Edit, Download, and Sign the Instructions for Completing Federal Form 8843

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To complete the Federal Form 8843, start by entering your name and taxpayer identification number. Then, provide your U.S. entry date and visa type. Continue to answer questions about your stay and the institution you are affiliated with.

How to fill out the Instructions for Completing Federal Form 8843?

1

Enter your personal information including name and taxpayer ID.

2

Provide details about your entry date and visa type.

3

Input your citizenship and passport information.

4

Complete the stay duration sections as applicable.

5

Sign and mail the completed form to the specified address.

Who needs the Instructions for Completing Federal Form 8843?

1

International students attending U.S. universities need this form to report their presence in the U.S.

2

Scholars and professors visiting the U.S. for research or teaching purposes must fill it out for compliance.

3

Dependents of international students or scholars also need to submit this form.

4

Anyone who did not work but stayed in the U.S. during the specified year requires this form.

5

Individuals applying for tax exemptions based on their student or scholar status need this form.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Instructions for Completing Federal Form 8843 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Instructions for Completing Federal Form 8843 online.

Editing your PDF using PrintFriendly is simple and intuitive. You can make changes to text directly on the PDF without any hassle. Our user-friendly interface allows you to customize, add annotations, and modify content easily.

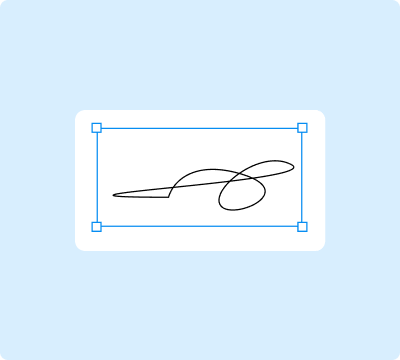

Add your legally-binding signature.

With PrintFriendly, signing your PDF is a breeze. You can add your digital signature to the document quickly. Ensure your PDF is legally binding by signing it directly within the editor.

Share your form instantly.

Sharing your edited PDF is straightforward on PrintFriendly. You can generate a shareable link to send to others effortlessly. Additionally, you have the option to download the PDF and share it via email or any other platform.

How do I edit the Instructions for Completing Federal Form 8843 online?

Editing your PDF using PrintFriendly is simple and intuitive. You can make changes to text directly on the PDF without any hassle. Our user-friendly interface allows you to customize, add annotations, and modify content easily.

1

Upload the PDF file to PrintFriendly.

2

Click on the text area that you wish to edit.

3

Make the necessary changes or add your annotations.

4

Preview your changes to ensure accuracy.

5

Download the final version of your edited PDF.

What are the instructions for submitting this form?

To submit Federal Form 8843, you must mail the completed form to the Internal Revenue Service Center at Austin, TX. Ensure that it is sent to the Department of Treasury, Internal Revenue Service Center, Austin, TX 73301-0215. It is important to send it well before the due date to avoid complications.

What are the important dates for this form in 2024 and 2025?

Important dates regarding Form 8843 for 2024 and 2025 will include the submission deadline that typically aligns with the annual tax return due date, usually April 15th of each year.

What is the purpose of this form?

The purpose of Federal Form 8843 is to provide a formal declaration of the presence of non-resident individuals in the U.S. for the tax year. It serves as a regulatory mechanism to ensure compliance with U.S. tax laws by international students and scholars. By completing this form, individuals clarify their non-resident status, helping the IRS in classification for tax exemption purposes.

Tell me about this form and its components and fields line-by-line.

- 1. Name: Your first name, middle initial, and last name.

- 2. Taxpayer Identification Number: Your Social Security number or a blank if you do not have one.

- 3. Date of Entry: The date you initially entered the U.S.

- 4. Visa Type: The type of visa you held upon entry.

- 5. Citizenship: The country you are a citizen of.

What happens if I fail to submit this form?

Failing to submit Form 8843 may lead to trouble with your tax obligations and could affect your visa status. It may also result in fines or penalties from the IRS.

- Visa Status Complications: Non-compliance may jeopardize your visa status and future entry into the U.S.

- IRS Penalties: Failure to file may lead to financial penalties imposed by the IRS.

