Edit, Download, and Sign the Texas Agricultural Sales Tax Exemption Form

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the Texas Agricultural Sales Tax Exemption Certification form, gather all necessary information about your agricultural purchases. Ensure you understand which items qualify for the sales tax exemption. After entering the required details, submit the form to the retailer.

How to fill out the Texas Agricultural Sales Tax Exemption Form?

1

Gather information about the retailer and purchaser.

2

List the items for which exemption is claimed.

3

Ensure that the items qualify for tax exemption.

4

Review the completed form for accuracy.

5

Submit the form to the retailer without delay.

Who needs the Texas Agricultural Sales Tax Exemption Form?

1

Farmers who purchase seeds and fertilizers to grow crops.

2

Ranchers buying feed for livestock to maintain their herds.

3

Agricultural producers seeking to purchase equipment for production.

4

Businesses involved in agricultural production requiring tax savings.

5

Individuals operating home gardens to grow produce for sale.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Texas Agricultural Sales Tax Exemption Form along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Texas Agricultural Sales Tax Exemption Form online.

Editing the Texas Agricultural Sales Tax Exemption Certification PDF on PrintFriendly is straightforward. You can easily modify any section of the document to suit your requirements. Our intuitive PDF editing tools allow you to update information seamlessly before submission.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is a breeze. You can quickly add your signature digitally for authentication. This feature ensures your submissions are both valid and professional.

Share your form instantly.

Sharing the completed PDF from PrintFriendly is easy. Simply use the share options to send the document via email or other platforms. This functionality allows for quick distribution and collaboration.

How do I edit the Texas Agricultural Sales Tax Exemption Form online?

Editing the Texas Agricultural Sales Tax Exemption Certification PDF on PrintFriendly is straightforward. You can easily modify any section of the document to suit your requirements. Our intuitive PDF editing tools allow you to update information seamlessly before submission.

1

Open the PDF editor on PrintFriendly.

2

Upload the Texas Agricultural Sales Tax Exemption Form.

3

Select the specific fields you need to edit.

4

Make your adjustments as required.

5

Download the updated document once you're finished.

What are the instructions for submitting this form?

To submit the Texas Agricultural Sales Tax Exemption Form, ensure it is completed in its entirety. Provide the form to the retailer at the time of your purchase. For any additional inquiries, you may contact the Texas Comptroller’s office directly or refer to their official website for the most current guidelines.

What are the important dates for this form in 2024 and 2025?

For 2024 and 2025, ensure that you are aware of any changes to tax regulations or form requirements that could impact the use of the Texas Agricultural Sales Tax Exemption Form. Important deadlines for filing with local tax authorities may also apply. Stay tuned to updates from the Texas Comptroller's office for the most accurate information.

What is the purpose of this form?

The Texas Agricultural Sales Tax Exemption Form is designed to help producers in the agricultural industry claim exemptions from sales and use tax on their qualifying purchases. This form serves as a legal document for retailers to accept tax-exempt purchases, ensuring producers can operate economically. Understanding the proper use of this form allows agricultural entities to optimize their resources effectively.

Tell me about this form and its components and fields line-by-line.

- 1. Name of Retailer: The legal name of the retailer from whom the agricultural producer is purchasing items.

- 2. Address: Complete address details including street number and postal code.

- 3. Purchaser Name: The name of the individual or business purchasing the qualifying items.

- 4. Ag/Timber Number: The identification number associated with agricultural operations for tax purposes.

- 5. Date: The date the certification form is completed.

What happens if I fail to submit this form?

Failing to submit the Texas Agricultural Sales Tax Exemption Form means that the retailer will charge sales tax on your purchases. This could lead to increased costs for agricultural producers who rely on these exemptions to reduce operational expenses. Properly submitting the form ensures compliance with tax regulations.

- Increased Expenses: Without the form, you will incur unnecessary sales taxes on qualifying purchases.

- Compliance Issues: Failing to submit may lead to issues with tax authorities regarding proper tax practices.

- Ineligibility for Future Exemptions: Repeated failures to submit may result in disqualification from claiming future exemptions.

How do I know when to use this form?

