Edit, Download, and Sign the Short Term Loan Application - BFFCU Payday Alternative

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this application, start by entering your personal information in the designated fields. Next, select your preferred payment method and the amount you wish to request. Finally, agree to the member agreement and sign the application.

How to fill out the Short Term Loan Application - BFFCU Payday Alternative?

1

Enter your personal information and contact details.

2

Select the payment options available to you.

3

Specify the amount requested for the loan.

4

Initial next to each agreement in the member agreement section.

5

Sign and date the form before submission.

Who needs the Short Term Loan Application - BFFCU Payday Alternative?

1

Individuals seeking short term financial relief from unexpected expenses.

2

Employees who need quick cash before their next payday.

3

Students requiring funds for tuition or school expenses.

4

Families facing temporary financial hardships that need fast assistance.

5

Members of BFFCU looking for a convenient loan option with lower rates than typical payday loans.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Short Term Loan Application - BFFCU Payday Alternative along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Short Term Loan Application - BFFCU Payday Alternative online.

Editing your PDF on PrintFriendly is straightforward. You can easily modify fields, add your information, and ensure everything is accurate. Make changes swiftly and prepare your document for submission.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is simple and efficient. You can add your signature directly within the document. This feature allows you to finalize your application quickly and conveniently.

Share your form instantly.

Sharing your PDF on PrintFriendly is seamless. You can send the document via email or share it through various platforms with just a click. Stay connected and ensure others receive the information they need.

How do I edit the Short Term Loan Application - BFFCU Payday Alternative online?

Editing your PDF on PrintFriendly is straightforward. You can easily modify fields, add your information, and ensure everything is accurate. Make changes swiftly and prepare your document for submission.

1

Open the PDF file in PrintFriendly.

2

Select the sections you want to edit.

3

Make your modifications or fill in the required information.

4

Review your changes for accuracy.

5

Download the edited PDF for submission.

What are the instructions for submitting this form?

To submit the completed form, you can email it to loans@bffcu.org, fax it to (707) 359-4290, or drop it off at our main office located at PO BOX 5760, Vacaville, CA 95696. Make sure to include your application fee of $20.00 with the submission for it to be processed.

What are the important dates for this form in 2024 and 2025?

As of now, no specific important dates are required for this form. Ensure you are a member in good standing for at least 3 months before applying. Keep an eye out for any policy updates in 2024.

What is the purpose of this form?

The purpose of this form is to provide a streamlined application process for BFFCU's Short Term Loan. It offers members an alternative to high-interest payday loans, allowing them to meet urgent financial needs effectively. By filling out this form, applicants can secure funds quickly while agreeing to fair repayment terms.

Tell me about this form and its components and fields line-by-line.

- 1. Member Name: Full name of the applicant.

- 2. Account #: Current account number with BFFCU.

- 3. Street Address: Residential address where the applicant resides.

- 4. City: City of residence.

- 5. State: State of residence.

- 6. Zip Code: Postal code for the address.

- 7. Home/Cell Phone #: Contact number for follow-up.

- 8. E-mail: Email address for communication.

What happens if I fail to submit this form?

If you fail to submit this form, your application for the short term loan will not be processed. This may lead to delays in acquiring financial assistance when needed. Ensure all required information is accurately filled out before submission.

- Incomplete Information: Missing fields may lead to application denial.

- Incorrect Payment Method: Choosing an invalid payment option can delay processing.

- Failure to Agree to Terms: Not initialing the agreement may result in rejection.

How do I know when to use this form?

- 1. Unexpected Medical Bills: Cover excessive medical expenses that arise suddenly.

- 2. Car Repairs: Fix essential transportation issues to ensure mobility.

- 3. Tuition Payments: Secure funds for urgent educational costs.

- 4. Emergency Household Expenses: Address urgent repairs or unforeseen household needs.

- 5. General Cash Flow Problems: Alleviate temporary financial strains between paychecks.

Frequently Asked Questions

How do I apply for the short term loan?

Simply fill out the application form with your correct details and submit it as instructed.

What are the payment options for this loan?

You can choose between a single payment, automatic transfer from checking, or payroll deduction.

Is there a fee for the application?

Yes, there is a non-refundable application fee of $20.00.

What is the maximum term for the loan?

The loan term cannot exceed three months.

What if my application is denied?

You will receive a notification, and you may apply again after resolving any issues.

What do I need to provide for employment verification?

You will need to submit your most recent paystub or proof of direct deposit.

Can I apply for a short term loan if I have existing loans?

You must have no current or previously delinquent loans with BFFCU.

What information is required to fill out the form?