- Tax Compliance Issues: You may face complications with your tax status in the U.S.

How do I know when to use this form?

- 1. For Tax Compliance: To comply with IRS regulations regarding your presence in the U.S.

- 2. Non-Work Reporting: To report your status if you did not engage in work activities.

- 3. Dependency Documentation: To register dependents who are also in the U.S. for tax purposes.

Frequently Asked Questions

What is Federal Form 8843?

Federal Form 8843 is a form that must be filed by international students and scholars to report their presence in the U.S. for tax purposes.

Who needs to file this form?

International students, scholars, and their dependents who were in the U.S. during the tax year are required to file this form.

How do I edit the PDF on PrintFriendly?

You can easily upload your PDF and edit text directly within the platform, making any necessary adjustments.

Can I share the edited PDF?

Yes, PrintFriendly allows you to share your edited PDF via a generated link or download it for email sharing.

What do I do if I worked in the U.S.?

If you worked in the U.S. in 2021, complete the 8843 form along with other related tax forms.

Is there a way to sign the PDF?

Yes, PrintFriendly offers the ability to add your digital signature directly onto your PDF.

What is the deadline for filing this form?

The deadline for filing Form 8843 is typically the same as the annual tax return due date.

Can I fill out this form online?

Yes, you can use the PrintFriendly platform to complete the form online before downloading it.

Do I need to include additional forms?

If you worked in the U.S., you may need to submit additional tax forms along with Form 8843.

What happens if I don't file this form?

Failure to file Form 8843 may lead to complications with your visa status and tax compliance.

Related Documents - Form 8843 Instructions

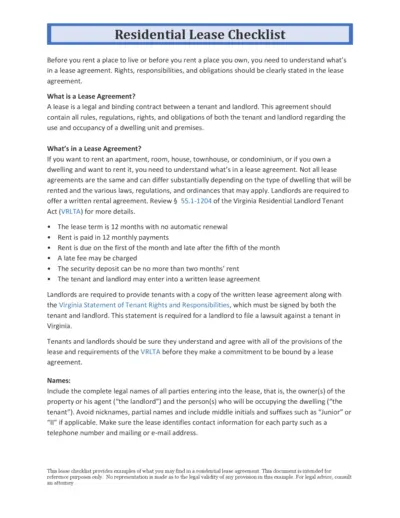

Residential Lease Agreement Checklist for Tenants and Landlords

This document provides a detailed checklist of what both tenants and landlords need to know and include in a residential lease agreement. It covers key elements such as lease terms, rent payment schedules, and maintenance responsibilities. Use this guide to ensure all rights and obligations are clearly outlined in your lease agreement.

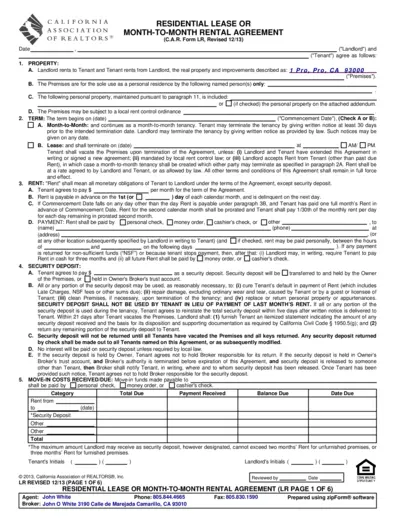

Residential Lease or Month-to-Month Rental Agreement

This file contains a comprehensive residential lease or month-to-month rental agreement used in California. It provides details on terms, obligations, and conditions for both landlords and tenants. Perfect for those seeking a standardized rental agreement form.

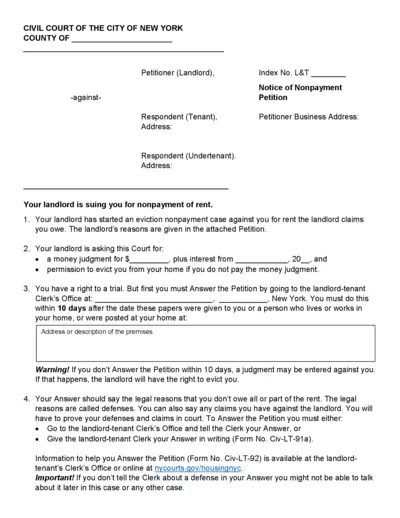

Civil Court of the City of New York Nonpayment Petition

This document is a Notice of Nonpayment Petition issued by the Civil Court of the City of New York. It details the actions that a landlord can take against a tenant for nonpayment of rent. It includes instructions on how the tenant can respond and their rights.

