Edit, Download, and Sign the House Rent Receipt Template for Tax Purpose

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the house rent receipt, start by entering the amount received. Next, provide details about the house owner and tenant, including their names and addresses. Lastly, complete the date and affix a revenue stamp if the payment exceeds Rs. 5000.

How to fill out the House Rent Receipt Template for Tax Purpose?

1

Enter the total rent amount received.

2

Fill in the names and details of the house owner and tenant.

3

Specify the house address and number.

4

Include the date of the transaction.

5

Affix a revenue stamp if applicable.

Who needs the House Rent Receipt Template for Tax Purpose?

1

Landlords who need to provide valid proof of rent received.

2

Tenants who want a formal acknowledgment of the rent paid.

3

Taxpayers requiring receipts for income tax declaration.

4

Real estate agents handling rental agreements.

5

Property managers who maintain documentation for multiple properties.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the House Rent Receipt Template for Tax Purpose along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your House Rent Receipt Template for Tax Purpose online.

You can easily edit your PDF on PrintFriendly by opening the document within our editor. Use the intuitive tools to make adjustments, add information, or correct errors. Once you're satisfied, download the edited version straight to your device.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is a seamless process. Simply navigate to the signing option within the editor and select your preferred method of signing. After you sign, you can promptly download the signed document for your records.

Share your form instantly.

Sharing your PDF on PrintFriendly is quick and easy. After editing or signing your document, use the share functionality to send it via email or social media. You can also create a shareable link for easy access.

How do I edit the House Rent Receipt Template for Tax Purpose online?

You can easily edit your PDF on PrintFriendly by opening the document within our editor. Use the intuitive tools to make adjustments, add information, or correct errors. Once you're satisfied, download the edited version straight to your device.

1

Open your PDF document in the PrintFriendly editor.

2

Use the text tools to modify the content as needed.

3

Add or remove any fields to customize the document.

4

Review your edits to ensure everything is accurate.

5

Download the completed document to your device.

What are the important dates for this form in 2024 and 2025?

For 2024, the key dates for filing taxes may vary based on local regulations; ensure to check the latest guidelines. In 2025, similar deadlines will apply as per the tax year. Always stay updated with changes in tax legislation for compliance.

What is the purpose of this form?

The purpose of this house rent receipt is to provide a formal acknowledgment of rent paid by a tenant to a landlord. It serves as proof for both parties concerning the amount transacted and can be utilized during tax filings. By having an official receipt, both landlords and tenants can ensure that their records are accurate and defensible in case of any discrepancies.

Tell me about this form and its components and fields line-by-line.

- 1. Amount Received: Total sum of money received as rent.

- 2. Tenant's Detail: Name and address of the tenant.

- 3. Landlord's Detail: Name and address of the landlord.

- 4. House No: Specific house number of the property.

- 5. Date: Date when the payment was received.

- 6. Signature: Signature of the landlord or authorized person.

- 7. PAN No: Permanent Account Number of the landlord (if applicable).

What happens if I fail to submit this form?

Failing to submit this form can lead to complications such as inability to claim rental deductions or legal recognition of payments made. It may also create disputes between tenants and landlords due to lack of proper documentation.

- Tax Implications: Without a receipt, claimed deductions could be challenged.

- Disputes: Absence of proof can cause disagreements between parties.

- Legal Issues: May encounter legal scrutiny during audits.

How do I know when to use this form?

- 1. Rental Payments: To record each rent payment transaction.

- 2. Income Tax Filing: To declare rental income accurately.

- 3. Legal Evidence: As proof in disputes between landlords and tenants.

Frequently Asked Questions

How do I edit my house rent receipt?

Open your receipt in the PrintFriendly editor and make changes using the tools provided.

Can I sign the document electronically?

Yes, PrintFriendly allows you to sign your PDFs electronically within the editor.

How do I share the PDF with others?

Use the share feature to email or create a shareable link directly from the editor.

What if I need to print it?

