Edit, Download, and Sign the myVTax Guide: Complete the Landlord Certificate

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the Landlord Certificate, first navigate to myVTax and log in. Provide the required general property and renter information. Ensure all entries are validated before submitting your application.

How to fill out the myVTax Guide: Complete the Landlord Certificate?

1

Access myVTax and log into your landlord account.

2

Enter general property information including owner details and rental address.

3

Input renter and unit information correctly.

4

Review all entries and validate addresses.

5

Submit the completed certificate by the deadline.

Who needs the myVTax Guide: Complete the Landlord Certificate?

1

Landlords who own rental properties to fulfill their legal obligations.

2

Property management companies managing rental units for compliance.

3

Real estate agents representing landlords during certificate submission.

4

Investors in rental properties to ensure accurate reporting of income.

5

Municipal officials requiring certificates for property assessments.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the myVTax Guide: Complete the Landlord Certificate along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your myVTax Guide: Complete the Landlord Certificate online.

Editing your PDF on PrintFriendly is straightforward; simply upload your document, and use our intuitive editing tools. Modify text, add annotations, or adjust layouts as needed. Once your edits are complete, you can easily download the updated file.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is simple and can be done digitally in just a few clicks. Use our signature tool to create or upload your signature directly onto the document. After signing, save your updated PDF with the valid signature included.

Share your form instantly.

Sharing your PDF is hassle-free with PrintFriendly. Use our built-in sharing features to send the document directly via email or social media. You can also generate a sharing link to distribute your PDF easily.

How do I edit the myVTax Guide: Complete the Landlord Certificate online?

Editing your PDF on PrintFriendly is straightforward; simply upload your document, and use our intuitive editing tools. Modify text, add annotations, or adjust layouts as needed. Once your edits are complete, you can easily download the updated file.

1

Upload your PDF document to PrintFriendly.

2

Use the editing tools to make changes to your document.

3

Review your edits to ensure everything is correct.

4

Save your changes once you are satisfied with the edits.

5

Download your edited PDF to your device.

What are the instructions for submitting this form?

To submit the Landlord Certificate, complete all required fields in the form. You can submit your certificate online through myVTax, or mail a paper copy to the Vermont Department of Taxes. For online submissions, ensure you log into your myVTax account and follow the prompts to upload your completed certificate. The physical submission can be sent to: Vermont Department of Taxes, 133 State Street, Montpelier, VT 05620. Always double-check that you have printed and signed before mailing.

What are the important dates for this form in 2024 and 2025?

For 2024, the deadline to submit the Landlord Certificate is January 31. In 2025, the same deadline applies. Make sure to plan accordingly to avoid late submissions.

What is the purpose of this form?

The Landlord Certificate serves as an essential document for reporting rental income and tenant details to the Vermont Department of Taxes. This form ensures that landlords comply with state regulations regarding property rental. By accurately completing this form, landlords can avoid potential legal issues and ensure proper documentation of their rental activities.

Tell me about this form and its components and fields line-by-line.

- 1. Owner or Landlord Name: The full name of the individual or entity leasing the rental property.

- 2. Landlord Mailing Address: The official address where the landlord receives correspondence.

- 3. Rental Unit Address: The physical address of the rental unit being reported.

- 4. SPAN Number: A unique identifier assigned to the property for tax purposes.

- 5. Number of Rental Units: Total number of rental units in the building.

- 6. Tenant Information: Details about the tenant including name, unit number, and rental duration.

What happens if I fail to submit this form?

If the Landlord Certificate is not submitted, landlords may face consequences such as penalties or compliance issues with the Vermont Department of Taxes. It is essential to submit by the designated deadline to avoid any disruption in rental operations.

- Legal Penalties: Failure to submit on time may result in fines or additional legal scrutiny.

- Delayed Reporting: Late submissions can lead to inaccurate records for tax assessments.

- Compliance Issues: Not submitting the certificate can create issues with local authorities.

How do I know when to use this form?

- 1. New Tenants: Use this form to report details whenever new tenants begin renting.

- 2. Change in Rental Information: Update the certificate if there are changes in rental terms or tenant details.

- 3. Annual Reporting Requirement: Submit this form annually by January 31 for compliance.

Frequently Asked Questions

What is the Landlord Certificate used for?

The Landlord Certificate is used to report tenant information and comply with Vermont tax regulations.

How can I edit the PDF using PrintFriendly?

You can edit the PDF by uploading it to PrintFriendly and using our editing tools to make necessary changes.

Can I share the edited PDF?

Yes, PrintFriendly allows you to easily share your edited PDF via email or social media.

What if I make a mistake while filling out the form?

You can revise any mistakes using the editing tools on PrintFriendly before final submission.

Is there a deadline for submitting the Landlord Certificate?

Yes, certificates must be submitted by January 31 each year.

Can I submit multiple certificates at once?

Yes, you can utilize the bulk upload option to submit multiple certificates.

Do I need a myVTax account to file the certificate?

You can file the certificate either with or without a myVTax account.

What information do I need to complete the certificate?

You need to provide general property information and renter details to complete the form.

How can I ensure my submission is accurate?

Make sure to validate addresses and review all entries before submission.

What happens if I miss the submission deadline?

Failing to submit by the deadline may lead to penalties or issues with compliance.

Related Documents - Landlord Certificate Guide

COPPER HILLS HOA Dues Reminder and Community Website Info

This file includes a reminder to pay HOA fees for Copper Hills, instructions for payment, and information about the new community website. The file provides ways to connect with the HOA board and includes an invoice for payment.

