Edit, Download, and Sign the Texas Revocable Living Trust

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this Texas Revocable Living Trust, you will start by entering the date and names of the Grantor and Trustee. You will need to detail the property being transferred to the Trust in Attachment A. Finally, you will outline specific distributions, personal property assignments, and any pet trust provisions.

How to fill out the Texas Revocable Living Trust?

1

Enter the date and names of the Grantor and Trustee.

2

Detail the property being transferred to the Trust in Attachment A.

3

Specify distributions of property after the Grantor’s death.

4

Assign personal property beneficiaries.

5

Outline any pet trust provisions.

Who needs the Texas Revocable Living Trust?

1

Individuals creating a revocable living trust to manage their property.

2

Grantors who want to outline specific distributions of their property.

3

People designating personal property beneficiaries.

4

Pet owners who want to create a pet trust.

5

Trustees managing a revocable living trust.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Texas Revocable Living Trust along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Texas Revocable Living Trust online.

You can edit this PDF on PrintFriendly by opening it in our online editor. Make any necessary changes to the text, add or remove sections, and update any fields. Save or print the updated document directly from the editor.

Add your legally-binding signature.

You can sign the PDF on PrintFriendly by opening the file in our editor. Use the built-in signature tool to add your signature to the document. Save or print the signed document directly from the editor.

Share your form instantly.

You can share the PDF on PrintFriendly by opening the file in our editor. Use the sharing options to email the document or generate a shareable link. Share the document with others directly from the editor.

How do I edit the Texas Revocable Living Trust online?

You can edit this PDF on PrintFriendly by opening it in our online editor. Make any necessary changes to the text, add or remove sections, and update any fields. Save or print the updated document directly from the editor.

1

Open the PDF file in the PrintFriendly editor.

2

Make necessary changes to the text and fields.

3

Add or remove sections as needed.

4

Update any property and beneficiary details.

5

Save or print the updated document.

What are the instructions for submitting this form?

To submit this form, ensure all fields are completed and the document is signed. Send the completed form to the address provided by your attorney or financial advisor. You can also email or fax the document if such options are provided by your legal counsel. Ensure you keep a copy for your records. Submission methods may vary, so consult with your legal advisor for the most appropriate method.

What are the important dates for this form in 2024 and 2025?

There are no specific dates associated with this form for 2024 and 2025.

What is the purpose of this form?

The purpose of this form is to establish a Texas Revocable Living Trust to manage the Grantor's property during their lifetime and distribute assets after death. It allows the Grantor to outline specific distributions, designate personal property beneficiaries, and create a pet trust. It also authorizes the Trustee to manage the Trust, handle income, and use the principal for the Grantor's benefit if incapacitated.

Tell me about this form and its components and fields line-by-line.

- 1. Date and Parties: Enter the date and the names of the Grantor and Trustee.

- 2. Attachment A: Detail the property being transferred to the Trust.

- 3. Specific Distributions: Outline distributions of property after the Grantor's death.

- 4. Personal Property: Assign personal property beneficiaries.

- 5. Pet Trust: Create a pet trust and designate a Pet Caretaker.

What happens if I fail to submit this form?

Failure to submit this form may result in the Grantor’s property not being managed or distributed according to their wishes.

- Unmanaged Property: Without a trust, property may not be managed according to the Grantor's wishes.

- Disputes: Heirs may dispute property management and distribution.

- Lack of Pet Trust: Pets may not receive the care specified by the Grantor.

How do I know when to use this form?

- 1. Estate Planning: Ensure property is managed and distributed according to your wishes.

- 2. Property Transfer: Transfer property to the Trust.

- 3. Beneficiary Designation: Appoint beneficiaries for personal property.

- 4. Pet Trust Creation: Provide care instructions for pets.

- 5. Incapacity Planning: Authorize the Trustee to manage property if incapacitated.

Frequently Asked Questions

How do I open the PDF file in PrintFriendly?

You can open the PDF file in PrintFriendly by uploading it to our online editor.

Can I make changes to the text in the PDF?

Yes, you can use the PrintFriendly editor to make changes to the text in the PDF.

How do I save the edited document?

You can save the edited document directly from the PrintFriendly editor.

Can I add my signature to the PDF?

Yes, you can use the signature tool in the PrintFriendly editor to add your signature.

How do I share the PDF document?

You can share the PDF document using the email or link-sharing options in the PrintFriendly editor.

Can I assign personal property beneficiaries?

Yes, you can assign personal property beneficiaries in the designated section of the PDF.

Is there a provision for a pet trust?

Yes, the PDF includes a section for creating a pet trust.

What happens to the property not listed in Attachment A?

Property not listed in Attachment A but transferred to the Trust is still part of the Trust.

Can I specify distributions of property upon my death?

Yes, you can specify distributions of property upon your death in the designated section of the PDF.

Who manages the Trust during the Grantor's life?