You can print your edited PDF directly from the PrintFriendly platform.

Is there a way to combine PDFs?

Currently, you can edit individual PDFs, but combining them is not available yet.

Are there any costs for editing PDFs?

Editing your PDF on PrintFriendly is free of charge.

What formats can I download my receipt in?

You can download your edited PDF in standard formats supported by PrintFriendly.

Can I use my phone to edit the PDF?

Yes, PrintFriendly is accessible on mobile devices for editing PDFs.

Will my changes be saved automatically?

While you can edit your document, be sure to download your receipt to keep your changes.

How fast can I download my edited document?

Downloading your edited document is quick and can be done instantly after you save your changes.

Related Documents - House Rent Receipt

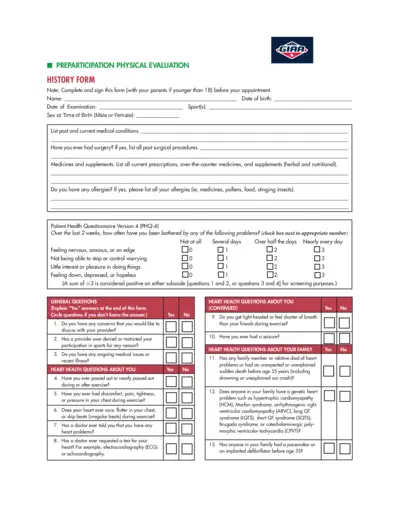

Preparticipation Physical Evaluation Form

The Preparticipation Physical Evaluation Form is used to assess the physical health and fitness of individuals before they participate in sports activities. It covers medical history, heart health, bone and joint health, and other relevant medical questions.

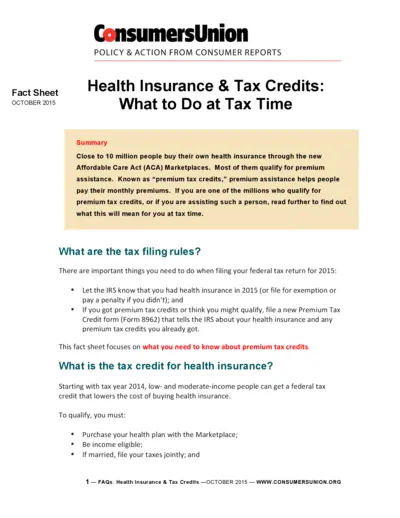

Health Insurance Tax Credits Guide 2015

This document provides a comprehensive guide on health insurance and premium tax credits for the 2015 tax year. It explains the tax filing rules, eligibility criteria, and detailed instructions for claiming and reporting premium tax credits. Essential for individuals who bought health insurance through the ACA Marketplaces.

TSP-77 Partial Withdrawal Request for Separated Employees

The TSP-77 form is used by separated employees to request a partial withdrawal from their Thrift Savings Plan account. It includes instructions for completing the form, certification, and notarization requirements. The form must be filled out completely and submitted along with necessary supporting documents.

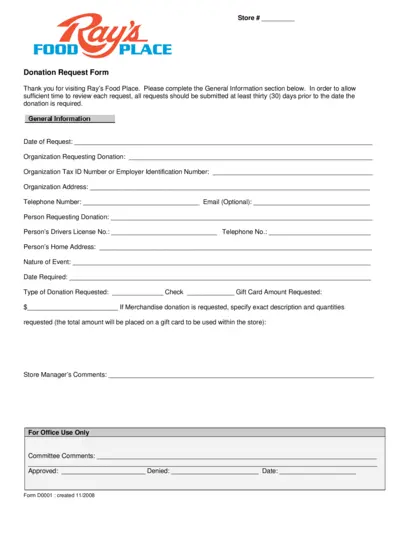

Ray's Food Place Donation Request Form Details

This file contains the donation request form for Ray's Food Place. Complete the general information section and follow the guidelines to submit your donation request at least 30 days in advance. The form includes fields for organization details and donation specifics.

