Edit, Download, and Sign the 1980 EO CPE Text Review of IRC 508 Developments

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the required forms, gather the necessary organizational documents. Ensure that you understand the specific IRS requirements pertaining to your organization. Finally, follow the guidelines laid out in the instructions section for completing your submission.

How to fill out the 1980 EO CPE Text Review of IRC 508 Developments?

1

Collect your organization's foundational documents.

2

Review IRC 508 compliance requirements.

3

Complete the necessary forms accurately.

4

Submit the forms within the stipulated time frame.

5

Retain copies of all submissions for your records.

Who needs the 1980 EO CPE Text Review of IRC 508 Developments?

1

Nonprofit organizations seeking tax-exempt status.

2

Individuals planning to establish a charitable trust.

3

Professional advisors assisting clients with IRS compliance.

4

Organizations retroactively applying for tax exemptions.

5

Foundations wanting to understand IRC 508 regulations.

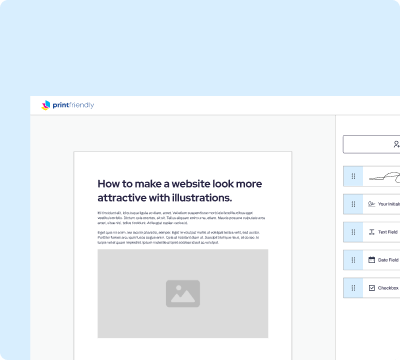

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the 1980 EO CPE Text Review of IRC 508 Developments along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your 1980 EO CPE Text Review of IRC 508 Developments online.

Edit your PDF effortlessly on PrintFriendly. Our user-friendly interface allows you to modify text, adjust fields, and personalize your document. Experience a hassle-free editing process that enhances your document's clarity and compliance.

Add your legally-binding signature.

Signing your PDF on PrintFriendly has never been easier. You can add a digital signature directly on the platform, ensuring authenticity. This feature streamlines the signing process for your important tax-exempt applications.

Share your form instantly.

Our platform makes sharing PDFs simple and efficient. Once you've edited your document, you can easily share it with stakeholders or advisors. Enjoy seamless sharing capabilities that foster collaboration and compliance.

How do I edit the 1980 EO CPE Text Review of IRC 508 Developments online?

Edit your PDF effortlessly on PrintFriendly. Our user-friendly interface allows you to modify text, adjust fields, and personalize your document. Experience a hassle-free editing process that enhances your document's clarity and compliance.

1

Open the PDF in PrintFriendly's editor.

2

Select the text or field you wish to modify.

3

Make the necessary changes directly in the document.

4

Save your edits within the platform.

5

Download the updated document for submission.

What are the instructions for submitting this form?

To submit your form, send it to the IRS via electronic submission where applicable. For physical submissions, mail to the designated IRS office addresses provided in the form's instructions. It's essential to ensure that your application is complete and accurate to avoid delays in processing.

What are the important dates for this form in 2024 and 2025?

Important dates for IRC 508 compliance in 2024 include deadlines for submitting exemptions and notices. Organizations should monitor updates from the IRS for any changes in regulations. Keep updated on annual requirements for tax filings and compliance check-ins.

What is the purpose of this form?

The purpose of this form is to ensure compliance with IRC 508 requirements for organizations seeking tax-exempt status. It outlines the necessary steps and documentation needed for proper filing. Ensuring that organizations fulfill these obligations helps maintain their nonprofit status and provides guidelines for fiscal accountability.

Tell me about this form and its components and fields line-by-line.

- 1. Organization Name: The legal name of the organization applying for tax-exempt status.

- 2. Date of Formation: The date the organization was officially established.

- 3. Purpose of Organization: A brief description of the activities the organization intends to carry out.

- 4. Gross Receipts: Estimation of the organization's income for the year.

- 5. Contact Information: Details of the person to contact regarding the application.

What happens if I fail to submit this form?

If you fail to submit this form, your organization may lose its tax-exempt status. Late submissions can result in penalties or back taxes owed. It's crucial to adhere to the outlined deadlines to maintain compliance.

- Loss of Tax-Exempt Status: Failure to submit can lead to revocation of nonprofit status and associated benefits.

- Penalties: Delays or inaccuracies in submission may incur financial penalties.

- Back Taxes: Potential liability for unpaid taxes during the period of noncompliance.

How do I know when to use this form?

- 1. Applying for Tax-Exempt Status: New organizations must submit this form to be recognized as tax-exempt.

- 2. Status Changes: Organizations changing their operational focus or structure may need to reapply.

- 3. Annual Compliance Checks: Organizations should regularly review and submit this form to maintain compliance with tax laws.

Frequently Asked Questions

How do I edit my PDF?

You can edit your PDF by opening it in our PrintFriendly editor and modifying the fields as needed.

Can I sign the PDF electronically?

Yes, you can add your digital signature directly through PrintFriendly.

How do I share my edited PDF?

