Understanding Form 1098T for Educational Tax Credits

This document provides detailed information about Form 1098T, which is vital for determining eligibility for educational tax credits. Users will find instructions on filling out the form, including necessary information and resources available. It aims to assist students and families in understanding the form's significance and how to properly utilize it.

Edit, Download, and Sign the Understanding Form 1098T for Educational Tax Credits

Form

eSign

Add Annotation

Share Form

How do I fill this out?

Filling out Form 1098T requires careful attention to the details of your educational expenses. Begin by gathering all relevant documentation such as receipts and payment records. Follow the step-by-step instructions on the form to ensure accurate completion.

How to fill out the Understanding Form 1098T for Educational Tax Credits?

1

Gather all necessary documents, such as receipts and statements.

2

Identify qualified tuition and related expenses for the calendar year.

3

Enter your Social Security Number or TIN as required.

4

Review the form for accuracy before submission.

5

Submit the completed form through the designated channels.

Who needs the Understanding Form 1098T for Educational Tax Credits?

1

College students applying for educational tax credits.

2

Parents claiming tax benefits for their child's education.

3

Financial aid offices that assist students with tax documents.

4

Tax preparers who need access to student tax information.

5

Dual-enrolled high school students taking college courses.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Understanding Form 1098T for Educational Tax Credits along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Understanding Form 1098T for Educational Tax Credits online.

Editing your PDF on PrintFriendly is a straightforward process. Simply upload your Form 1098T and use the intuitive editing tools available to make necessary adjustments. Once you're satisfied with your edits, download the updated form to your device.

Add your legally-binding signature.

Signing your PDF in PrintFriendly can be done using our simple signing feature. You can add a digital signature directly to the document with just a few clicks. This ensures that your Form 1098T is officially signed and ready for submission.

Share your form instantly.

Sharing your PDF using PrintFriendly is quick and easy. You can generate a shareable link to your edited document with a single click. This allows you to send your Form 1098T to others seamlessly.

How do I edit the Understanding Form 1098T for Educational Tax Credits online?

Editing your PDF on PrintFriendly is a straightforward process. Simply upload your Form 1098T and use the intuitive editing tools available to make necessary adjustments. Once you're satisfied with your edits, download the updated form to your device.

1

Upload your Form 1098T PDF file to PrintFriendly.

2

Use the editing tools to make changes to the document.

3

Add any required information or adjustments.

4

Preview the document to ensure accuracy.

5

Download the finalized PDF for submission.

What are the instructions for submitting this form?

To submit Form 1098T, email it to the designated tax office at taxoffice@example.edu or fax it to (123) 456-7890. Physical submissions can be sent to Missouri Western State University, Business Office, 123 College Ave, St. Joseph, MO 64507. For accurate processing, ensure all information is complete and correct before submission.

What are the important dates for this form in 2024 and 2025?

In 2024, Form 1098T will need to be filed by January 31 for the 2023 tax year. For 2025, the deadline remains the same as part of ongoing requirements. It's crucial to plan ahead to ensure timely submission and avoid potential penalties.

What is the purpose of this form?

The purpose of Form 1098T is to assist students and educational institutions in reporting qualified tuition payments for tax credits. The form provides a summary of payments received for qualified expenses, which can affect a student's eligibility for various education-related financial benefits. Understanding and utilizing Form 1098T can help individuals maximize their tax credits and manage their educational expenses effectively.

Tell me about this form and its components and fields line-by-line.

- 1. Box 1: Reports the qualified tuition and related expenses paid during the calendar year.

- 2. Box 2: Reserved for future use.

- 3. Box 3: Reserved for future use.

- 4. Box 4: Reports adjustments to qualified expenses from a prior year.

- 5. Box 5: Shows the amount of scholarships and grants paid directly to the school.

- 6. Box 6: Displays adjustments to scholarships or grants from a prior year.

- 7. Box 7: Indicates amounts for academic periods that start next calendar year.

- 8. Box 8: Indicates if the student is enrolled at least half-time.

