California Franchise Tax Board Form 568 Booklet Instructions 2020

This document contains the detailed instructions and forms for the California Franchise Tax Board's Form 568 for Limited Liability Companies (LLCs) for the year 2020. It includes necessary forms, guidelines, and updates. Ideal for LLCs needing compliance with California tax laws.

Edit, Download, and Sign the California Franchise Tax Board Form 568 Booklet Instructions 2020

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To effectively complete this form, carefully follow the provided guidelines and instructions. Begin by gathering all relevant financial documentation required for accurate reporting. Filling out the form accurately ensures compliance with California tax regulations.

How to fill out the California Franchise Tax Board Form 568 Booklet Instructions 2020?

1

Gather all necessary financial documents before starting.

2

Read the general and specific instructions carefully.

3

Fill in the required fields on Form 568 and attached schedules.

4

Ensure all information is accurate and complete.

5

Review the form and submit it as indicated.

Who needs the California Franchise Tax Board Form 568 Booklet Instructions 2020?

1

LLC members who need to report annual income and deductions.

2

Business owners seeking compliance with California tax regulations.

3

Accountants preparing tax returns for LLCs.

4

Tax professionals needing detailed guidance for Form 568.

5

LLCs applying for specific tax exclusions or credits.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the California Franchise Tax Board Form 568 Booklet Instructions 2020 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your California Franchise Tax Board Form 568 Booklet Instructions 2020 online.

On PrintFriendly, you can easily edit your Form 568 PDF using our intuitive editor. Modify text, add annotations, and ensure all information is up-to-date before submission. Enjoy a convenient and user-friendly editing experience.

Add your legally-binding signature.

PrintFriendly allows you to sign your Form 568 PDF digitally. Add your signature quickly and securely with our straightforward signing tool. Save time and avoid the hassle of printing, signing, and scanning documents.

Share your form instantly.

Easily share your completed Form 568 PDF using PrintFriendly's sharing options. Send your form via email, generate a shareable link, or directly share it on cloud storage. Simplify the process of distributing your important tax documents.

How do I edit the California Franchise Tax Board Form 568 Booklet Instructions 2020 online?

On PrintFriendly, you can easily edit your Form 568 PDF using our intuitive editor. Modify text, add annotations, and ensure all information is up-to-date before submission. Enjoy a convenient and user-friendly editing experience.

1

Upload the Form 568 PDF to PrintFriendly.

2

Open the PDF in the editor tool.

3

Make necessary edits to the text and fields.

4

Add annotations or additional information as required.

5

Save the edited PDF and download it.

What are the instructions for submitting this form?

For submitting Form 568, you can use multiple methods: electronically via e-file, by mail to Franchise Tax Board, P.O. Box 942857, Sacramento, CA 94257-0651, or through an authorized tax professional. Ensure all required forms and attachments are included. Timely submission is crucial to avoid penalties.

What are the important dates for this form in 2024 and 2025?

The deadlines for Form 568 submissions in 2024 and 2025 will be in-line with the California Franchise Tax Board's guidelines. Always check for specific dates annually to ensure on-time filing.

What is the purpose of this form?

Form 568 is crucial for Limited Liability Companies (LLCs) in California, enabling them to report income, deductions, and tax liabilities accurately. It ensures compliance with state tax regulations and can impact financial outcomes for the business. Proper completion and submission of Form 568 are necessary to avoid penalties and stay in good standing with the California Franchise Tax Board.

Tell me about this form and its components and fields line-by-line.

- 1. Business Name: The official name of the LLC as registered with the state.

- 2. EIN: Employer Identification Number assigned to the LLC by the IRS.

- 3. Income: Total income earned by the LLC during the fiscal year.

- 4. Deductions: Eligible deductions from the total income of the LLC.

- 5. Credits: Applicable tax credits that the LLC can claim.

What happens if I fail to submit this form?

Failure to submit Form 568 can result in penalties and legal complications. It is essential for maintaining compliance with state tax regulations.

- Penalties: You may incur financial penalties for late or non-submission.

- Legal Issues: Failing to file can lead to legal actions against your LLC.

- Loss of Good Standing: Your LLC might lose its good standing with the state government.

How do I know when to use this form?

- 1. Annual Tax Filing: Required for yearly income and deductions reporting.

- 2. Claiming Tax Credits: Use it to claim specific credits available to LLCs.

- 3. Legal Compliance: Ensures your LLC complies with California tax laws.