You will need personal information, payment preference, and agreement initials.

How do I submit the form?

You can submit the form via email, fax, or in person at the credit union.

What should I do if I need assistance with the form?

Contact BFFCU customer service for guidance in completing your application.

Related Documents - BFFCU Loan Application

Recovery Loan Scheme Phase 3 Application Form

This file provides guidance and instructions for UK businesses to apply for secured loans under the government-backed Recovery Loan Scheme (RLS) Phase 3 with Atom bank.

Managing Financial Affairs and Estate Planning Guide

This file provides detailed guidance on managing financial affairs and estate planning. It covers crucial legal documents and advance care planning. It also includes information on funeral planning and resources for end-of-life concerns.

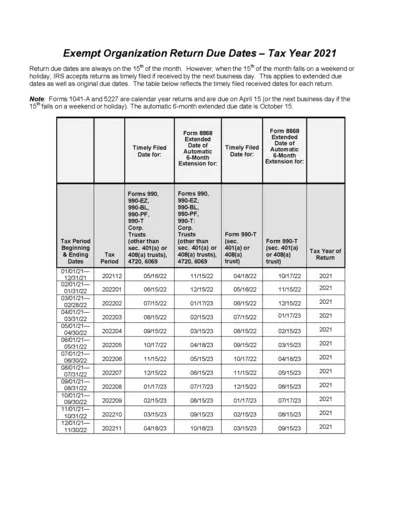

Exempt Organization Return Due Dates - Tax Year 2021

This file provides detailed information on return due dates for exempt organizations for the tax year 2021. It includes original and extended due dates, along with specific forms and filing periods. Use this guide to ensure timely submission of your tax returns.

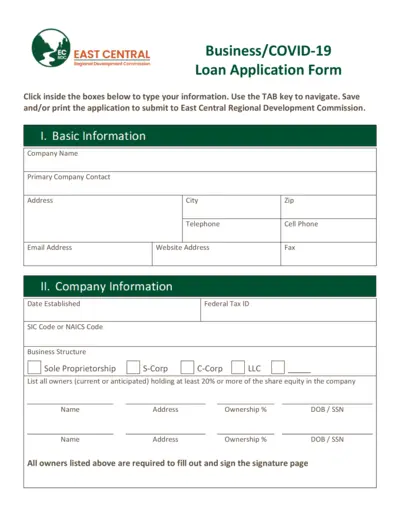

Business/COVID-19 Loan Application - East Central Regional Development Commission

This file is a loan application form provided by the East Central Regional Development Commission for businesses affected by COVID-19. It includes sections for basic information, company information, requested amount, sources and use of funds, proposed financing terms, job creation, and business profile. The application can be filled out, saved, and printed for submission.

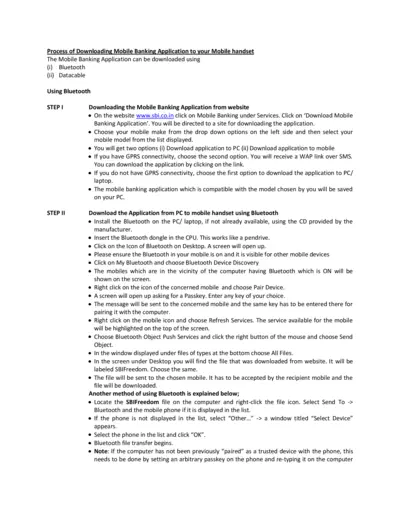

Mobile Banking Application Download Guide

This document guides you through the process of downloading the SBI Mobile Banking application to your phone using either Bluetooth or a data cable. Detailed steps are provided for both methods to ensure a smooth installation. Ensure you follow each step carefully for successful application setup.

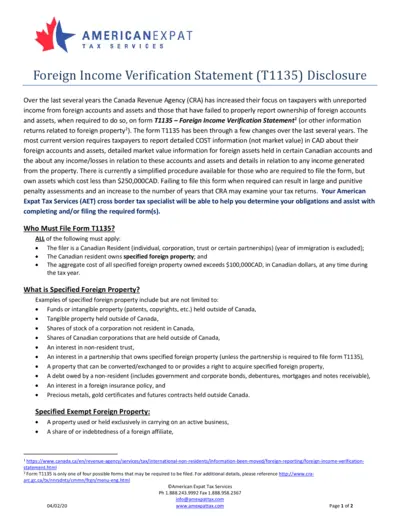

Foreign Income Verification Statement (T1135) Information

This document provides detailed guidelines about the Foreign Income Verification Statement (T1135) disclosure. It explains who must file it, what foreign properties must be reported, and the penalties for non-compliance. There are also instructions on how to file the form and how a tax specialist can assist.

