Edit, Download, and Sign the Understanding Foreign Entertainers Tax Application

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the Foreign Entertainers Tax application, start by gathering your estimated income and expenses. Next, complete the FEU8 form accurately and ensure all required documentation is attached. Finally, submit your application to HMRC by the deadline specified.

How to fill out the Understanding Foreign Entertainers Tax Application?

1

Download the FEU8 form from HMRC and complete it.

2

Include your estimated income and expenses on the form.

3

Attach your venue contract while submitting the form.

4

Mail or fax the completed form to HMRC by mid-July.

5

Ensure you include all necessary details to avoid delays.

Who needs the Understanding Foreign Entertainers Tax Application?

1

Artists performing in the UK who are not tax residents.

2

Theatre companies employing foreign entertainers.

3

Event organizers managing international events.

4

Music bands touring in the UK.

5

Film production units hiring foreign actors.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Understanding Foreign Entertainers Tax Application along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Understanding Foreign Entertainers Tax Application online.

You can easily edit this PDF on PrintFriendly by opening the file in our editor. It's intuitive to change text, adjust images, and add notes directly within the PDF. Once edited, simply download your updated document for your records.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is made straightforward. Use our designated signing feature to add your signature anywhere on the document. After signing, you can download the PDF immediately.

Share your form instantly.

Sharing your PDF on PrintFriendly is quick and easy. You can generate a shareable link to your edited document or send it directly via email. Stay connected with colleagues by sharing important files effortlessly.

How do I edit the Understanding Foreign Entertainers Tax Application online?

You can easily edit this PDF on PrintFriendly by opening the file in our editor. It's intuitive to change text, adjust images, and add notes directly within the PDF. Once edited, simply download your updated document for your records.

1

Open the PDF file in the PrintFriendly editor.

2

Select the area you want to edit and make your changes.

3

Add any new text or images as needed.

4

Review your edits to ensure everything is correct.

5

Download the finalized PDF for your records.

What are the instructions for submitting this form?

Submit the FEU8 form by completing it with the necessary details and sending it to HMRC via post or fax. The postal address is HMRC Personal Tax International, Foreign Entertainers Unit, SO708, PO Box 203, Bootle, L69 9AP. You may also fax your form to +44 3000 547 383 to expedite the process.

What are the important dates for this form in 2024 and 2025?

Important dates for the FEU8 application include a submission deadline of mid-July. Those submitting forms after August 31 may risk refusal. Ensure you file all necessary documents in a timely manner to avoid complications.

What is the purpose of this form?

The purpose of the FEU8 form is to assess the tax obligations of foreign entertainers working in the UK. This form helps determine the correct amount of Foreign Entertainers Tax that needs to be paid, facilitating compliance with UK tax laws. It is crucial for ensuring that international performers meet their tax liabilities when engaging with UK audiences.

Tell me about this form and its components and fields line-by-line.

- 1. Estimated Income: This field captures your projected revenues from ticket sales and other income.

- 2. Estimated Expenditures: This field lists expected costs such as venue hire and publicity expenses.

- 3. Payment Date: Indicates when you expect to receive payments for performances.

- 4. Supporting Documentation: Requires attachments such as contracts and previous tax declarations.

What happens if I fail to submit this form?

Failure to submit the FEU8 form can lead to legal consequences, including the withholding of box office takings. You may also face difficulties in claiming tax refunds in the future. It's imperative to adhere to submission deadlines to avoid unnecessary complications.

- Legal Compliance: Not filing may result in non-compliance with UK tax laws.

- Financial Penalties: Late or missing submissions can incur financial penalties and tax liabilities.

- Box Office Withholding: Without submission, box office takings may be withheld by the venue or society.

How do I know when to use this form?

- 1. Employment Engagement: For foreign entertainers engaged in performances in the UK.

- 2. Event Management: Applicable for event managers hiring international talent.

- 3. Tax Reporting: Necessary for accurate reporting of international entertainers' income.

Frequently Asked Questions

How do I download the edited PDF?

After making your edits, simply click the download button provided in the PrintFriendly editor.

Can I share the PDF with others?

Yes, you can share the PDF via a link or email directly from the PrintFriendly platform.

Is it possible to sign the PDF online?

Absolutely! Use our signing tool to add your signature electronically.

What types of forms can I edit?

You can edit various forms, including tax applications and official documents, using our editor.

Do I need to create an account to edit PDFs?

