IRS Publication 501 Exemptions Standard Deduction

IRS Publication 501 provides essential details on exemptions, standard deductions, and filing information for the 2014 tax year. This guide is important for taxpayers to understand their filing requirements and benefits. Access crucial IRS resources and information to simplify your tax preparation process.

Edit, Download, and Sign the IRS Publication 501 Exemptions Standard Deduction

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, gather your personal and financial information, including income details and exemption qualifications. Carefully review the instructions provided in the publication to determine your filing status and applicable deductions. Follow the guidelines to complete the form accurately.

How to fill out the IRS Publication 501 Exemptions Standard Deduction?

1

Review the filing requirements and determine if you must file a tax return.

2

Gather necessary information including income, exemptions, and deductions.

3

Fill out the appropriate form based on your filing status.

4

Double-check your entries for accuracy and completeness.

5

Submit the form by the relevant due date to ensure compliance.

Who needs the IRS Publication 501 Exemptions Standard Deduction?

1

U.S. citizens looking to file their income tax returns for the 2014 tax year.

2

Resident aliens who must comply with federal tax regulations.

3

Individuals seeking to claim exemptions for dependents.

4

Tax professionals assisting clients with filing requirements.

5

Anyone requiring detailed information on standard deductions applicable to their filing status.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the IRS Publication 501 Exemptions Standard Deduction along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your IRS Publication 501 Exemptions Standard Deduction online.

With PrintFriendly, you can easily edit this PDF to customize your tax information. Our intuitive interface allows you to make changes in real-time, ensuring that the form is accurate before submission. Utilize our tools to highlight and annotate any sections as needed.

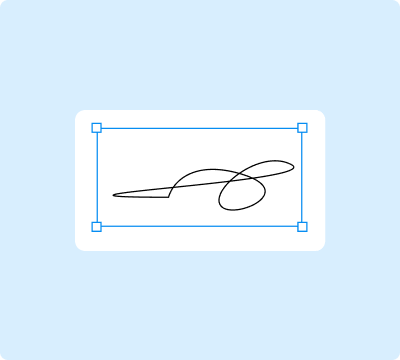

Add your legally-binding signature.

PrintFriendly provides a seamless way to sign your PDF documents electronically. Use our e-signature feature to add your digital signature directly onto the form. This process enhances convenience and ensures your submission is ready for filing.

Share your form instantly.

Sharing your edited PDF is straightforward with PrintFriendly's sharing options. Once your document is ready, you can share it easily via email or social media. Take advantage of our links to distribute important tax information with friends and clients.

How do I edit the IRS Publication 501 Exemptions Standard Deduction online?

With PrintFriendly, you can easily edit this PDF to customize your tax information. Our intuitive interface allows you to make changes in real-time, ensuring that the form is accurate before submission. Utilize our tools to highlight and annotate any sections as needed.

1

Upload the PDF to the PrintFriendly editor.

2

Use the editing tools to modify text and fields as needed.

3

Review your changes to ensure all details are accurate.

4

Save your edited document to your device.

5

Download the finalized version for submission.

What are the instructions for submitting this form?

To submit this form, you can file electronically through the IRS e-file system or mail a paper copy of the completed form to the appropriate IRS address specified in the publication. If you're choosing to send it by mail, ensure it is postmarked by the due date of your return. For assistance, consult a tax professional or the IRS website for specific mailing addresses based on your state.

What are the important dates for this form in 2024 and 2025?

Important deadlines for the 2014 tax year typically include April 15, 2015, for individual returns. Extensions may be requested, but submissions must be timely. Taxpayers should be aware of any specific state deadlines that may differ.

What is the purpose of this form?

The purpose of IRS Publication 501 is to provide clear instructions and essential details regarding filing exemptions, deductions, and general filing requirements for the tax year 2014. It serves as a comprehensive resource for all taxpayers needing guidance on how to navigate their energy efficiently before submitting their returns. By leveraging this publication, taxpayers can optimize their filing approach and fully comply with IRS standards.

Tell me about this form and its components and fields line-by-line.

- 1. Filing Status: Determines what category you fall under and the standard deductions applicable.

- 2. Exemptions: Identifies the number of exemptions you can claim for dependents.

- 3. Income: Reports all sources of income for the tax year.

- 4. Deductions: States deductions that may be applicable based on your filing status.

What happens if I fail to submit this form?

Failure to submit this form can result in penalties and interest on unpaid taxes. Additionally, you may lose the opportunity to claim any refunds due to incorrect filings. It is crucial to adhere to deadlines to avoid complications.