- 1. Purchasing Livestock Feed: Claim exemptions while buying feed for your animals.

- 2. Buying Seeds and Fertilizers: Use the form when purchasing agricultural inputs.

- 3. Acquiring Farming Equipment: Equip your farm without incurring unnecessary sales tax.

Frequently Asked Questions

Who should use the Texas Agricultural Sales Tax Exemption Form?

This form is for anyone involved in agricultural production who needs to claim tax exemption on qualifying purchases.

What items are exempt from sales tax?

Items used exclusively for agricultural production such as seeds and livestock feed are exempt.

How do I submit this form?

You must provide the completed form to the retailer for them to validate the tax exemption.

Can I use this exemption for clothing?

No, clothing is not qualifying for the agricultural sales tax exemption.

Is there an expiration date for this exemption form?

The form remains valid as long as it is filled out accurately and the exemptions apply.

Do I need an ag/timber number for all purchases?

You only need an ag/timber number for certain items; other specific items like livestock do not require it.

What do I do if my item doesn’t qualify?

You will need to pay the sales tax on any disqualified items.

How can I contact customer service for help?

You can reach out to customer service via the contact information provided on your local comptroller’s website.

Can I fill out this form online?

Yes, you can fill out and edit this PDF document online using PrintFriendly.

What happens if I submit inaccurate information?

You may be liable for the sales tax on items that do not qualify if your form is inaccurate.

Related Documents - Ag Tax Exemption Form

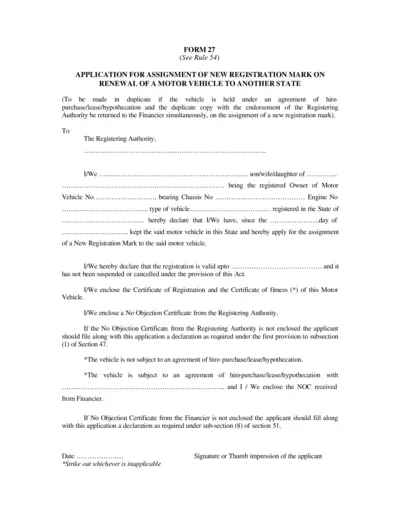

FORM 27 - Application for New Registration Mark Assignment

Form 27 is used for applying for the assignment of a new registration mark for a motor vehicle when relocating to a different state. The form ensures that the vehicle is registered in the new state. It requires details like vehicle number, chassis number, engine number, and more.

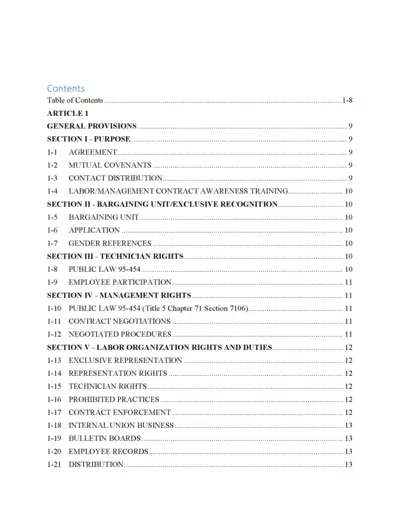

Labor Management Agreement File

This file provides comprehensive details on labor management agreements, including general provisions, bargaining units, technician rights, management rights, and more. It's essential for understanding the rights and responsibilities outlined within labor organization structures. Users can utilize this file to streamline their understanding and compliance with labor agreements.

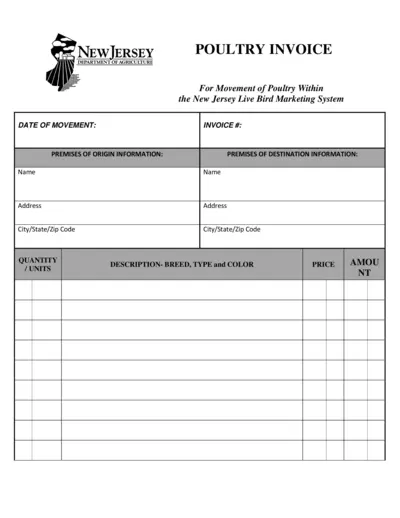

New Jersey Poultry Invoice Form

This file includes detailed instructions for completing a poultry invoice required for the movement of poultry within the New Jersey Live Bird Marketing System. It includes information on premises of origin and destination, quantity, breed, type, and color of poultry, as well as pricing and certification of negative avian influenza status.