The Trustee manages the Trust during the Grantor's life.

Related Documents - Texas Living Trust

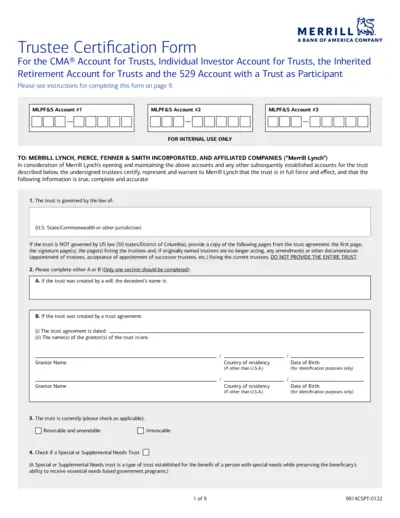

Trustee Certification Form for Merrill Lynch Accounts

This file provides a Trustee Certification Form for various Merrill Lynch accounts including the CMA Account for Trusts, Individual Investor Account for Trusts, and Inherited Retirement Account for Trusts. It contains detailed instructions for completing the form, which is necessary for opening and maintaining trust accounts at Merrill Lynch. Users must ensure the provided information is accurate and complete.

A4 Long Weekly Planner Pad Instructions and Details

This A4 Long Weekly Planner Pad is ideal for organizing your week. It features a landscape format and includes guidelines for optimal design. Perfect for both personal and professional use.

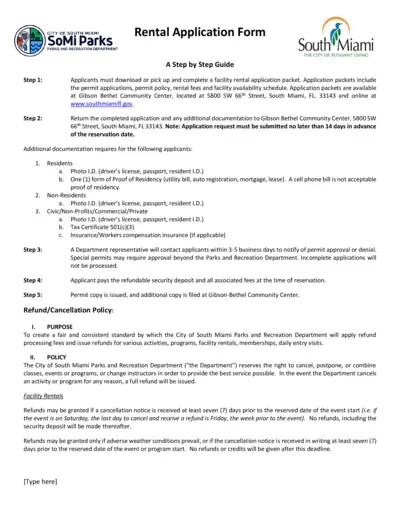

South Miami Parks and Recreation Rental Application

This rental application form provides all necessary information for reserving a facility in South Miami. Users will find detailed instructions and requirements for applicants. It ensures a streamlined reservation process for events and activities.

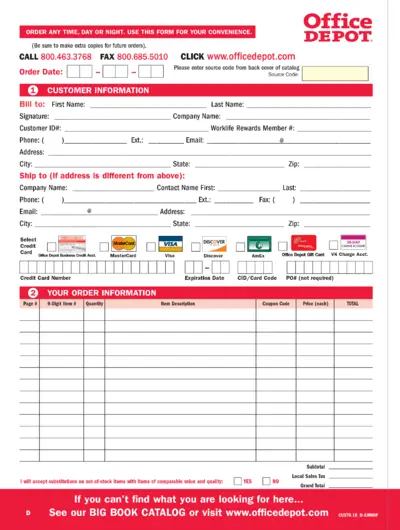

Office Depot Order Form for Convenient Purchasing

This Office Depot order form allows customers to conveniently place orders any time, day or night. It helps efficiently manage customer information and order details. Easily fill out the form to ensure accurate order processing.

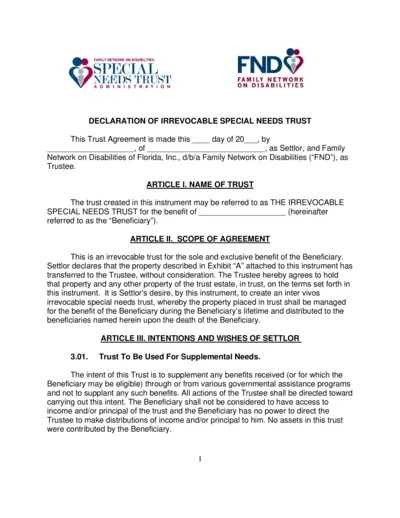

Irrevocable Special Needs Trust Overview

This document outlines the creation of an irrevocable special needs trust for the benefit of individuals with disabilities. It explains the roles of the settlor and trustee and the framework for managing trust assets. This trust is designed to supplement the beneficiary's governmental assistance without affecting eligibility.

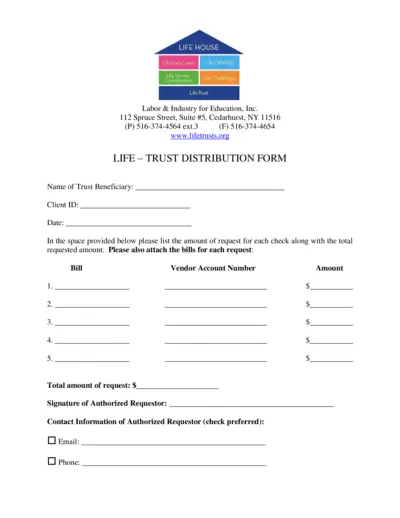

Life Trust Distribution Form Instructions

This document outlines the procedures for requesting distributions from a Life Trust. Users will find detailed guidance on how to accurately fill out the form. It is essential for trust beneficiaries requiring funds for various expenses.