- Penalties for Late Filing: You may face fines if you fail to file your returns on time.

- Loss of Refund: Missing the filing deadline could mean you lose out on refunds you are entitled to.

- Increased Scrutiny: Submitting late may lead to increased scrutiny from the IRS on your future returns.

How do I know when to use this form?

- 1. When Filing Taxes: Use the form to file your federal income tax return accurately.

- 2. Claiming Exemptions: Required if you are claiming exemptions for dependents.

- 3. Understanding Deductions: Essential for understanding deductions applicable based on filing status.

Frequently Asked Questions

What is IRS Publication 501?

IRS Publication 501 provides guidance on exemptions, standard deductions, and filing requirements for taxpayers.

Who should use this form?

U.S. citizens and resident aliens preparing their taxes for the 2014 tax year need to refer to this form.

How can I edit the PDF?

You can edit the PDF by uploading it to PrintFriendly and utilizing our editing tools.

Can I sign my PDF electronically?

Yes, PrintFriendly allows you to add a digital signature to your PDF.

How do I share my completed form?

You can share your PDF via email or social media directly from PrintFriendly.

What if I need help filling out the form?

Instructions are provided in Publication 501 to assist you with filling out the form correctly.

Is there a deadline for filing?

Yes, it’s important to submit the form by the IRS deadlines for the 2014 tax year.

Can I save my edits on PrintFriendly?

You can download your edited document, but saving directly on PrintFriendly is not currently available.

Where can I find IRS resources?

Visit the IRS website for additional resources and assistance with your tax preparation.

How do I access the latest tax forms?

You can access the latest forms by visiting the IRS website or using PrintFriendly to edit and download them.

Related Documents - IRS Pub 501

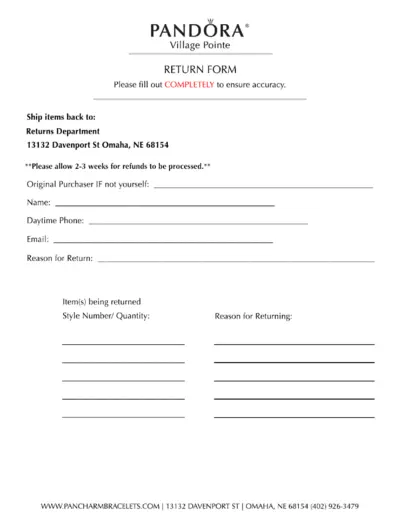

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

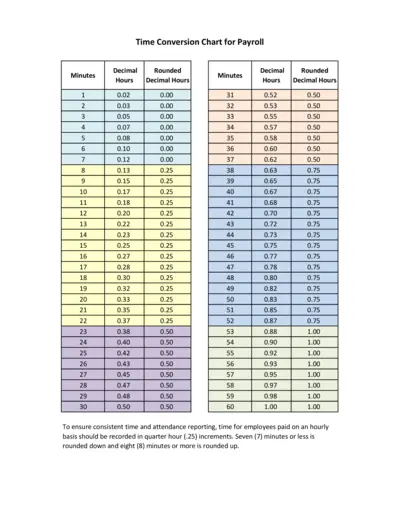

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

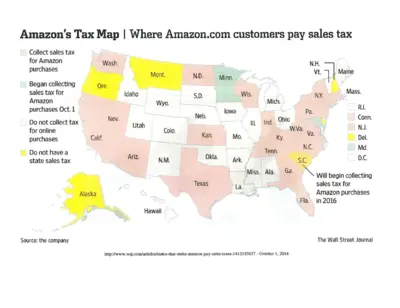

Amazon Sales Tax Map and Collection Details

This document provides a map of U.S. states where Amazon collects sales taxes and details the reasons for tax collection. It includes information on states with physical Amazon facilities, affiliate nexus laws, and states that will begin collecting taxes in the future. This is useful for understanding Amazon's tax obligations across states.