- 9. Box 9: Indicates if the student is enrolled in a graduate program.

- 10. Box 10: Used for insurance contract reimbursements for tuition.

What happens if I fail to submit this form?

Failing to submit Form 1098T can lead to complications with the IRS regarding tax liabilities. Individuals may miss out on potential tax benefits or face penalties for non-compliance. It is essential to submit timely and accurately to avoid such issues.

- Missed Tax Benefits: Without proper documentation, you may lose eligibility for valuable tax credits.

- IRS Penalties: Failure to submit can result in penalties imposed by the IRS.

- Inaccurate Reporting: Incorrect or incomplete submissions can lead to issues with the tax return.

How do I know when to use this form?

- 1. Claiming Tax Credits: Use this form when applying for educational tax credits during your tax filing.

- 2. Reporting Expenses: Report any qualified tuition payments made to your educational institution.

- 3. Verifying Eligibility: Verify eligibility for various financial aid or tax benefits.

Frequently Asked Questions

What is Form 1098T?

Form 1098T is an informational form provided to students for tax purposes regarding educational expenses.

Who needs to fill out Form 1098T?

Students and parents claiming educational tax credits need to fill out this form.

Where can I find more information about Form 1098T?

More information can be found through the IRS website or local tax advisors.

Can I edit my Form 1098T on PrintFriendly?

Yes, you can easily edit your Form 1098T using the editing tools on PrintFriendly.

How do I download my edited Form 1098T?

After editing, simply click the download button to save your updated form.

What if I make a mistake on my Form 1098T?

You can always go back and edit the document as many times as needed before downloading.

How do I sign my Form 1098T?

You can add a digital signature to your Form 1098T using PrintFriendly's signing feature.

Is there a fee to use PrintFriendly for my Form 1098T?

No, PrintFriendly allows you to edit and download your forms for free.

Can I share my Form 1098T with others?

Yes, PrintFriendly provides options to easily share your edited document.

What are the filing deadlines for Form 1098T?

Check the IRS website for the most current deadlines related to Form 1098T filings.

Related Documents - Form 1098T Guide

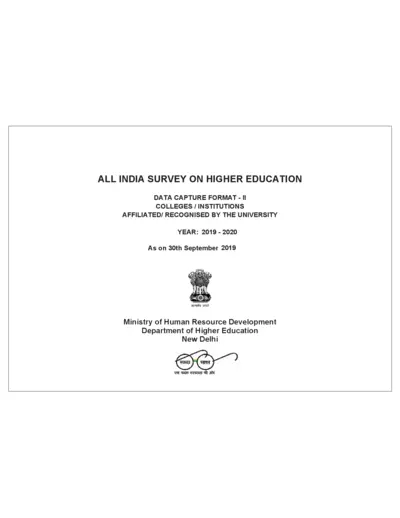

All India Survey on Higher Education Data Capture Format 2019-2020

This file is the All India Survey on Higher Education for the year 2019-2020. It contains data capture formats for colleges and institutions affiliated by the university. The information includes college details, contact information, and geographical referencing.

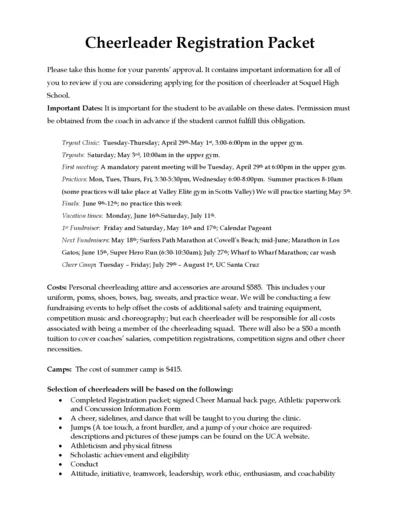

Soquel High School Cheerleader Registration Packet 2024-2025

This file contains important information for students considering applying for the cheerleader position at Soquel High School. It includes dates, costs, and instructions for tryouts and participation. Make sure to review and get parental approval before proceeding.