Committee Charters Oaks East Homeowners Association

This document outlines the various committee charters of Oaks East Homeowners Association. It provides detailed information about responsibilities, procedures, and authority for each committee. This is essential for homeowners to understand their community's governance.

Annual Fire Inspection Notification for Tenants

This file serves as a sample letter to notify tenants about upcoming annual fire inspections. It provides detailed instructions on what to expect during the inspection. Utilize this template to ensure all tenants are informed timely and effectively.

Chapter 227 Abandoned Property Guidelines

This document provides detailed definitions, procedures, and regulations regarding abandoned property, including towing and storage requirements. It outlines the responsibilities of property owners and the penalties for violations. This is essential for anyone involved in managing or dealing with abandoned vehicles and vessels.

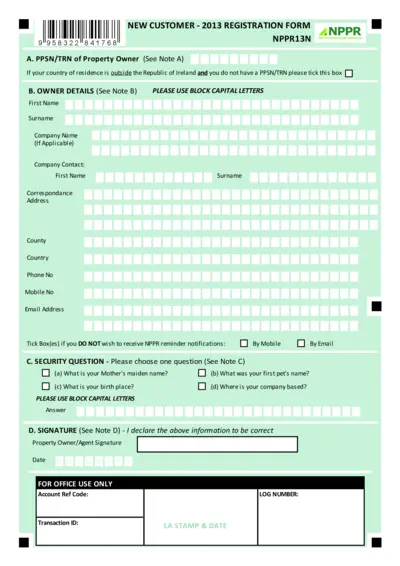

Non Principal Private Residence Registration Form

The Non Principal Private Residence Registration Form allows property owners to register their non-principal private residences. It collects essential information such as owner details, property addresses, and payment options. Use this form to ensure compliance and manage your property registration effectively.

Commercial Asset Property Management Manual

This manual serves as a comprehensive guide for the policies and procedures involved in property management. It covers essential topics including compliance, insurance, and tenant relations. Designed for property managers and associated professionals, it ensures standardized operations and best practices.

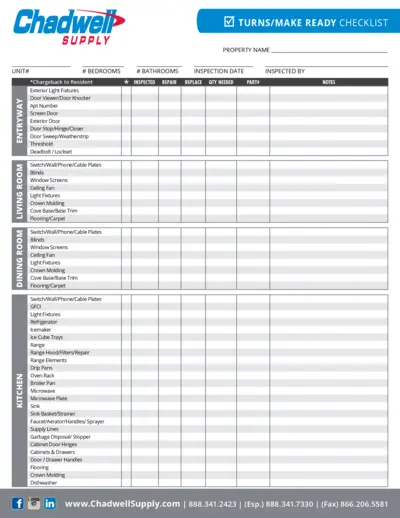

Chadwell Supply Detailed Turns Checklist Document

This checklist is essential for completing unit inspections and repairs. It details various components and their respective inspection requirements. Use this document to ensure property maintenance standards are met efficiently.

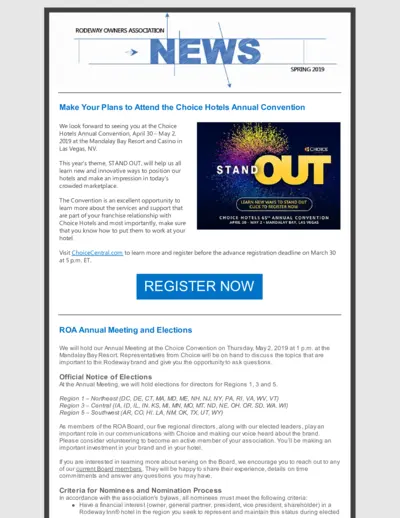

Rodeway Owners Association News Spring 2019

This file contains important news and guidelines for members of the Rodeway Owners Association, focusing on the upcoming Choice Hotels Annual Convention held in Las Vegas. It outlines the details of the convention, election processes, and updates on policies affecting the association. Use this file to stay informed about your rights and responsibilities as a member.

T2 Rural Land Use and Development Guidelines

This document outlines the characteristics and guidelines for T2 Rural land use. It details the development patterns focused on preserving the natural and agricultural landscape while providing residents with a rural lifestyle. Understanding these guidelines is essential for developers, residents, and planners involved in rural development.

Public Housing Resident Organizing Toolkit

This toolkit provides essential forms and templates for resident councils. It includes guidelines on ensuring member privacy and effective organizing. Perfect for individuals involved in public housing governance.

COVID-19 Rent Relief Program Tenant Approval

This document provides details about the COVID-19 Rent Relief Program approval for tenants. It outlines payment disbursement, terms and conditions. It includes instructions for landlords regarding their compensation.

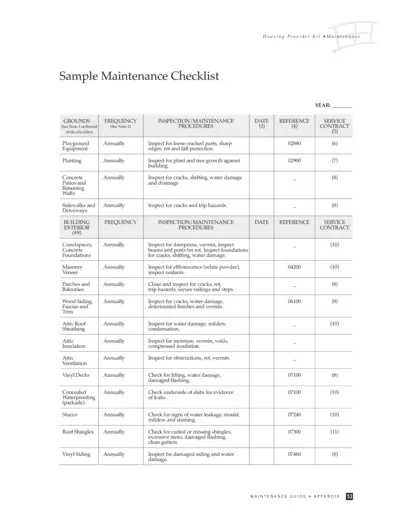

Housing Provider Maintenance Checklist Guide

This Housing Provider Kit offers essential maintenance checklists to ensure the upkeep of residential properties. Designed for property managers and maintenance teams, it provides detailed inspection procedures for various building components. Regular maintenance helps to prevent costly repairs and enhances tenant satisfaction.