- 4. Financial Reporting: Helps maintain accurate financial records for the business.

- 5. Avoiding Penalties: Timely filing helps avoid late submission penalties.

Frequently Asked Questions

How do I upload and edit Form 568 on PrintFriendly?

Simply upload the PDF and start editing using our user-friendly tools.

Can I digitally sign the Form 568 PDF on PrintFriendly?

Yes, our tool allows you to add a secure digital signature to your PDF.

How can I share my edited Form 568 PDF?

You can share the PDF via email, link, or directly to cloud storage.

Is it possible to add annotations to the Form 568 PDF?

Yes, our editor enables you to add annotations easily.

Can I save the edited Form 568 PDF on PrintFriendly?

Yes, after completing your edits, you can save and download the PDF.

Does PrintFriendly support adding additional forms to my PDF?

You can upload and merge additional forms with your existing PDF.

What if I need to make corrections after editing the PDF?

You can re-upload the PDF and make further edits as needed.

How secure is the digital signing process on PrintFriendly?

Our digital signing tool is secure and ensures your signatures are valid.

Can I use PrintFriendly to fill out other California tax forms?

Yes, our platform supports various tax forms for easy completion.

Is there customer support available if I face issues?

Yes, PrintFriendly offers customer support to assist with any issues.

Related Documents - FTB Form 568 Instructions 2020

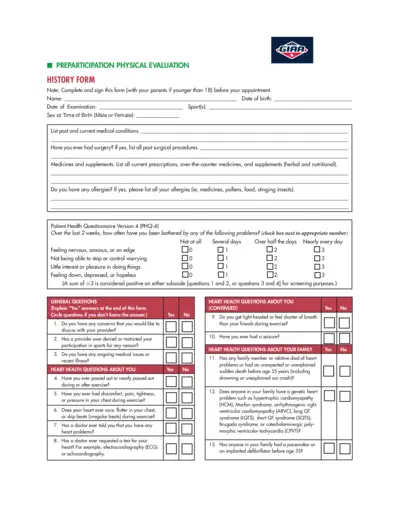

Preparticipation Physical Evaluation Form

The Preparticipation Physical Evaluation Form is used to assess the physical health and fitness of individuals before they participate in sports activities. It covers medical history, heart health, bone and joint health, and other relevant medical questions.

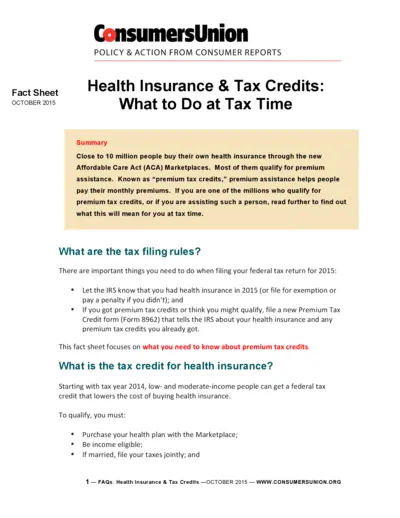

Health Insurance Tax Credits Guide 2015

This document provides a comprehensive guide on health insurance and premium tax credits for the 2015 tax year. It explains the tax filing rules, eligibility criteria, and detailed instructions for claiming and reporting premium tax credits. Essential for individuals who bought health insurance through the ACA Marketplaces.

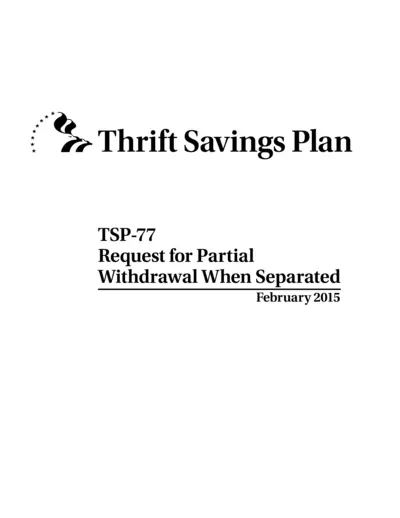

TSP-77 Partial Withdrawal Request for Separated Employees

The TSP-77 form is used by separated employees to request a partial withdrawal from their Thrift Savings Plan account. It includes instructions for completing the form, certification, and notarization requirements. The form must be filled out completely and submitted along with necessary supporting documents.

