Sample Hardship Letter for Loan Modification Guidance

This document provides a sample hardship letter to facilitate communication with lenders for loan modifications. It outlines essential elements to include based on personal circumstances. Use this resource as a reference when drafting your own hardship letter.

Edit, Download, and Sign the Sample Hardship Letter for Loan Modification Guidance

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this hardship letter, start by gathering your personal financial information. Clearly explain your situation and the hardships you are facing. Provide specific details about your proposed solution and your financial recovery plan.

How to fill out the Sample Hardship Letter for Loan Modification Guidance?

1

Gather all necessary personal and financial information.

2

Clearly outline your hardship circumstances.

3

Describe what led to your financial difficulties.

4

Propose a realistic repayment plan to the lender.

5

Include supporting documents to validate your claims.

Who needs the Sample Hardship Letter for Loan Modification Guidance?

1

Homeowners facing financial difficulties who need loan modifications.

2

Borrowers who have experienced job loss and cannot maintain mortgage payments.

3

Families with unexpected medical expenses affecting their finances.

4

Individuals experiencing divorce or separation needing financial adjustments.

5

Consumers seeking to retain their home amid overwhelming financial challenges.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Sample Hardship Letter for Loan Modification Guidance along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Sample Hardship Letter for Loan Modification Guidance online.

With our PDF editor, you can easily modify the sample hardship letter to suit your needs. Adjust any sections to reflect your personal circumstances accurately. Our user-friendly interface allows for quick edits without hassle.

Add your legally-binding signature.

Sign the PDF directly on PrintFriendly with our new e-signature feature. Simply add your signature where indicated and confirm it. This ensures your letter is completed professionally before submission.

Share your form instantly.

Sharing your PDF is easy on PrintFriendly. You can send a direct link to your edited document via email or social media. Share your letter quickly with others who may need to see it.

How do I edit the Sample Hardship Letter for Loan Modification Guidance online?

With our PDF editor, you can easily modify the sample hardship letter to suit your needs. Adjust any sections to reflect your personal circumstances accurately. Our user-friendly interface allows for quick edits without hassle.

1

Open the PDF editor on PrintFriendly.

2

Upload the sample hardship letter PDF.

3

Edit the text where necessary to include your information.

4

Save the edited PDF to your device.

5

Use the share feature if you need to send it to someone else.

What are the instructions for submitting this form?

To submit this hardship letter, gather all required documentation and ensure your letter is complete. You can send the letter via email to your lender's loss mitigation department or mail it to their physical address. Ensure to include your account number on all correspondence for proper processing.

What are the important dates for this form in 2024 and 2025?

While this letter does not have specific deadlines, it is crucial to act promptly if facing potential foreclosure or loan modification requests. Keep track of any deadlines set by your lender regarding modification requests. Always check with your financial institution for specific dates relevant to your case.

What is the purpose of this form?

The purpose of this hardship letter is to clearly and effectively communicate your financial struggles to your lender. It provides a structured format for detailing your circumstances and requests a review for loan modification options. By articulating your situation and proposing a solution, you enhance your chances of receiving assistance from your lender.

Tell me about this form and its components and fields line-by-line.

- 1. Name: Your full name as it appears on the loan.

- 2. Address: Your current residence address.

- 3. Account Number: The mortgage account number related to your loan.

- 4. Hardship Explanation: A detailed explanation of your financial hardship.

- 5. Proposed Solution: Your plan for repayment or loan modification.

What happens if I fail to submit this form?

Failing to submit your hardship letter can lead to foreclosure proceedings or continued financial stress. Without this letter, your lender may not understand your situation and be unable to assist you effectively. It's essential to be proactive and make your lender aware of your financial distress as soon as possible.

- Foreclosure Risk: Not submitting a hardship letter may increase your risk of foreclosure.

- Lack of Communication: Without a letter, your lender may not grasp your financial challenges and needs.

- Stressful Financial Situation: Ignoring submission could result in worsening your financial situation.

How do I know when to use this form?

- 1. Job Loss: When lost income affects your mortgage payment ability.

- 2. Medical Expenses: If unexpected medical bills strain your finances significantly.

- 3. Divorce: During separation or divorce when financial responsibilities change.

Frequently Asked Questions

What is a hardship letter?

A hardship letter is a document requesting leniency from your lender due to financial difficulties.

How do I download a PDF after editing?

After editing, simply click the download button to save the new version of your PDF.

Can I use the sample letter as is?

While you can use it for guidance, it’s crucial to customize it to reflect your specific situation.

What if I have multiple hardships?