No, you can edit and download PDFs without creating an account on PrintFriendly.

What happens if I forget to save my edits?

Once you click download, your edits will be saved in the file you obtain. Always remember to download before leaving the site.

Can I revert back to the original PDF?

Once edited, the original file will not be saved on our platform. Please make sure to create a backup before editing.

Is there a limit on how many PDFs I can edit?

No, you can edit as many PDFs as you like without any limits.

How can I access the PDF after editing?

You can access your edited PDF immediately after downloading it.

Are there any fees for using the editing tools?

No, all editing features on PrintFriendly are free to use.

Related Documents - FEU Tax Application

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

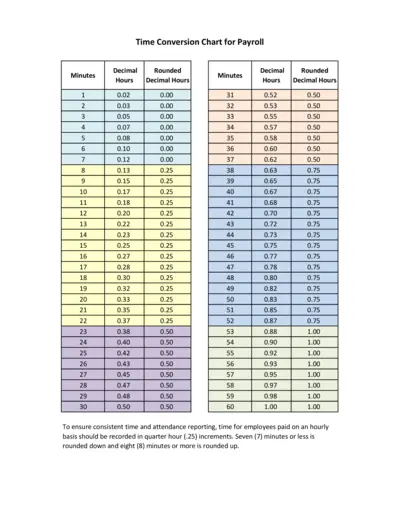

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

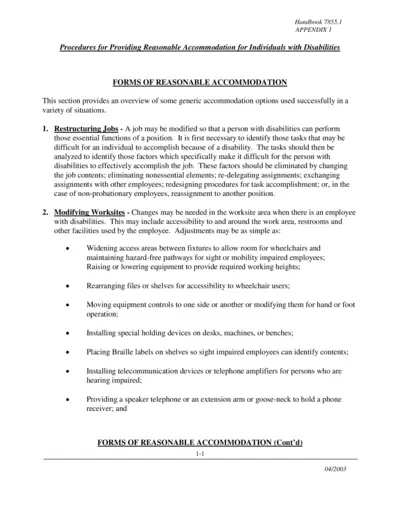

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

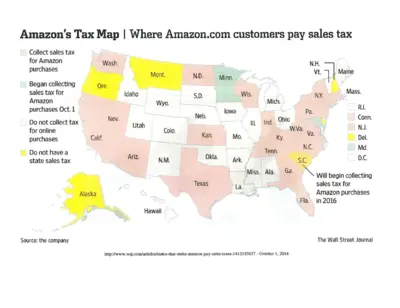

Amazon Sales Tax Map and Collection Details

This document provides a map of U.S. states where Amazon collects sales taxes and details the reasons for tax collection. It includes information on states with physical Amazon facilities, affiliate nexus laws, and states that will begin collecting taxes in the future. This is useful for understanding Amazon's tax obligations across states.