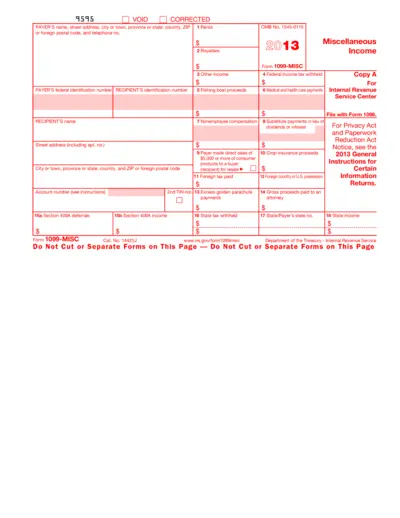

Form 1099-MISC: Miscellaneous Income for 2013

This file is a 2013 version of the IRS Form 1099-MISC used to report miscellaneous income. It includes fields for reporting various types of payments made to individuals or entities. The form is typically filed by payers to report income paid to recipients.

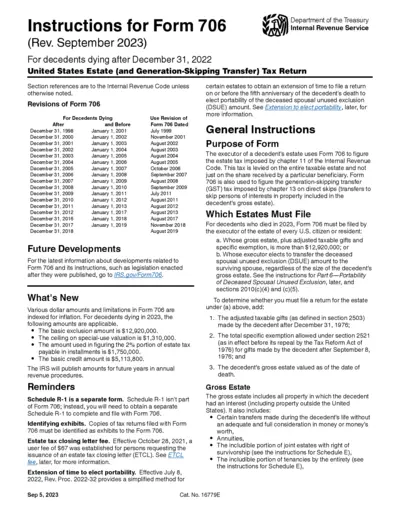

Instructions for Form 706 (Rev. September 2023)

This document provides detailed instructions for completing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return for decedents dying after December 31, 2022. It includes information on revisions, general instructions, and specific filing requirements. The instructions also cover important updates and reminders related to the form.

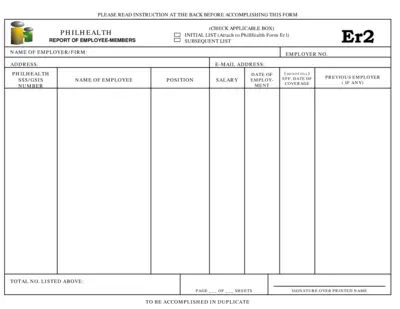

PhilHealth Report of Employee-Members Form Instructions

This file provides instructions for employers on how to fill out and submit the PhilHealth Report of Employee-Members form. It is essential for employers to report new hires to PhilHealth to ensure proper coverage. Detailed instructions and requirements are included.

Copyright Registration Form TX Instructions

This form is used for the registration of nondramatic literary works, such as fiction, nonfiction, poetry, textbooks, and computer programs. It provides detailed information on how to complete the form, including what information is required for each section and how to submit the application. Use it to ensure your work is properly registered for copyright protection.

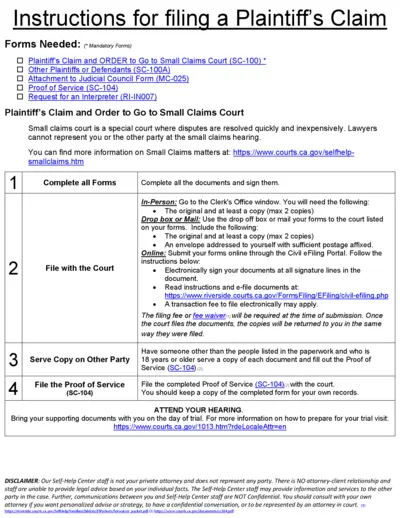

Plaintiff's Claim and Instructions for Small Claims Court

This file provides instructions and necessary forms for filing a Plaintiff's Claim in Small Claims Court. It includes details on filling out, submitting, and serving the forms. Ensure to follow the steps carefully to protect your rights.