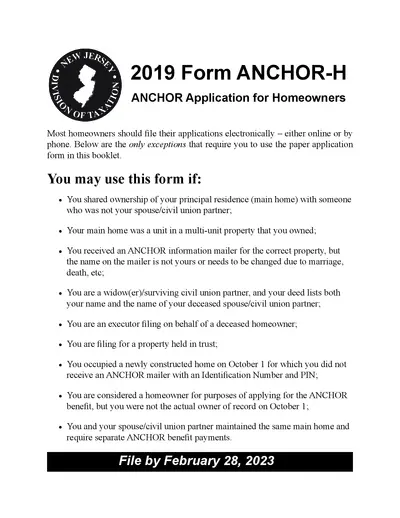

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

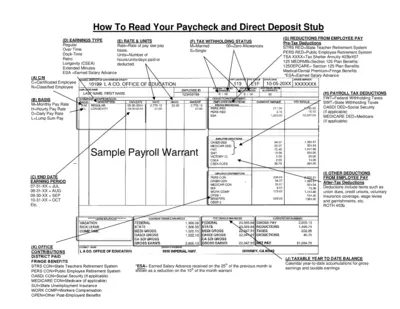

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

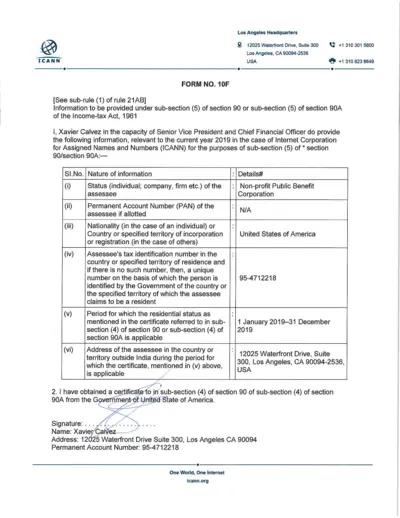

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

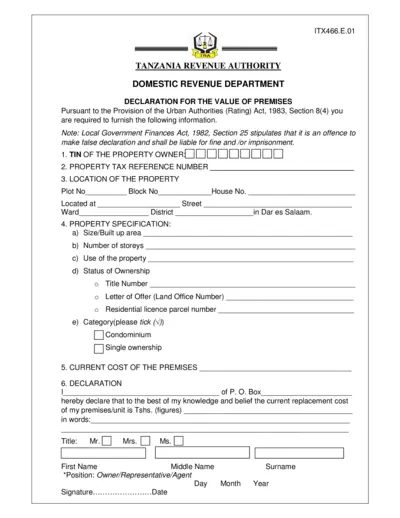

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

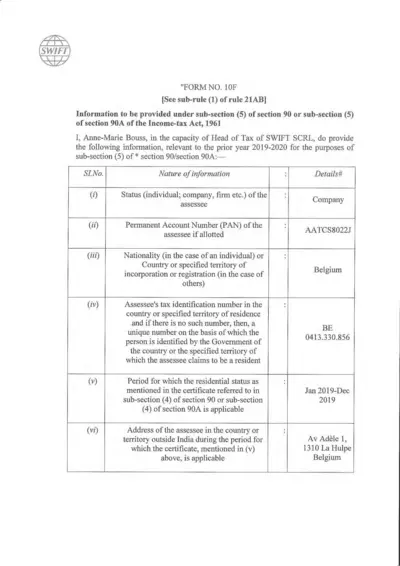

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

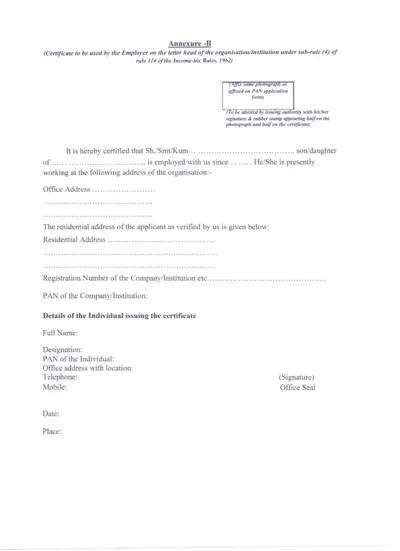

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

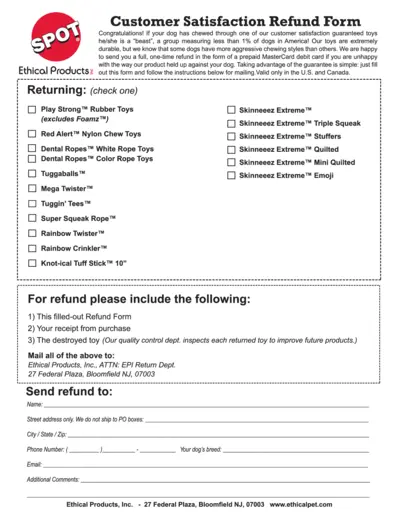

Customer Satisfaction Refund Form For Dog Toys

This file is a refund form for customer satisfaction guaranteed dog toys from Ethical Products Inc. If your dog has chewed through one of their durable toys, you can request a one-time refund using this form. Follow the instructions to obtain a refund via a prepaid MasterCard debit card.