Once your edits are complete, you can share your PDF via email or direct link.

What formats can I download my PDF in?

You can download your PDF in standard formats compatible with most devices.

Is there customer support available?

Yes, we offer customer support to assist you with any issues you may encounter.

Can I save the PDF after editing?

You can download your edited PDF, but saving directly on our site is not available.

What if I need to make more edits later?

You can always go back and edit your PDF as needed before final submission.

Are there restrictions on what I can edit?

Most fields are fully editable, with certain areas locked for compliance.

Do I need an account to edit PDFs?

No account is required; all editing capabilities are accessible to users.

Is my data safe while editing PDF?

Absolutely, our platform ensures a secure editing environment for your documents.

Related Documents - IRC 508 Overview

Blackbaud Online Express Overview

Blackbaud Online Express is a cloud-based online fundraising and marketing tool integrated with The Raiser's Edge. It offers features like online fundraising, email marketing, and dashboard metrics to help nonprofits. The tool is user-friendly with pre-designed templates and a drag-and-drop editor.

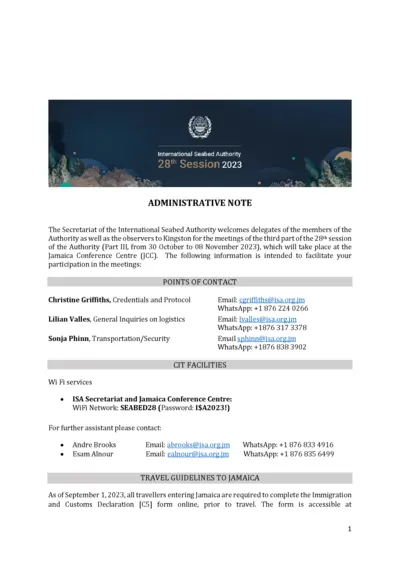

ISA 28th Session Administrative Note 2023

This file contains administrative notes for the 28th session of the International Seabed Authority held in 2023. It includes contact information, travel guidelines, transportation services, and lunch options. Delegates are provided with essential details to facilitate their participation.

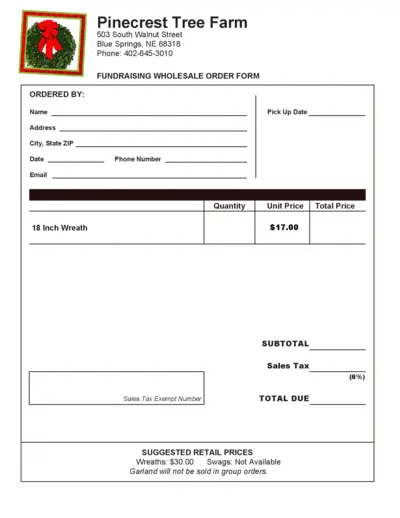

Fundraising Wholesale Order Form for Pinecrest Tree Farm

This PDF file is used for placing wholesale fundraising orders at Pinecrest Tree Farm. It includes sections for contact information, product order quantities, and pricing details. Suitable for managing wreath and swag orders.

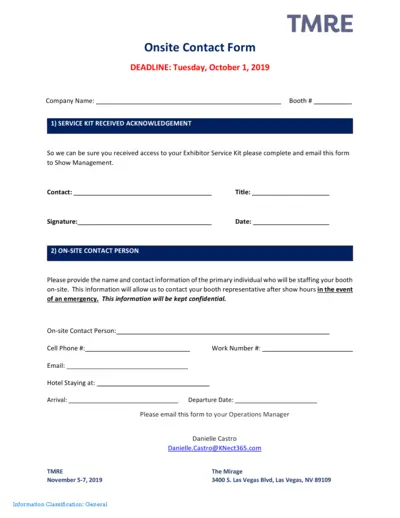

TMRE Onsite Contact Form: Acknowledgement and Contact Info

This file is used for acknowledging receipt of the service kit and providing on-site contact information for The Mirage event in November 2019. It ensures that the event management can reach the booth representative in case of emergencies and confirms that the exhibitor has successfully received the service kit.

Wonderfly Events Planning Agreement

This file is an Event Planning Agreement between a client and Wonderfly Events LLC for planning and hosting an event. It outlines the duties of Wonderfly, payment terms, rescheduling and cancellation policies, and use of property. It also includes important details for both parties to adhere to.

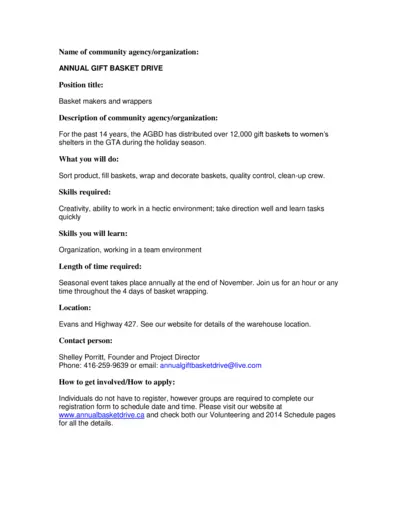

Annual Gift Basket Drive Volunteer Information

This file provides details and instructions about volunteering for the Annual Gift Basket Drive, including the required skills, time commitment, and how to get involved. It covers the event's purpose, location, and contact information for prospective volunteers. Perfect for anyone looking to contribute to a good cause during the holiday season.