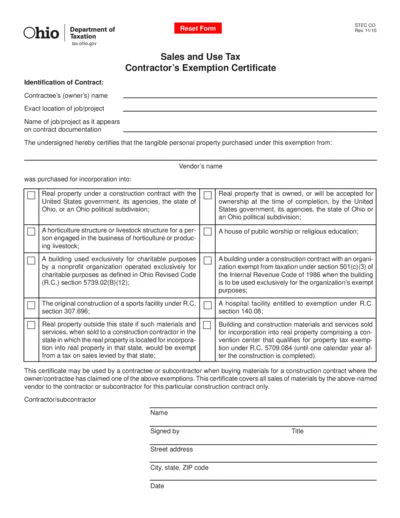

Ohio Sales and Use Tax Contractor's Exemption Certificate

This document is the Ohio Sales and Use Tax Contractor's Exemption Certificate. Contractors use this form to claim exemptions on certain taxable goods for specified exempt uses. It's crucial for contractors working with tax-exempt entities or on tax-exempt projects.

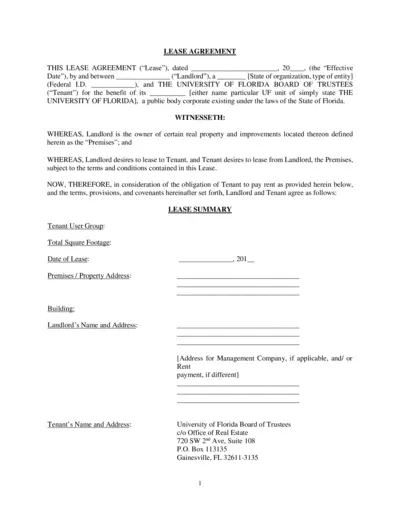

Lease Agreement for University of Florida Premises

This lease agreement file outlines the terms and conditions for renting a property owned by the Landlord to the University of Florida Board of Trustees. It covers key aspects such as lease term, rent details, improvements, and permitted use. Ideal for landlords and tenants involved in leasing agreements.

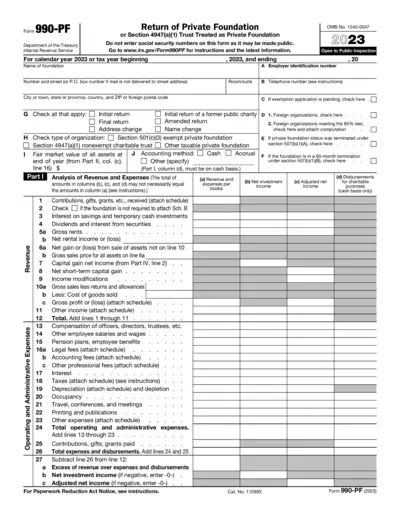

Return of Private Foundation Form 990-PF 2023

Form 990-PF is a return for private foundations required by the IRS. It includes information on revenue, expenses, and other financial details. Avoid entering social security numbers on this form.

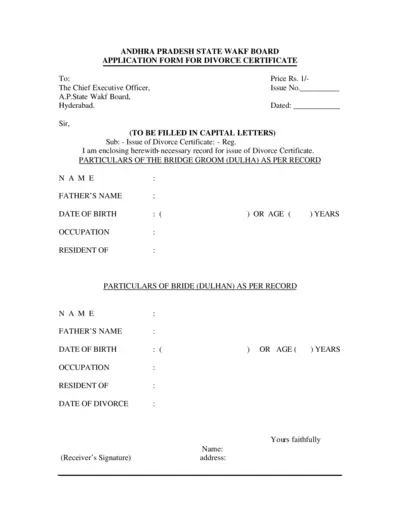

Application Form for Divorce Certificate - Andhra Pradesh State Wakf Board

This form is used to apply for a Divorce Certificate from the Andhra Pradesh State Wakf Board in Hyderabad. The form requires details of both bride and groom as per recorded information. It also includes fields for verification and office use only.