The Modernization of Annuities: Insights for RIAs and Clients

This file provides detailed information on the modernization of annuities, designed for registered investment advisors (RIAs) and wealth managers. It covers types of annuities, their benefits, and how they integrate with financial planning tools. It also includes statistical insights on the use of annuities by pre-retirees and retirees.

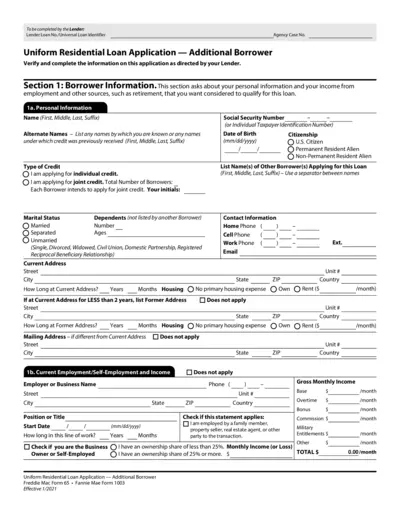

Uniform Residential Loan Application - Additional Borrower

This file is a Uniform Residential Loan Application for an additional borrower. It includes sections to fill out personal information, employment details, income sources, and other financial information required for a loan application. The file is intended to be completed by the lender and borrower.

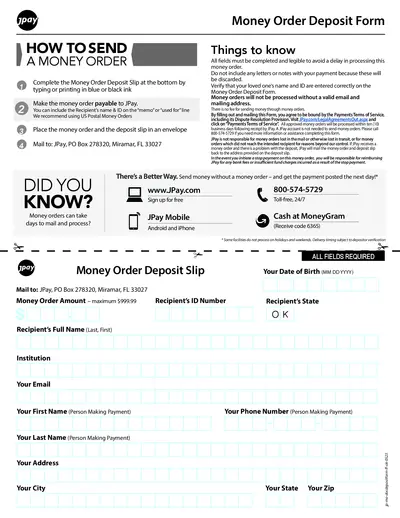

How to Send a Money Order with JPay

This document provides step-by-step instructions on sending a money order through JPay. It includes a fillable deposit slip form and important guidelines for completing and mailing your money order. Ensure all details are correct to avoid processing delays.

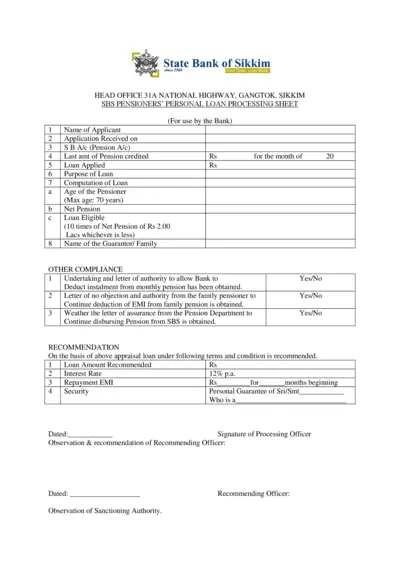

SBS Pensioners Personal Loan Processing Sheet

This document is a processing sheet for the SBS Pensioners Personal Loan for pensioners seeking loans from the State Bank of Sikkim. It guides applicants through the necessary details required for loan processing and approval. The form includes sections for applicant information, loan eligibility, and required compliance documents.

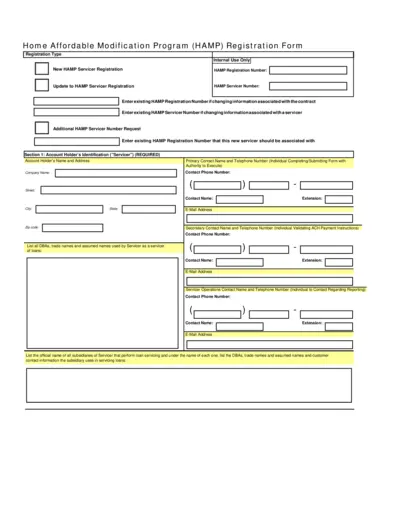

Home Affordable Modification Program Registration

This file provides essential instructions for servicers in the Home Affordable Modification Program (HAMP). It includes details about registration, ACH payment instructions, and contact information requirements. Utilize this form to ensure compliance with HAMP regulations.

GE U.S. Savings and Retirement FAQs

This document contains essential FAQs about GE U.S. savings and retirement plans, tailored for former GE employees. It provides critical information regarding benefit assignments, pension plan mappings, and upcoming changes affecting retirement resources.