You should express each hardship clearly in the letter, prioritizing the most significant ones.

How detailed should my financial information be?

Provide sufficient detail to make your case compelling while ensuring clarity and conciseness.

Do I need to attach additional documents?

Yes, attaching supporting documents like income statements can help strengthen your case.

What do I do if my payments are still not accepted?

Follow up with your lender promptly if your proposed plan is not accepted.

Can I request a loan modification for any reason?

You can request a modification for various legitimate financial hardships, but each will be evaluated individually.

Is there a specific format I should follow?

While you can follow the letter template, personalization and clarity are key.

What if my situation changes after submitting?

Notify your lender immediately if your financial situation changes.

Related Documents - Hardship Letter Template

All India Survey on Higher Education Data Capture Format 2019-2020

This file is the All India Survey on Higher Education for the year 2019-2020. It contains data capture formats for colleges and institutions affiliated by the university. The information includes college details, contact information, and geographical referencing.

Soquel High School Cheerleader Registration Packet 2024-2025

This file contains important information for students considering applying for the cheerleader position at Soquel High School. It includes dates, costs, and instructions for tryouts and participation. Make sure to review and get parental approval before proceeding.

Effective Summer Learning Program Planning Toolkit

This file offers guidance and evidence-based tools for delivering effective summer learning programs. It covers planning, recruitment, staffing, and more. The toolkit is designed for education leaders and program managers.

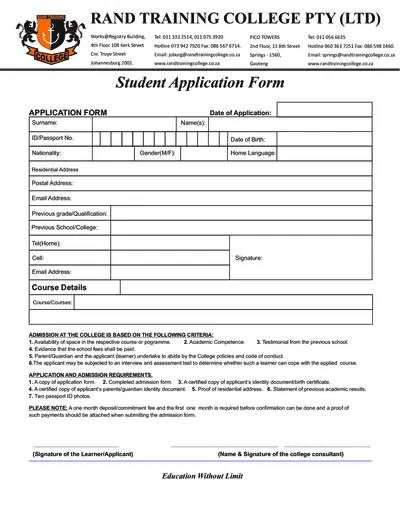

Student Application Form for Rand Training College

This file is a student application form for Rand Training College, including admission requirements and course details. It requires personal information, previous academic records, and other supporting documents. Complete the form to apply for courses offered by the college.

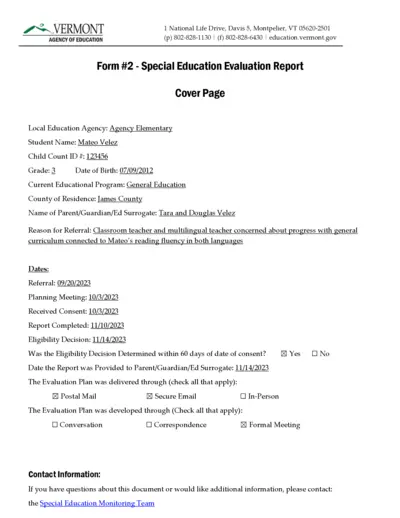

Special Education Evaluation Report - Vermont Agency

This file contains the Special Education Evaluation Report for a student named Mateo Velez. It includes details about the evaluation plan, team members involved, and assessment procedures used. The document is designed to determine the student's eligibility for special education services.

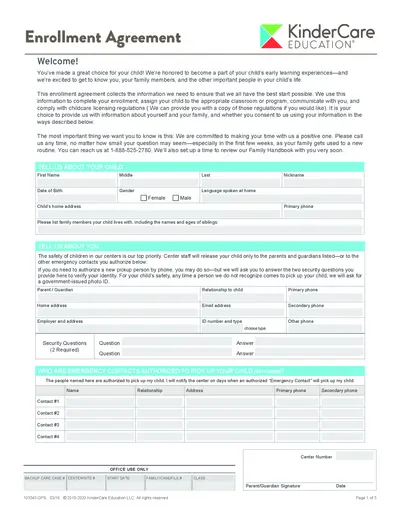

KinderCare Education Enrollment Agreement Form

This file is the enrollment agreement for KinderCare Education. It collects crucial information for your child's enrollment, classroom/program assignment, and compliance with childcare licensing regulations. Make sure to fill it out accurately to ensure a smooth enrollment process.