Effective Summer Learning Program Planning Toolkit

This file offers guidance and evidence-based tools for delivering effective summer learning programs. It covers planning, recruitment, staffing, and more. The toolkit is designed for education leaders and program managers.

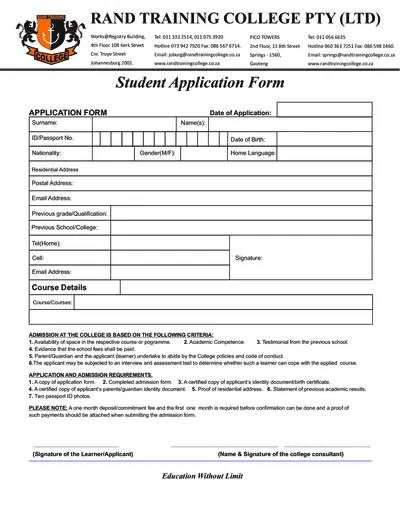

Student Application Form for Rand Training College

This file is a student application form for Rand Training College, including admission requirements and course details. It requires personal information, previous academic records, and other supporting documents. Complete the form to apply for courses offered by the college.

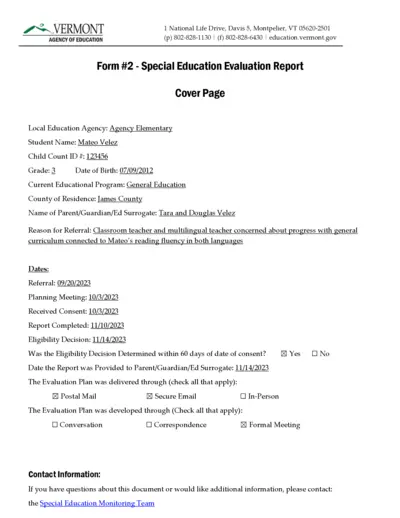

Special Education Evaluation Report - Vermont Agency

This file contains the Special Education Evaluation Report for a student named Mateo Velez. It includes details about the evaluation plan, team members involved, and assessment procedures used. The document is designed to determine the student's eligibility for special education services.

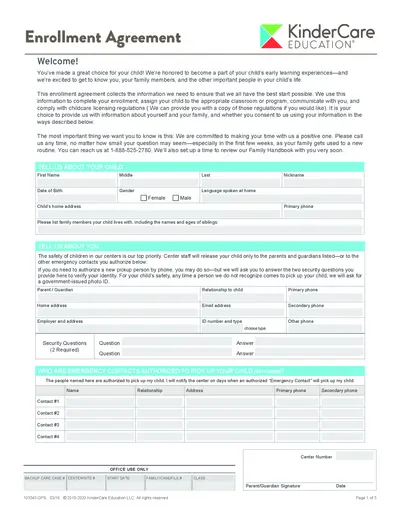

KinderCare Education Enrollment Agreement Form

This file is the enrollment agreement for KinderCare Education. It collects crucial information for your child's enrollment, classroom/program assignment, and compliance with childcare licensing regulations. Make sure to fill it out accurately to ensure a smooth enrollment process.

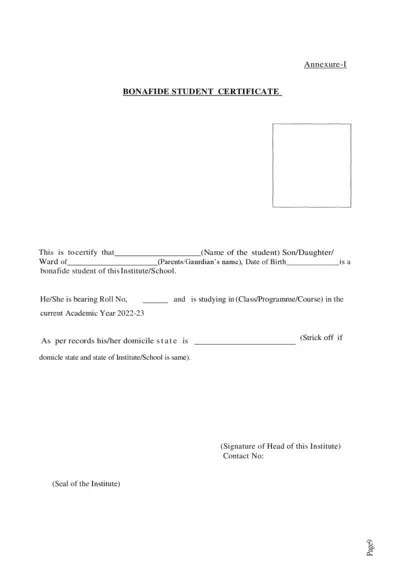

Bonafide Student Certificate & Scholarship Consent Forms

This file contains the Bonafide Student Certificate template, consent form for the use of Aadhaar/EID numbers in a state scholarship application, and an institution verification form for scholarship applications. It is intended for students applying for state scholarships and institutions verifying student information.

