Profit and Loss Statement for Business Owners

This file is a Profit and Loss Statement that needs to be filled out for each business owned by the borrower(s). It includes sections for income, expenses, and net income or loss. The form requires signatures from the borrower(s) to verify the accuracy of the information.

Edit, Download, and Sign the Profit and Loss Statement for Business Owners

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this Profit and Loss Statement, you'll need to gather information about your business's income and expenses for the specified period. You will then list this information in the relevant sections, ensuring accuracy and completeness. Finally, sign and date the form to verify the information provided.

How to fill out the Profit and Loss Statement for Business Owners?

1

Enter the names of the borrowers and company name.

2

Specify the type of business and the period for the statement.

3

Provide detailed information about gross sales, other income, and total income.

4

List all business expenses, including salaries, utilities, rent, etc.

5

Calculate the net income or loss by subtracting total expenses from total income.

Who needs the Profit and Loss Statement for Business Owners?

1

Freelancers who need to document their business income and expenses.

2

Small business owners looking to track their financial performance.

3

Loan applicants required to provide financial information to lenders.

4

Accountants assisting clients with financial statement preparation.

5

Entrepreneurs seeking to understand their business profitability.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Profit and Loss Statement for Business Owners along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Profit and Loss Statement for Business Owners online.

With PrintFriendly, you can easily edit your PDFs directly within our platform. Use our intuitive editor to add or adjust information, making sure all details are correct. Save and download the edited version of your PDF seamlessly.

Add your legally-binding signature.

Sign your PDF documents effortlessly with PrintFriendly. Open the PDF in our editor and use the signature tool to add your digital signature. Save and download the signed document for your records or submission.

Share your form instantly.

Share your PDF documents quickly and easily using PrintFriendly. After editing or signing your file, use our sharing options to email, download, or generate a shareable link. Distribute your document to relevant stakeholders efficiently.

How do I edit the Profit and Loss Statement for Business Owners online?

With PrintFriendly, you can easily edit your PDFs directly within our platform. Use our intuitive editor to add or adjust information, making sure all details are correct. Save and download the edited version of your PDF seamlessly.

1

Upload your PDF file to PrintFriendly.

2

Open the file in the PDF editor.

3

Use the editing tools to make necessary changes.

4

Save the edited PDF.

5

Download the updated file to your device.

What are the instructions for submitting this form?

Submit the completed Profit and Loss Statement via email, fax, online submission form, or physical mail, depending on the requirements of the lender or institution requesting it. Always double-check the contact information provided by the requester to ensure proper delivery. It is advisable to keep a copy of the submitted form for your records.

What are the important dates for this form in 2024 and 2025?

For the years 2024 and 2025, make sure to submit your Profit and Loss Statement before tax filing deadlines, as well as any relevant loan application or financial review periods.

What is the purpose of this form?

The purpose of the Profit and Loss Statement is to provide a detailed summary of a business's financial performance over a specified period. By compiling information about income and expenses, business owners can better understand their profitability and make informed financial decisions. Additionally, this form is often required by lenders for loan applications, making it an essential document for accessing financial assistance or credit.

Tell me about this form and its components and fields line-by-line.

- 1. Borrower(s) Name(s): The names of the individuals borrowing or owning the business.

- 2. Company Name: The name of the business for which the statement is being completed.

- 3. Type of Business: The nature or industry of the business.

- 4. Period: The specific time frame for which the statement is applicable.

- 5. Gross Sales and Receipts: The total income from sales and other receipts during the period.

- 6. Other Income: Any additional income, such as interest or fees earned.

- 7. Total Income: The sum of gross sales and other income.

- 8. Business Only Salaries Paid to Owners: Salaries paid to owners, excluding the borrower(s).

- 9. Expenses: Various business expenses, including salaries, benefits, payroll taxes, utilities, rent, insurance, advertising, telephone, office expenses, repairs and maintenance, travel, meals, entertainment, and other business expenses.

- 10. Total Business Expenses: The sum of all listed business expenses.

- 11. Net Income/Loss: The difference between total income and total expenses.

- 12. Amount of Net Income that Borrower(s) Received: The part of net income received by the borrower(s).