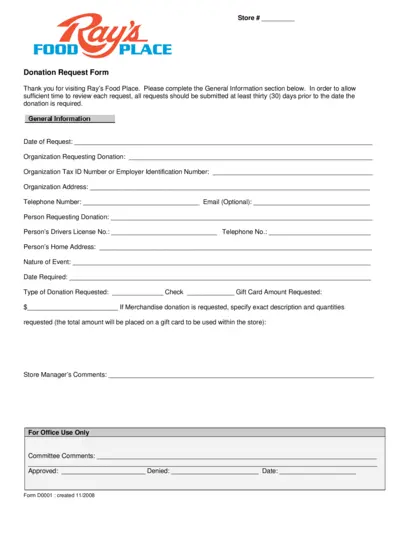

Ray's Food Place Donation Request Form Details

This file contains the donation request form for Ray's Food Place. Complete the general information section and follow the guidelines to submit your donation request at least 30 days in advance. The form includes fields for organization details and donation specifics.

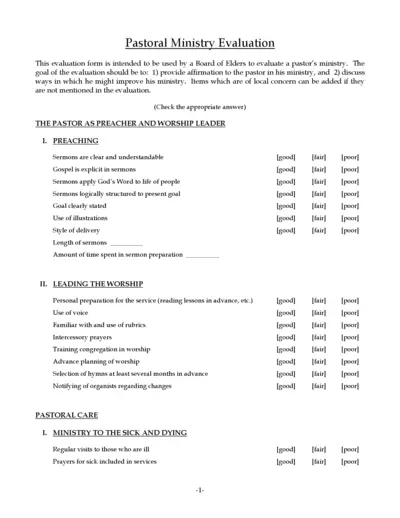

Pastoral Ministry Evaluation Form for Board of Elders

This evaluation form is designed for the Board of Elders to assess and provide feedback on a pastor's ministry. It aims to offer affirmation and identify areas for improvement. The form covers preaching, worship leading, pastoral care, administration, and more.

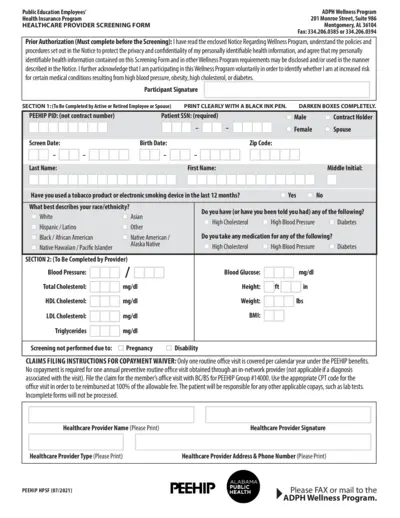

Health Provider Screening Form for PEEHIP Healthcare

This file contains the Health Provider Screening Form for PEEHIP public education employees and spouses. It includes instructions on how to fill out the form for wellness program participation. The form collects personal, medical, and screening details to assess wellness.

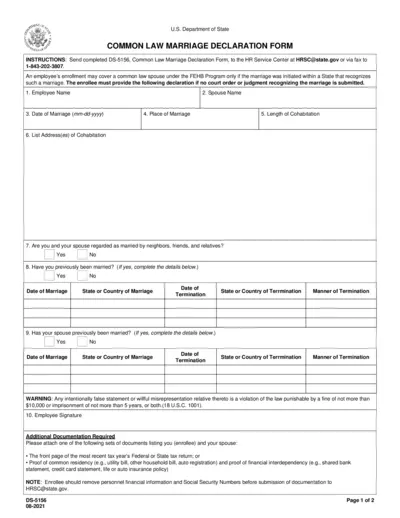

Common Law Marriage Declaration Form for FEHB Program

This form is used to declare a common law marriage for the purpose of enrolling a spouse under the Federal Employees Health Benefits (FEHB) Program. It requires personal details, marriage information, and additional documentation. Submission instructions and legal implications are included.

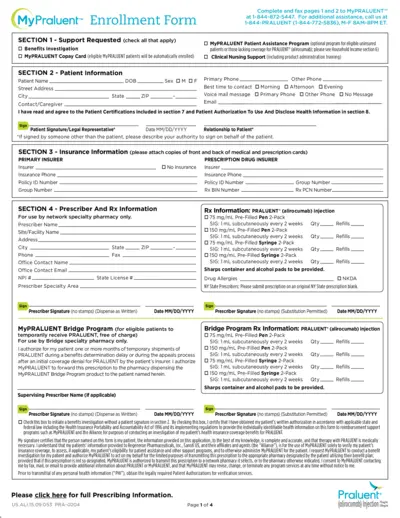

MyPRALUENT™ Enrollment Form Instructions and Details

This document provides comprehensive instructions and details for enrolling in the MyPRALUENT™ program, including benefits, patient assistance, and clinical support. It outlines the required patient, insurance, and prescriber information, as well as the steps for treatment verification and household income documentation.