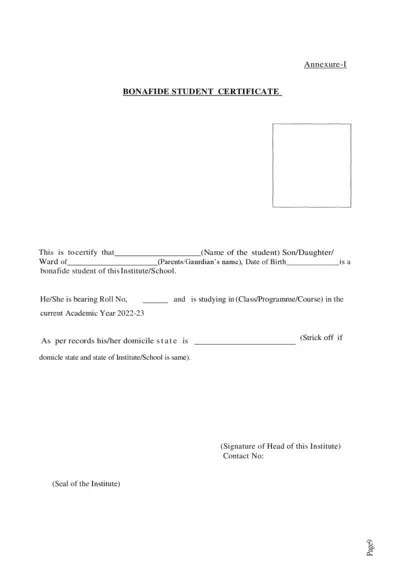

Bonafide Student Certificate & Scholarship Consent Forms

This file contains the Bonafide Student Certificate template, consent form for the use of Aadhaar/EID numbers in a state scholarship application, and an institution verification form for scholarship applications. It is intended for students applying for state scholarships and institutions verifying student information.

NIOS Prospectus 2011-12 for Gulf, Kuwait, Qatar

This file provides details and instructions for admission to the National Institute of Open Schooling (NIOS) for secondary and senior secondary courses in Gulf, Kuwait, and Qatar. It includes information on the admission process, available subjects, and other essential details. It is useful for prospective students seeking flexible and accessible education options.

Undergraduate Bursary and Loan Opportunities for 2024 at University of Cape Town

This file provides information about the bursary and loan opportunities available for undergraduate students at the University of Cape Town for the academic year 2024. It includes details about financial aid, scholarships, and bursaries offered by the university and external organizations. Students can find instructions on how to apply and important contact information in this comprehensive guide.

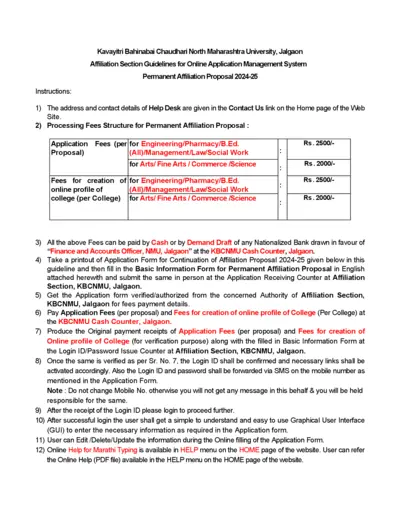

KBCNMU Permanent Affiliation Proposal 2024-25 Guidelines

This file provides detailed guidelines for filling out the Permanent Affiliation Proposal for 2024-25 for Kavayitri Bahinabai Chaudhari North Maharashtra University. It includes instructions for processing fees, submission process, and necessary documents. The document is essential for institutions seeking permanent affiliation with the university.

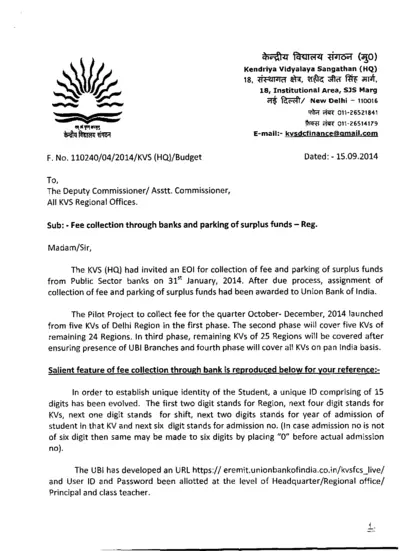

KVS Fee Collection and Surplus Funds Management 2014

This file contains information about the fee collection process through banks and the management of surplus funds for Kendriya Vidyalaya Sangathan (KVS). It details the pilot project, phases of implementation, and instructions for schools. It also includes guidelines for filling out student information online and tripartite accounts.

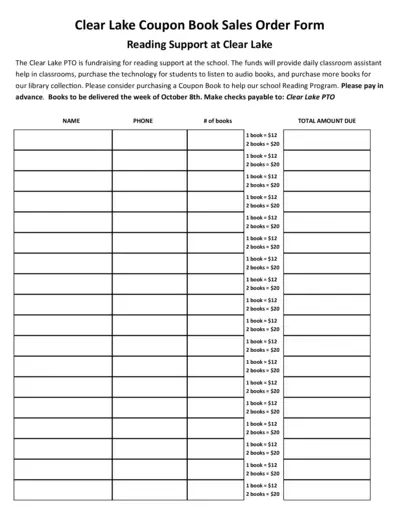

Clear Lake PTO Reading Support Coupon Book Sales Order Form

This form is used for purchasing coupon books to support reading programs at Clear Lake. The funds will help provide classroom assistance, technology for audiobooks, and more books for the library. Please fill out the form to help support the school.