South Carolina Business Tax Application Guide

This document serves as a comprehensive guide for filling out the South Carolina Business Tax Application. It provides essential details and step-by-step instructions to ensure successful registration. Access resources and contact information to facilitate the application process.

Edit, Download, and Sign the South Carolina Business Tax Application Guide

Form

eSign

Add Annotation

Share Form

How do I fill this out?

Filling out the South Carolina Business Tax Application can seem daunting, but we're here to help. Start by gathering all required information including business ownership details and tax identification numbers. Follow the outlined steps for each section to ensure accuracy and completeness.

How to fill out the South Carolina Business Tax Application Guide?

1

Gather all necessary business information.

2

Choose the correct type of ownership.

3

Complete the required sections accurately.

4

Double-check your application for errors.

5

Submit the application through the appropriate channels.

Who needs the South Carolina Business Tax Application Guide?

1

Business owners starting a new enterprise in South Carolina.

2

Entrepreneurs looking to register their LLC or corporation.

3

Freelancers who need to file taxes for their work.

4

Companies applying for specific licenses or tax exemptions.

5

Individuals seeking to comply with state tax requirements.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the South Carolina Business Tax Application Guide along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your South Carolina Business Tax Application Guide online.

Editing your Business Tax Application on PrintFriendly is user-friendly and efficient. Simply upload your PDF file into our platform, and utilize our editing tools to amend any necessary sections. Once you're satisfied with the edits, you can save your document and share it easily.

Add your legally-binding signature.

Signing your Business Tax Application is made simple with PrintFriendly. Once you have edited your document, utilize our signature feature to add your name and date. This ensures your application meets all official requirements before submission.

Share your form instantly.

Sharing your completed Business Tax Application is quick and easy on PrintFriendly. You can share the document via email or through direct links to ensure your colleagues or partners have access. Collaborate effectively by allowing them to view or edit the shared PDF as needed.

How do I edit the South Carolina Business Tax Application Guide online?

Editing your Business Tax Application on PrintFriendly is user-friendly and efficient. Simply upload your PDF file into our platform, and utilize our editing tools to amend any necessary sections. Once you're satisfied with the edits, you can save your document and share it easily.

1

Upload your Business Tax Application PDF to PrintFriendly.

2

Utilize the editing tools to make necessary changes.

3

Review the modifications to ensure accuracy.

4

Save the edited file securely on your device.

5

Share the updated application with others if required.

What are the instructions for submitting this form?

To submit the South Carolina Business Tax Application, visit the SCDOR website for online submission or download the form to mail to SCDOR, PO Box 125, Columbia, SC 29214-0850. Ensure to include your FEIN or SSN with the application. Direct fax submissions can be sent to the relevant department, following submission guidelines provided in the application instructions.

What are the important dates for this form in 2024 and 2025?

Key deadlines for filing and updates regarding tax registration will be specified by the South Carolina Department of Revenue. Keep an eye on any amendments to filing requirements in 2024 and 2025. Stay informed on any changes to tax laws that might affect your application timeline.

What is the purpose of this form?

The purpose of the South Carolina Business Tax Application is to facilitate the official registration of businesses for tax compliance. This form helps establish a business's accountability in terms of tax obligations and allows for appropriate permits and licenses to be issued. By completing this application, business owners can ensure their operations align with state regulations and avoid legal penalties.

Tell me about this form and its components and fields line-by-line.

- 1. Entity Registration Information: Details about the business ownership structure and identification.

- 2. Owner Information: Information regarding the business's owners or partners.

- 3. Business Addresses: Physical and mailing addresses for official communications.

- 4. Account Details: Information on tax liabilities and business activities.

- 5. Banking Information: Details about the financial institution handling business transactions.

- 6. Signatures: Signatures of all relevant parties to validate the application.

What happens if I fail to submit this form?

Failing to submit the Business Tax Application can result in legal repercussions including fines and penalties. Businesses may also be unable to operate legally within South Carolina until their application is processed. It is crucial to ensure timely submission to avoid delays and compliance issues.

- Legal Penalties: Failure to register can lead to monetary fines from the state.