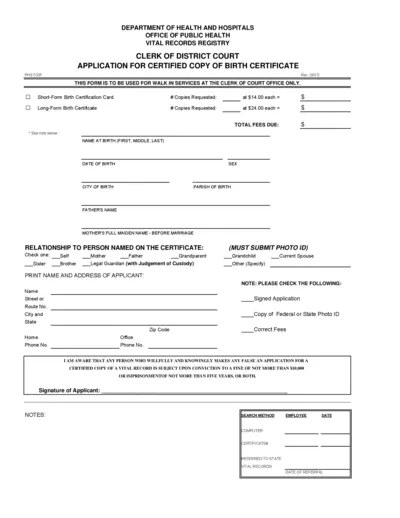

Application for Certified Copy of Birth Certificate

This form is used to request a certified copy of a birth certificate from the Clerk of Court Office. It includes details about the applicant, the person named on the certificate, and requires a photo ID and the correct fee. This form is only for walk-in services.

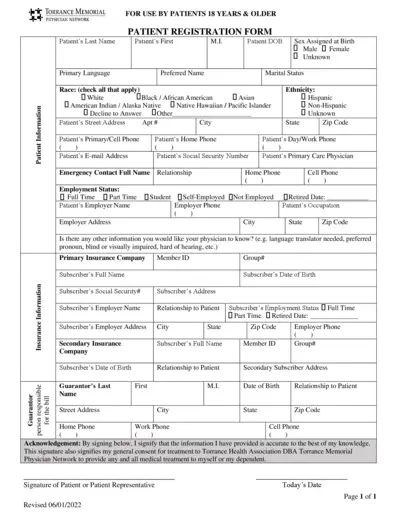

Torrance Memorial Physician Network Forms for Patients 18+

This file contains important forms for patients 18 years and older registered with Torrance Memorial Physician Network. It includes patient registration, acknowledgment of receipt of privacy practices, and financial & assignment of benefits policy forms. Complete these forms to ensure your medical records are up-to-date and to understand your financial responsibilities.

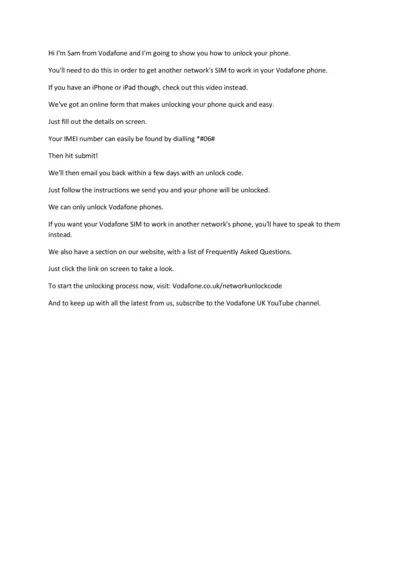

Vodafone Phone Unlocking Guide: Steps to Unlock Your Phone

This guide from Vodafone provides a step-by-step process to unlock your phone. Learn how to obtain your unlock code by filling out an online form. Follow the instructions to complete the unlocking process.

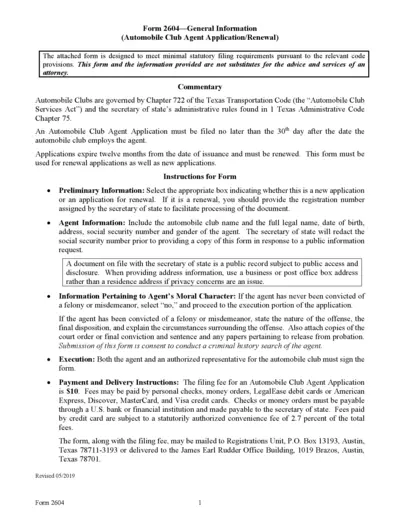

Texas Automobile Club Agent Application Form

This file is the Texas Automobile Club Agent Application or Renewal form, which must be submitted within 30 days after hiring an agent. The form includes fields for agent identification, moral character information, and requires signature from both the agent and an authorized representative of the automobile club. Filing fees and submission instructions are also provided.