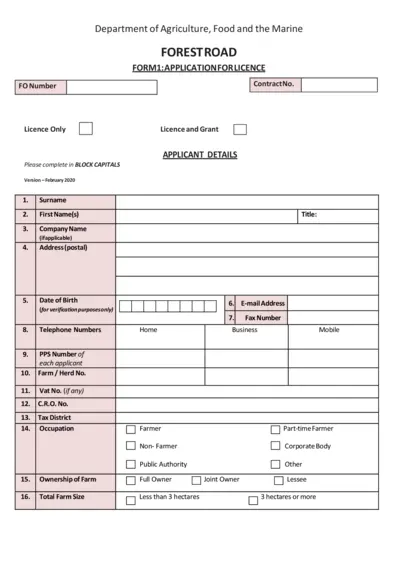

Forest Road Licence Application Form - Department of Agriculture

This is an application form for a forest road licence issued by the Department of Agriculture, Food, and the Marine. The form requires applicant and site details, as well as a declaration and consent section. Detailed instructions, constraints, and ownership information are necessary for completion.

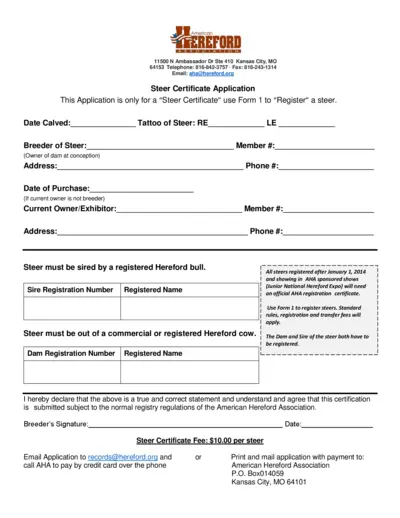

Steer Certificate Application - American Hereford Association

This file is a Steer Certificate Application from the American Hereford Association. It is used to apply for a Steer Certificate for a steer that meets the required criteria. The form includes sections for information about the breeder, current owner, and registration details of the steer.

American Angus Association Recordbook for Junior Members

This recordbook is designed to compile records of Angus activities. It is useful when applying for various awards and scholarships. It also serves as an educational aid and a source of fond memories.

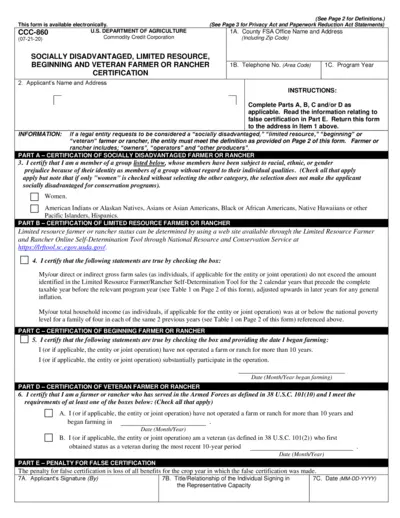

USDA CCC-860 Form: Certification for Farmers and Ranchers

This file is a USDA CCC-860 form used for certifying socially disadvantaged, limited resource, beginning, and veteran farmers or ranchers. It includes instructions on how to complete the form and definitions relevant to the application process. Learn how to determine eligibility and submit the form to the County FSA Office.