- 13. Borrower Signature: Signature of the borrower to verify the accuracy of the information.

- 14. Co-Borrower Signature: Signature of the co-borrower, if applicable.

- 15. Date: The date when the form is signed.

What happens if I fail to submit this form?

Failing to submit the Profit and Loss Statement can lead to serious consequences for your business.

- Loan Application Rejection: Lenders may reject loan applications due to incomplete financial information.

- Inaccurate Financial Records: Lack of submission can result in inaccurate financial tracking and management.

- Tax Penalties: Failure to provide necessary information may lead to tax-related issues and penalties.

How do I know when to use this form?

- 1. Loan Applications: Submitting this form along with your loan application helps provide a clear picture of your business finances.

- 2. Financial Reviews: Use this form during internal or external financial reviews to assess your business performance.

- 3. Tax Filing: This form can be used to support your tax filings by providing detailed financial information.

- 4. Management Decisions: Use the form to aid in making informed business management decisions based on financial performance.

- 5. Investor Relations: Providing this statement can help keep investors informed about the business's financial status.

Frequently Asked Questions

How do I fill out the Profit and Loss Statement?

Gather information about your business income and expenses, enter it in the specified fields, and sign and date the form.

Can I edit the PDF on PrintFriendly?

Yes, you can use PrintFriendly's PDF editor to make changes to your PDF document.

Is it possible to sign the PDF on PrintFriendly?

Yes, you can use PrintFriendly's signature tool to add your digital signature to the PDF.

How can I share the completed PDF?

You can share the PDF via email, download it, or generate a shareable link using PrintFriendly's sharing options.

Does PrintFriendly support PDF downloads?

Yes, you can download your edited or signed PDF directly from PrintFriendly.

What information do I need to fill out the Profit and Loss Statement?

You need details on your business's income, expenses, and net income for the specified period.

Can I save my progress while editing the PDF on PrintFriendly?

Yes, make sure to periodically save your changes to avoid losing any data.

What types of businesses can use this Profit and Loss Statement?

This form can be used by various business types, including freelancers, small businesses, and more.

How do I verify the information provided on the form?

Review the completed form for accuracy and sign and date it to verify the information.

Why is it important to fill out a Profit and Loss Statement?

This statement helps track financial performance, supports loan applications, and assists with business management.

Related Documents - Profit and Loss Statement

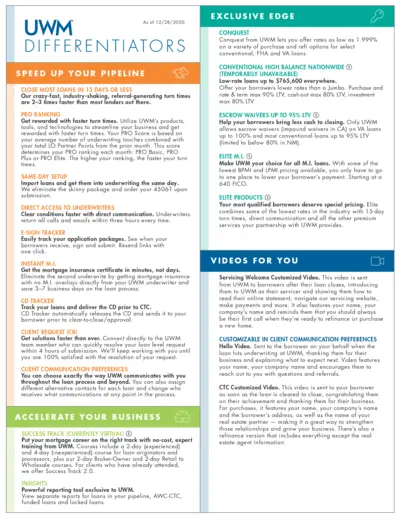

UWM File Details and Instructions

This file provides detailed information and instructions on the services and products offered by UWM. It highlights various features such as turn times, direct access to underwriters, E-sign tracker, and more. Users can find guidance on how to accelerate their business practices.

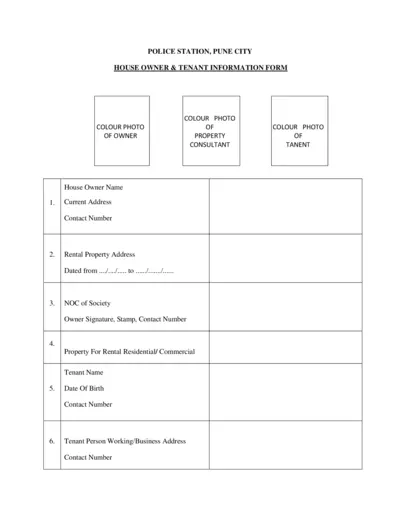

Police Station Pune City House Owner & Tenant Information Form

This form is for house owners in Pune City to provide necessary information about their tenants to the police station. It includes details about the owner, tenant, and rental property. It ensures proper verification and record-keeping.