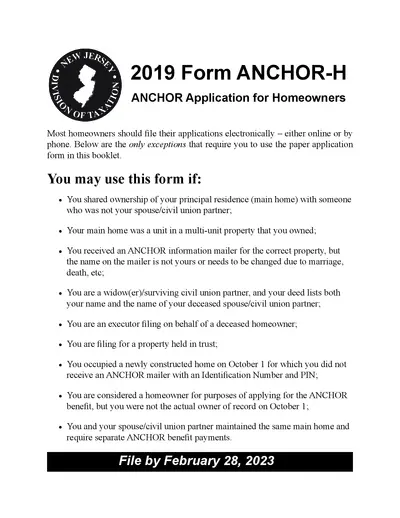

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

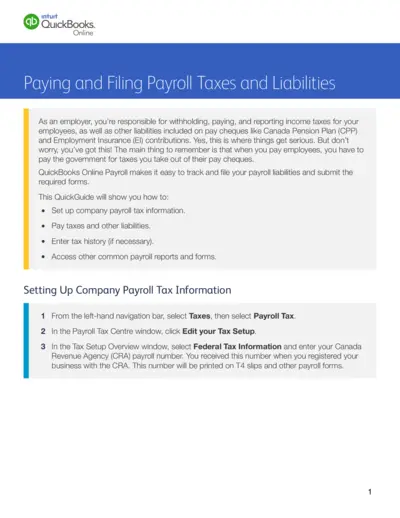

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

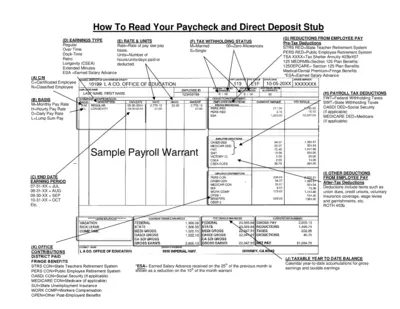

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

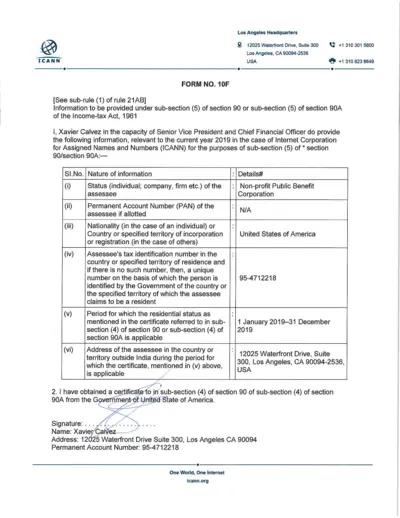

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

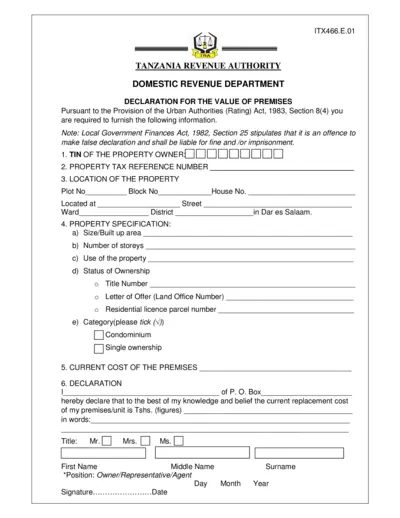

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

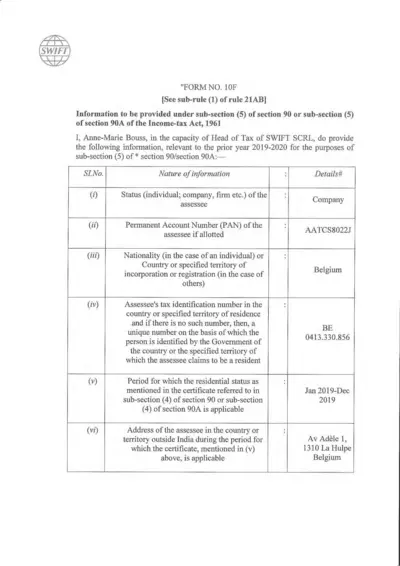

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

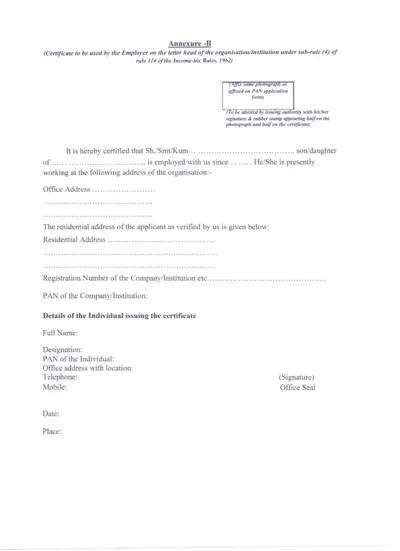

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

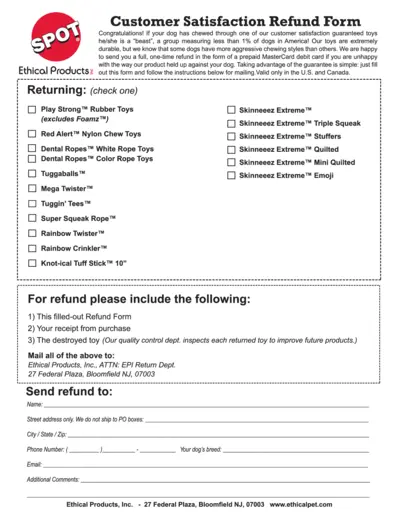

Customer Satisfaction Refund Form For Dog Toys

This file is a refund form for customer satisfaction guaranteed dog toys from Ethical Products Inc. If your dog has chewed through one of their durable toys, you can request a one-time refund using this form. Follow the instructions to obtain a refund via a prepaid MasterCard debit card.