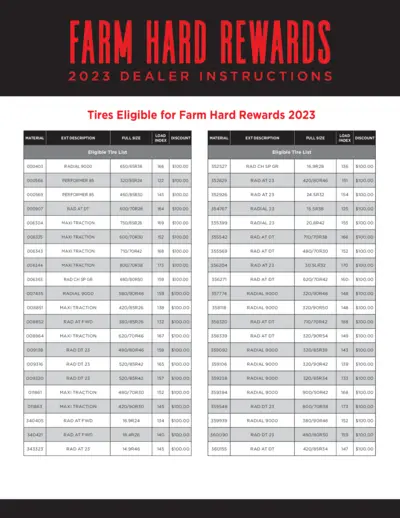

Farm Hard Rewards 2023 Dealer Instructions and Eligible Tires

This document contains detailed instructions for dealers participating in the Farm Hard Rewards program for 2023. Included is a comprehensive list of eligible tires with corresponding load indexes and discounts. Dealers must follow the guidelines for redemption and record-keeping purposes.

Adesso TruForm 150 Illuminated Ergonomic Keyboard Overview

The Adesso Tru-Form 150 is an illuminated ergonomic keyboard designed with a split key zone to encourage natural hand positioning, perfect for extended use. It features quiet membrane key switches, 20 built-in hotkeys, and is USB powered. The backlit keys can be switched between three colors, making it ideal for night use.

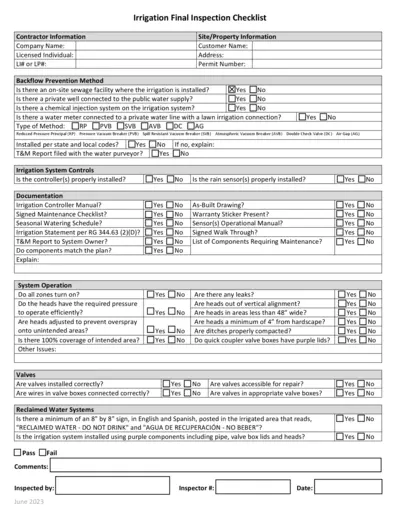

Irrigation Final Inspection Checklist

This Irrigation Final Inspection Checklist is designed to help ensure that all installation and operational requirements are met for irrigation systems. It includes sections for contractor information, site/property information, backflow prevention methods, irrigation system controls, system operation, valves, reclaimed water systems, and more. The checklist assists inspectors in verifying that systems comply with state and local codes and function properly.

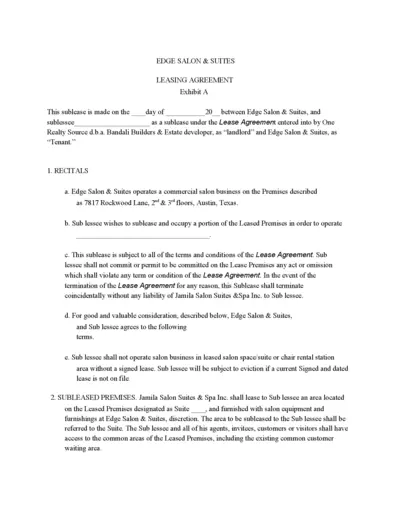

Edge Salon & Suites Sublease Agreement: Lease and Terms.

This file contains the sublease agreement between Edge Salon & Suites and a sublessee. It outlines the terms and conditions for renting a suite or station. It includes details on rent, operating policies, and responsibilities.

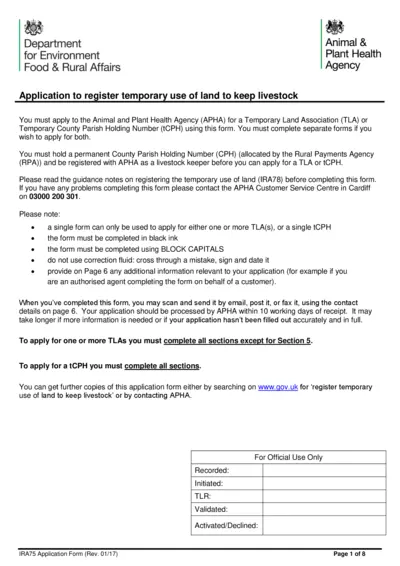

Application to Register Temporary Use of Land for Livestock

This file is used to apply for a Temporary Land Association (TLA) or Temporary County Parish Holding Number (tCPH) to register temporary use of land for keeping livestock. Complete separate forms if applying for both. Ensure you have a permanent CPH allocated by RPA and are registered as a livestock keeper with APHA before applying.