Transferring Assets to Your Revocable Trust Guide

This file provides comprehensive instructions on how to transfer assets to a Revocable Trust. It outlines the benefits of doing so during your lifetime and the necessary steps for various asset types. Ideal for individuals looking to avoid probate and ensure effective financial management.

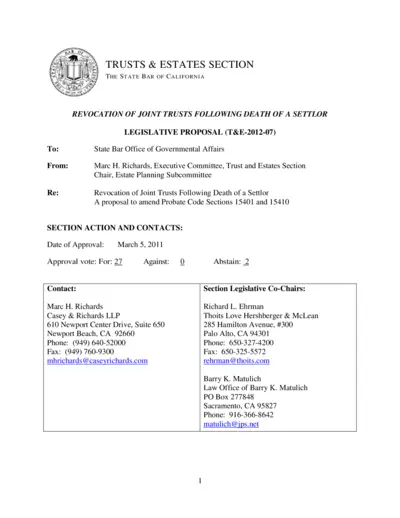

Revocation of Joint Trusts Following Death of Settlor

This document provides guidelines on the revocation of joint trusts after a settlor's death. It offers legal insights and clarifications regarding power of revocation. Ideal for estate planners and individuals involved in trust management.

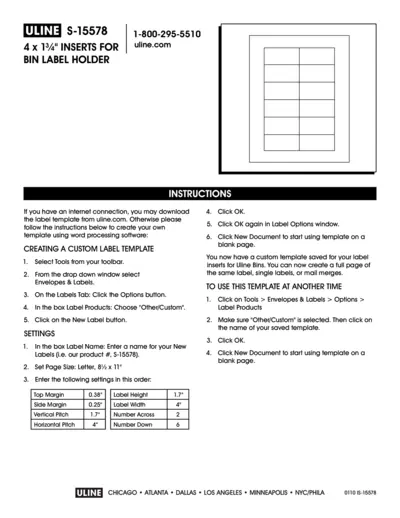

Uline S-15578 Custom Label Template Instructions

This document provides detailed instructions for creating custom label templates for Uline S-15578 inserts. Users will learn how to set up the template using word processing software. Follow the step-by-step guide to efficiently utilize your Uline label holders.

EIT Governing Board Application Form Instructions

This file provides detailed instructions for applicants interested in joining the Governing Board of the EIT. It outlines the necessary documents and standards expected for submission. The application process requires careful attention to the specified criteria and guidelines to ensure eligibility.

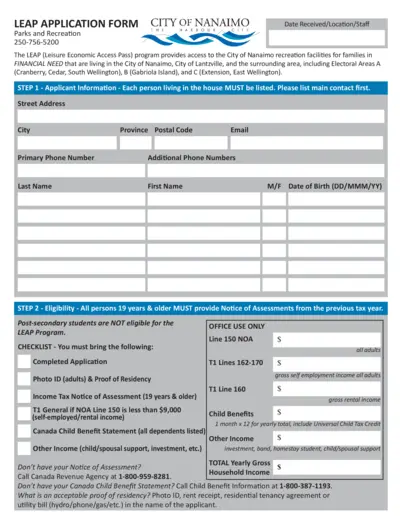

LEAP Application Form for Parks and Recreation

The LEAP (Leisure Economic Access Pass) application form enables residents of Nanaimo to access city recreation facilities. Families in financial need are encouraged to apply to benefit from this program. Gather the necessary documents and complete the application to ensure eligibility.

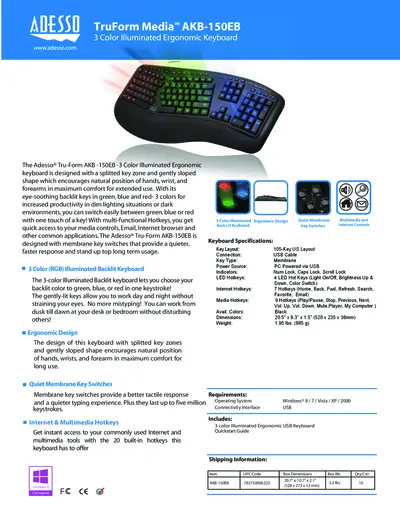

Adesso TruForm AKB-150EB Ergonomic Keyboard

Explore the Adesso TruForm AKB-150EB Ergonomic Keyboard designed for maximum comfort and productivity. Featuring 3 color illuminated keys, this keyboard is perfect for extended use in any environment. Achieve a quiet and efficient typing experience with its advanced membrane key switches.