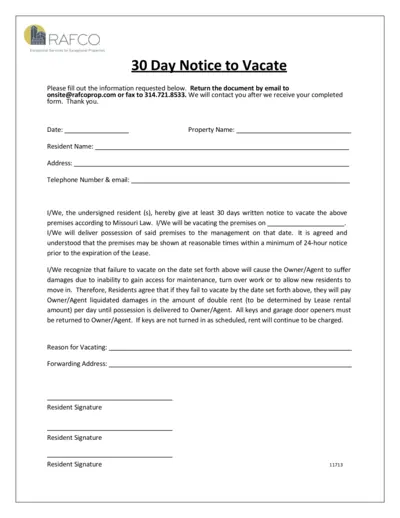

RAFCO 30 Day Notice to Vacate Form for Properties

This file is a 30-day notice to vacate form from RAFCO. It includes fields for property and resident information, as well as instructions for vacating the premises. It is intended to be submitted via email or fax.

Bubble Map Worksheet Template for Visual Learning

This Bubble Map file is a worksheet template designed for visual learning. It helps users organize thoughts and ideas through bubbles and connections. Ideal for students, educators, and professionals.

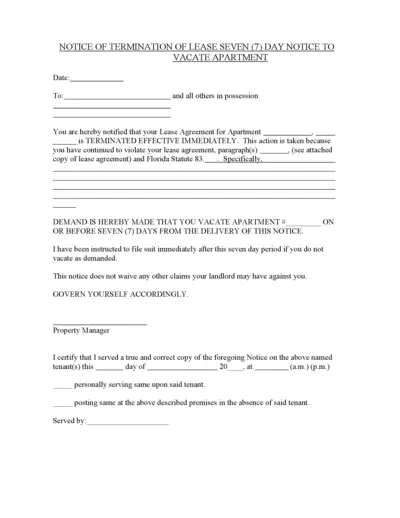

Notice of Termination of Lease - Seven Day Notice

This document serves as a Notice of Termination of Lease. It is used to notify tenants that their lease agreement is terminated immediately. The tenant is required to vacate the premises within seven days.

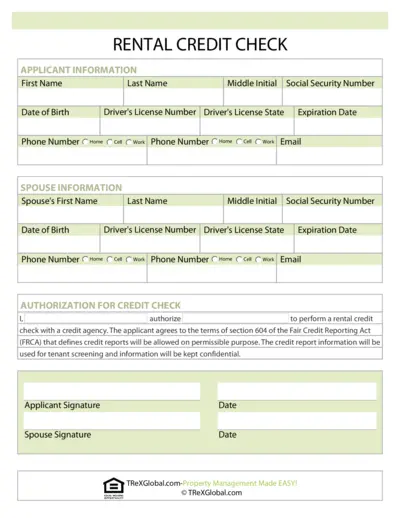

Rental Credit Check Authorization Form

This document is used to authorize a rental credit check for potential tenants. It requires personal information for both the applicant and their spouse. It ensures compliance with the Fair Credit Reporting Act (FCRA) for tenant screening purposes.

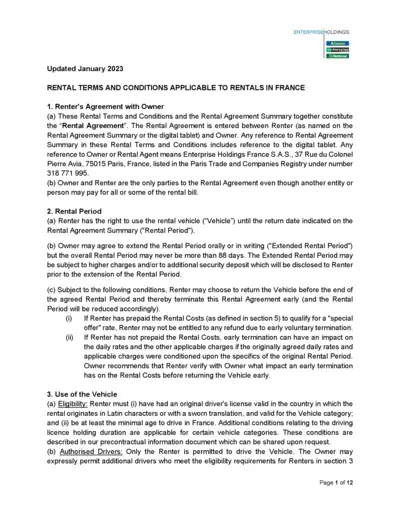

Rental Terms and Conditions for France Rentals - January 2023

This document outlines the rental terms and conditions applicable to car rentals in France with Enterprise Holdings, Alamo, and National. It includes details about the rental agreement, rental period, vehicle usage, main obligations, and more. It is essential for anyone renting a vehicle in France with these companies to understand their rights and responsibilities.