- Business Interruption: Without proper registration, business operations may be suspended.

- Ineligibility for Licenses: Not submitting may result in the inability to apply for necessary business licenses.

How do I know when to use this form?

- 1. New Business Registration: Required for all new businesses establishing a legal entity.

- 2. Change of Ownership Structure: Used when modifying the ownership status of the business.

- 3. Application for Licenses: Necessary for obtaining various business licenses and permits.

Frequently Asked Questions

What is the Business Tax Application?

The Business Tax Application is a form required to register a business for tax purposes in South Carolina.

How do I edit the PDF?

You can easily edit the PDF by uploading it to PrintFriendly and using our editing tools.

Can I share my edited document?

Yes, PrintFriendly allows you to share your edited documents via email or direct link.

What information do I need to fill out the application?

You will need ownership details, FEIN, and information about the business structure.

How do I submit the application?

After completing, you can submit the application online, by mail, or fax.

Is there a fee for the application?

There are specific fees based on the type of registration; refer to the instructions for details.

What if I make a mistake on the application?

You can edit the PDF and correct any errors before final submission.

Where can I find additional resources?

Visit the South Carolina Department of Revenue's website for more resources and guidance.

What are the filing deadlines?

Please check the relevant deadlines mentioned in the guide for accurate filing.

Can I save my changes?

Yes, you can save your changes after editing your document with PrintFriendly.

Related Documents - Business Tax Application

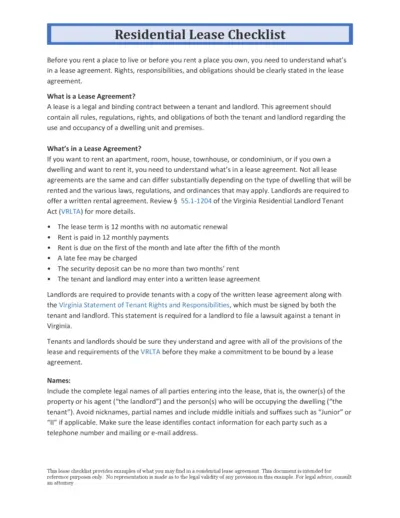

Residential Lease Agreement Checklist for Tenants and Landlords

This document provides a detailed checklist of what both tenants and landlords need to know and include in a residential lease agreement. It covers key elements such as lease terms, rent payment schedules, and maintenance responsibilities. Use this guide to ensure all rights and obligations are clearly outlined in your lease agreement.

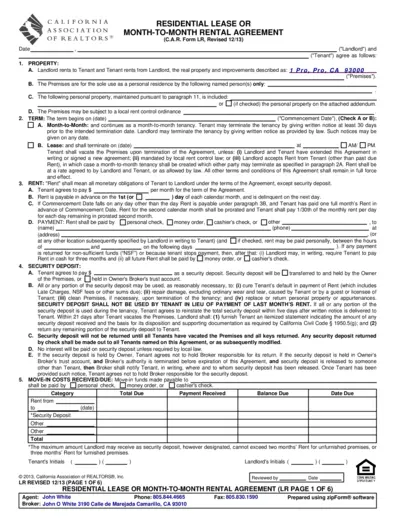

Residential Lease or Month-to-Month Rental Agreement

This file contains a comprehensive residential lease or month-to-month rental agreement used in California. It provides details on terms, obligations, and conditions for both landlords and tenants. Perfect for those seeking a standardized rental agreement form.

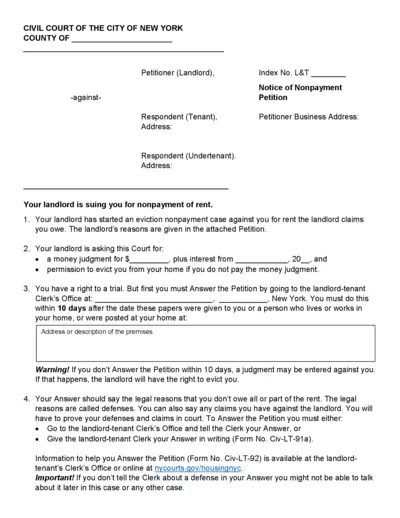

Civil Court of the City of New York Nonpayment Petition

This document is a Notice of Nonpayment Petition issued by the Civil Court of the City of New York. It details the actions that a landlord can take against a tenant for nonpayment of rent. It includes instructions on how the tenant can respond and their rights.