NIOS Prospectus 2011-12 for Gulf, Kuwait, Qatar

This file provides details and instructions for admission to the National Institute of Open Schooling (NIOS) for secondary and senior secondary courses in Gulf, Kuwait, and Qatar. It includes information on the admission process, available subjects, and other essential details. It is useful for prospective students seeking flexible and accessible education options.

Undergraduate Bursary and Loan Opportunities for 2024 at University of Cape Town

This file provides information about the bursary and loan opportunities available for undergraduate students at the University of Cape Town for the academic year 2024. It includes details about financial aid, scholarships, and bursaries offered by the university and external organizations. Students can find instructions on how to apply and important contact information in this comprehensive guide.

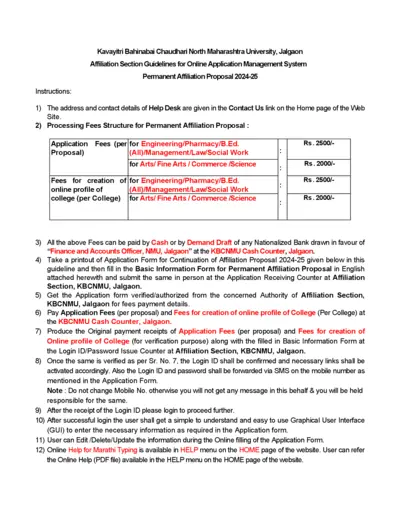

KBCNMU Permanent Affiliation Proposal 2024-25 Guidelines

This file provides detailed guidelines for filling out the Permanent Affiliation Proposal for 2024-25 for Kavayitri Bahinabai Chaudhari North Maharashtra University. It includes instructions for processing fees, submission process, and necessary documents. The document is essential for institutions seeking permanent affiliation with the university.

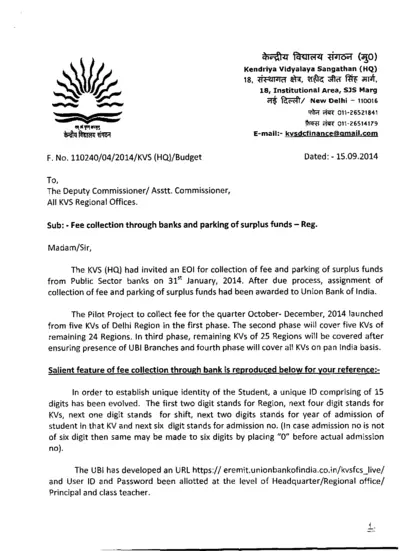

KVS Fee Collection and Surplus Funds Management 2014

This file contains information about the fee collection process through banks and the management of surplus funds for Kendriya Vidyalaya Sangathan (KVS). It details the pilot project, phases of implementation, and instructions for schools. It also includes guidelines for filling out student information online and tripartite accounts.

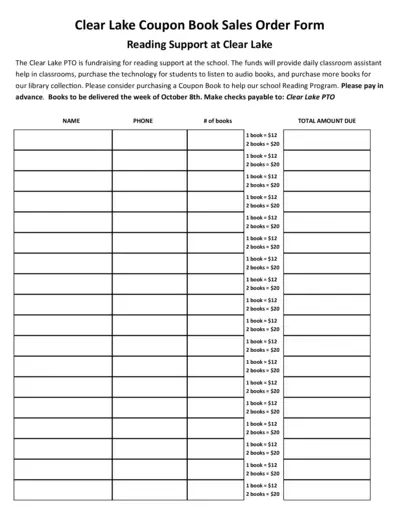

Clear Lake PTO Reading Support Coupon Book Sales Order Form

This form is used for purchasing coupon books to support reading programs at Clear Lake. The funds will help provide classroom assistance, technology for audiobooks, and more books for the library. Please fill out the form to help support the school.