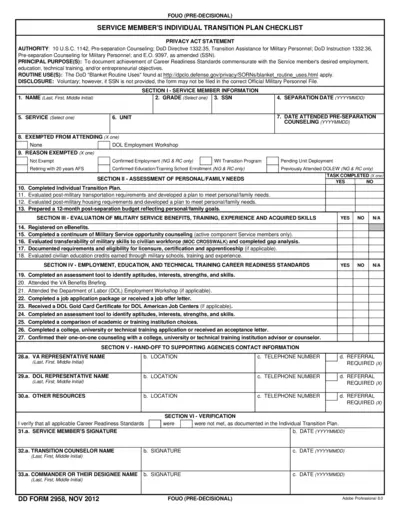

Service Member's Individual Transition Plan Checklist

This file is a checklist intended for service members to document and certify the achievement of career readiness standards as they transition out of the military. It includes sections for personal and family needs assessment, evaluation of military service benefits and acquired skills, career readiness standards, and contact information for supporting agencies. The checklist must be completed and verified by the service member, transition counselor, and unit commander prior to separation.

Bangladesh Judicial Service Commission Form Instructions

This document provides detailed instructions for filling out and submitting the Bangladesh Judicial Service Commission form, including essential deadlines and required fields.

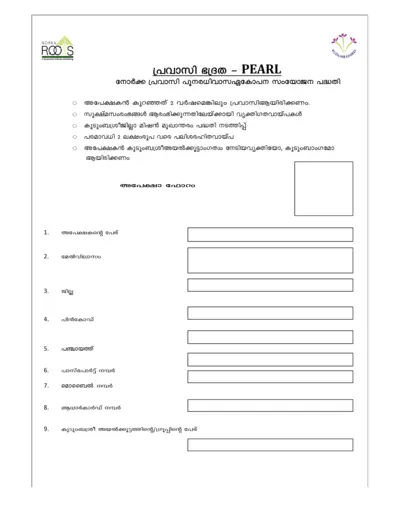

NORKA, RØD S - Government of Kerala Undertaking File

This document is issued by the Government of Kerala and pertains to various government-related undertakings. It provides important instructions and details necessary for various procedures. Users should follow the guidelines carefully to ensure compliance.

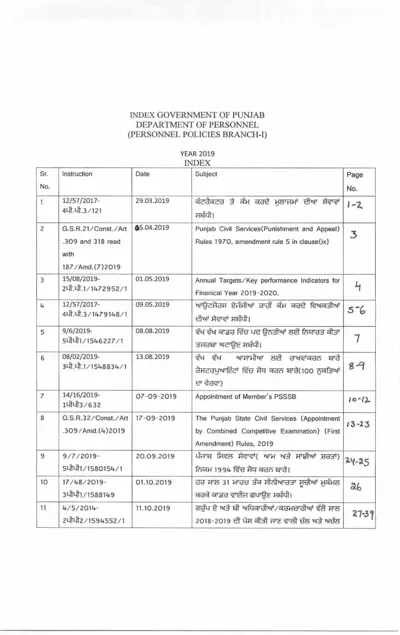

GOVERNMENT OF PUNJAB DEPARTMENT OF PERSONNEL MANUAL 2019

This document is a manual by the Government of Punjab's Department of Personnel, outlining various personnel policies and instructions issued in the year 2019. It includes amendments, performance indicators, appointment procedures, and relevant rules for civil services and recruitment. The manual serves as a comprehensive guide for personnel management and related administrative processes.

Oklahoma DOT Roadway Design CADD Standards Manual

The Oklahoma DOT Roadway Design CADD Standards Manual effective April 1, 2015 details the best practices for all related engineering work. Following these standards ensures readability, uniformity, and proficiency in design plans. This manual is essential for designers working with or for the Oklahoma Department of Transportation.

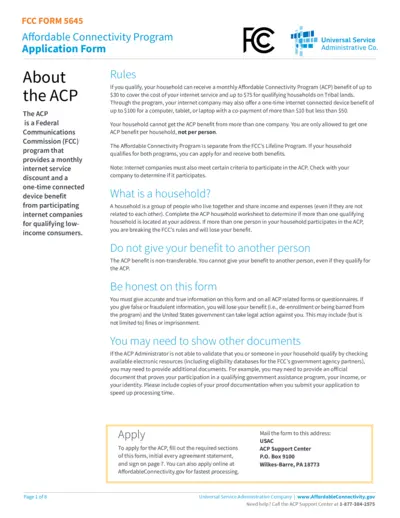

Affordable Connectivity Program Application Form FCC Form 5645

FCC Form 5645 is an application form for the Affordable Connectivity Program (ACP) that provides monthly internet service discounts and a one-time device benefit for qualifying low-income consumers. The form includes sections for personal information, identity verification, and household details. Instructions for submission and required documentation are also provided.