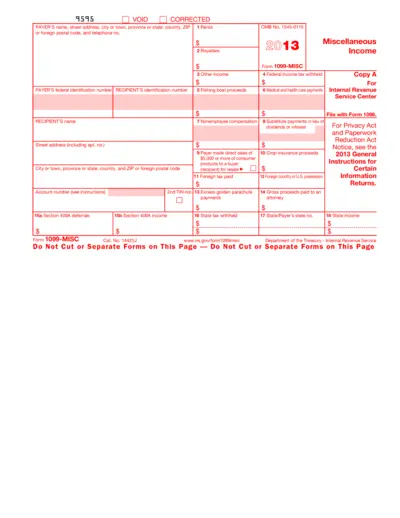

Form 1099-MISC: Miscellaneous Income for 2013

This file is a 2013 version of the IRS Form 1099-MISC used to report miscellaneous income. It includes fields for reporting various types of payments made to individuals or entities. The form is typically filed by payers to report income paid to recipients.

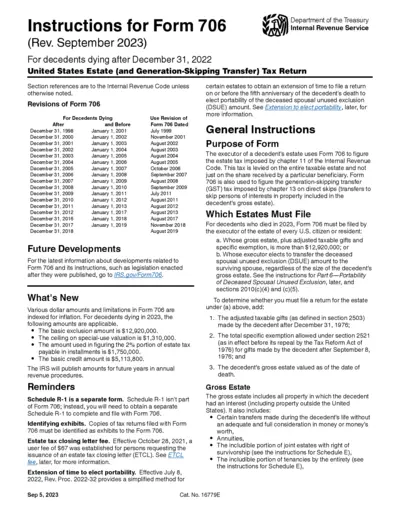

Instructions for Form 706 (Rev. September 2023)

This document provides detailed instructions for completing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return for decedents dying after December 31, 2022. It includes information on revisions, general instructions, and specific filing requirements. The instructions also cover important updates and reminders related to the form.

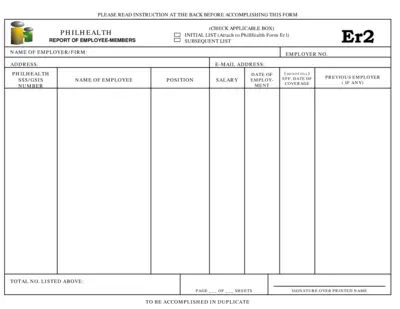

PhilHealth Report of Employee-Members Form Instructions

This file provides instructions for employers on how to fill out and submit the PhilHealth Report of Employee-Members form. It is essential for employers to report new hires to PhilHealth to ensure proper coverage. Detailed instructions and requirements are included.

Copyright Registration Form TX Instructions

This form is used for the registration of nondramatic literary works, such as fiction, nonfiction, poetry, textbooks, and computer programs. It provides detailed information on how to complete the form, including what information is required for each section and how to submit the application. Use it to ensure your work is properly registered for copyright protection.

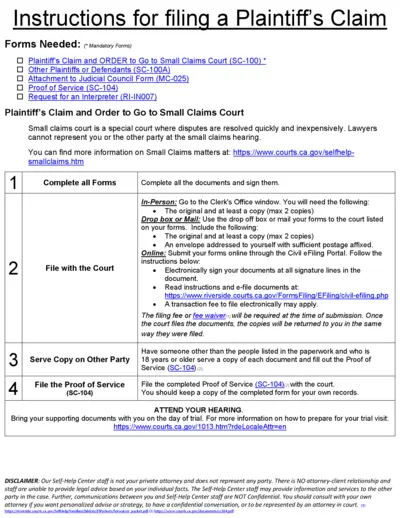

Plaintiff's Claim and Instructions for Small Claims Court

This file provides instructions and necessary forms for filing a Plaintiff's Claim in Small Claims Court. It includes details on filling out, submitting, and serving the forms. Ensure to follow the steps carefully to protect your rights.