Wayne County Fair Board Meeting and Accounts Payable Details

This document includes the details of the Wayne County Fair Board of Directors Regular Monthly Meeting on June 13, 2019, and the accounts payable records. It also contains the minutes of the Regular Monthly Directors Meeting on May 9, 2019.

Mr. Omelette Menu Packages for Special Events

This file contains detailed information about Mr. Omelette's menu packages, including various omelette selections, salads, breads, and optional services to enhance your party. It provides pricing details and additional services available for an unforgettable event.

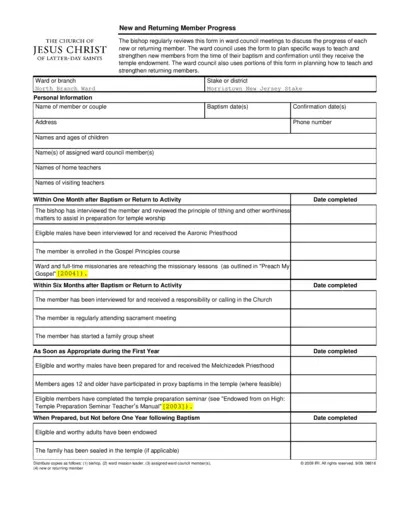

New and Returning Member Progress Form

This file helps the bishop and ward council to monitor and guide the progress of new or returning members from baptism to temple endowment. It includes instructions and fields for various stages of spiritual growth and activity in the church. Essential information and dates are recorded to ensure proper fellowship and support.

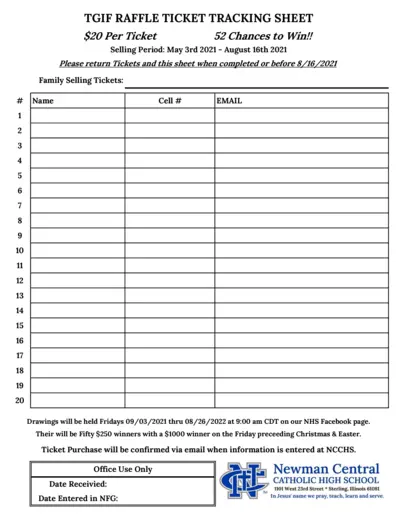

TGIF Raffle Ticket Tracking Sheet - Detailed Instructions & Information

The TGIF Raffle Ticket Tracking Sheet is designed to help you keep track of raffle ticket sales and participant information. It includes sections for recording ticket purchases, drawing dates, and winner announcements. Use this sheet to ensure all entries are accurately recorded and easily accessible.

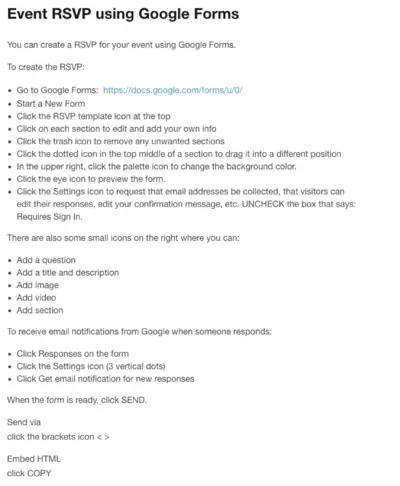

Event RSVP using Google Forms

Create your event RSVP using Google Forms with this simple guide. Edit sections, add questions, change the background color, and send the form effortlessly. Receive email notifications for responses.

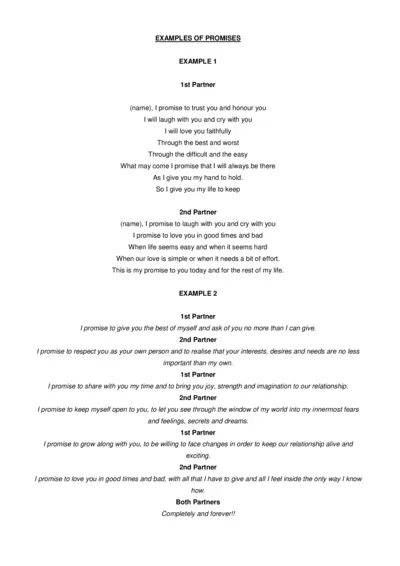

Examples of Wedding Vows and Promises

This file contains various examples of wedding vows and promises for partners to use as inspiration for their own ceremony. These examples can help couples express their love, commitment, and support for each other. Ideal for anyone planning a wedding and looking for meaningful vows.