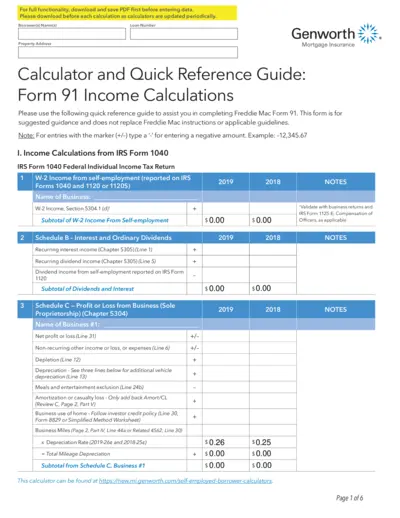

Freddie Mac Form 91 Mortgage Insurance Calculation Tool

This PDF is a guide for completing Freddie Mac Form 91. It includes instructions for calculating income from various sources. The guide also details how to use the Genworth Mortgage Insurance Calculator.

Health Informatics Practicum Thank You Letter Template

This file is a thank you letter template for a practicum experience in Health Informatics. It helps users express their gratitude for the opportunity and the learnings gained. The letter highlights the user's appreciation for the staff and the professional experience.

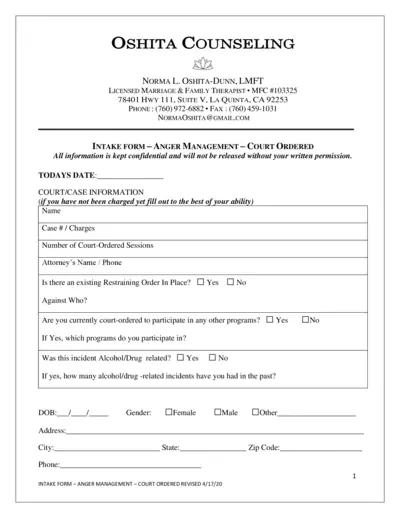

Court-Ordered Anger Management Intake Form

This intake form is designed for individuals required to complete anger management sessions by court order. It collects personal, legal, and psychological information to help therapists provide appropriate therapy. Confidentiality is ensured.

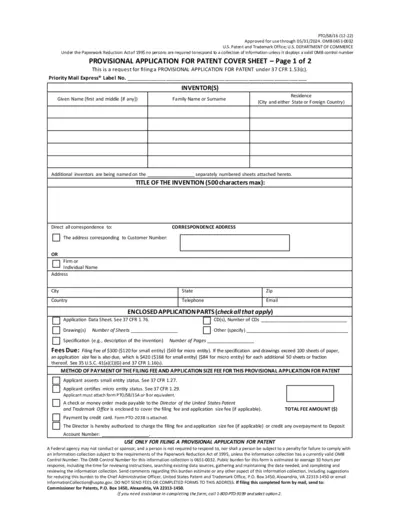

Provisional Patent Application Cover Sheet - Instructions

This file is a cover sheet for a provisional patent application under 37 CFR 1.53(c). It includes inventor details, invention title, correspondence address, fees due, and payment methods.

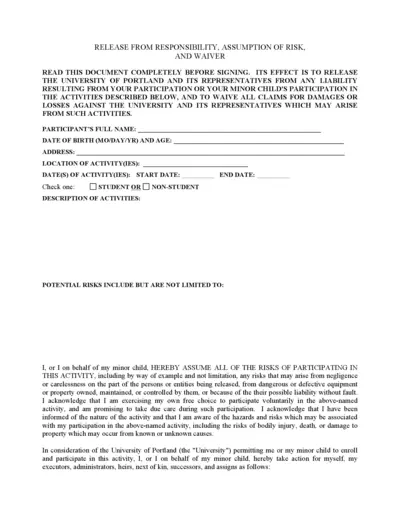

University of Portland Activity Waiver and Release Form

This document releases the University of Portland from any liability related to participation in specified activities. It includes details on assuming risk and waiving claims for damages. It is important to read and understand fully before signing.