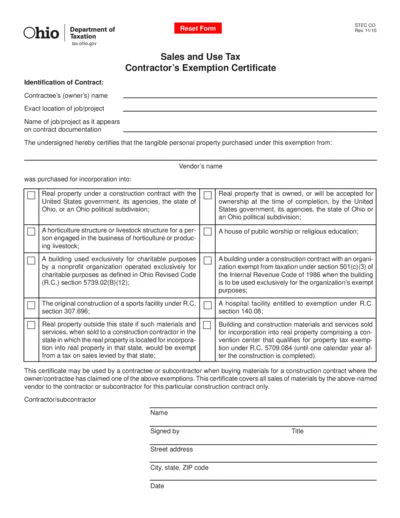

Ohio Sales and Use Tax Contractor's Exemption Certificate

This document is the Ohio Sales and Use Tax Contractor's Exemption Certificate. Contractors use this form to claim exemptions on certain taxable goods for specified exempt uses. It's crucial for contractors working with tax-exempt entities or on tax-exempt projects.

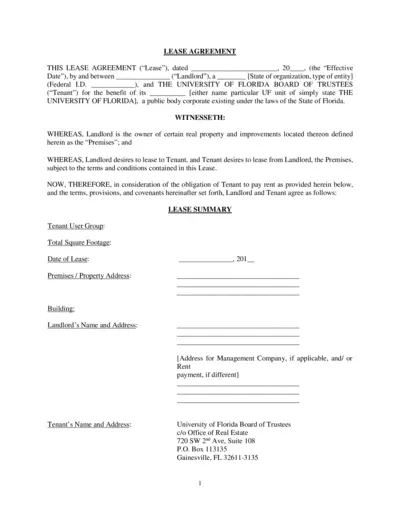

Lease Agreement for University of Florida Premises

This lease agreement file outlines the terms and conditions for renting a property owned by the Landlord to the University of Florida Board of Trustees. It covers key aspects such as lease term, rent details, improvements, and permitted use. Ideal for landlords and tenants involved in leasing agreements.

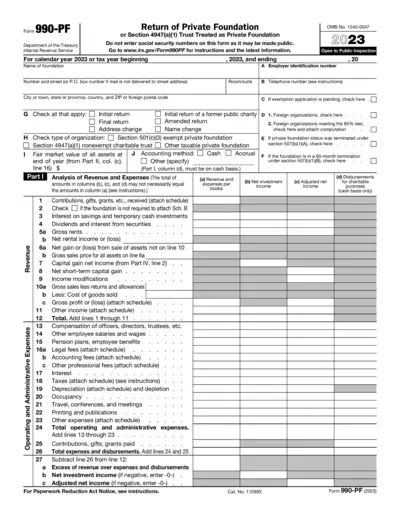

Return of Private Foundation Form 990-PF 2023

Form 990-PF is a return for private foundations required by the IRS. It includes information on revenue, expenses, and other financial details. Avoid entering social security numbers on this form.

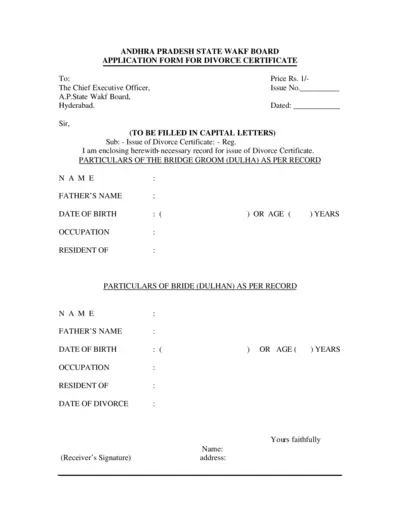

Application Form for Divorce Certificate - Andhra Pradesh State Wakf Board

This form is used to apply for a Divorce Certificate from the Andhra Pradesh State Wakf Board in Hyderabad. The form requires details of both bride and groom as per recorded information. It also includes fields for verification and office use only.