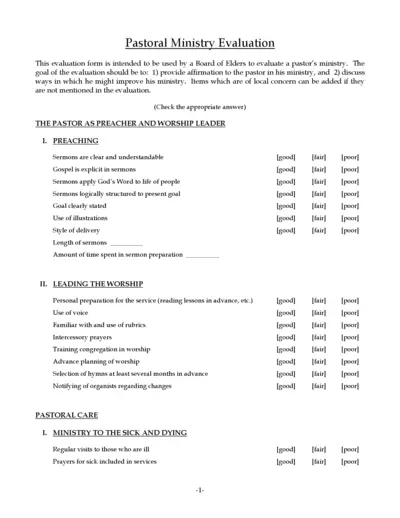

Pastoral Ministry Evaluation Form for Board of Elders

This evaluation form is designed for the Board of Elders to assess and provide feedback on a pastor's ministry. It aims to offer affirmation and identify areas for improvement. The form covers preaching, worship leading, pastoral care, administration, and more.

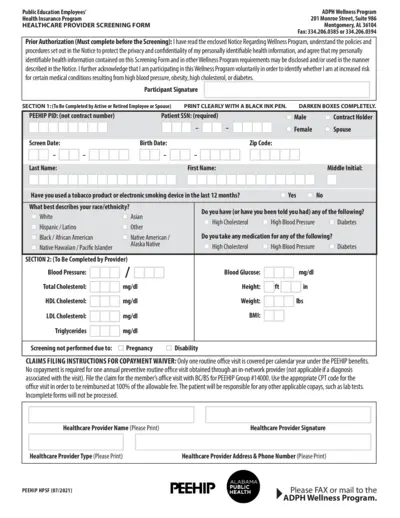

Health Provider Screening Form for PEEHIP Healthcare

This file contains the Health Provider Screening Form for PEEHIP public education employees and spouses. It includes instructions on how to fill out the form for wellness program participation. The form collects personal, medical, and screening details to assess wellness.

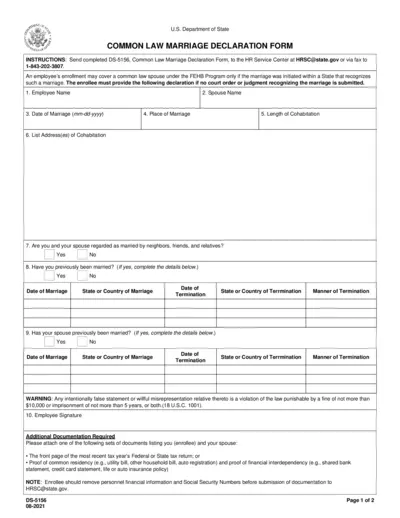

Common Law Marriage Declaration Form for FEHB Program

This form is used to declare a common law marriage for the purpose of enrolling a spouse under the Federal Employees Health Benefits (FEHB) Program. It requires personal details, marriage information, and additional documentation. Submission instructions and legal implications are included.

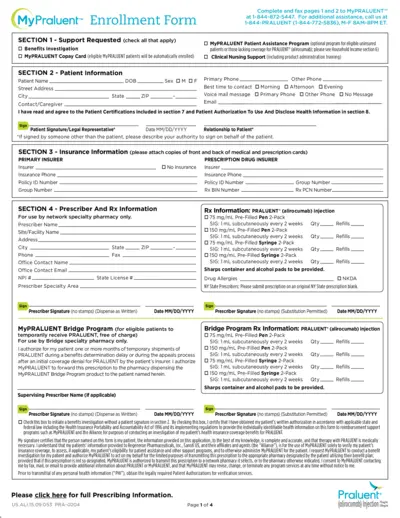

MyPRALUENT™ Enrollment Form Instructions and Details

This document provides comprehensive instructions and details for enrolling in the MyPRALUENT™ program, including benefits, patient assistance, and clinical support. It outlines the required patient, insurance, and prescriber information, as well as the steps for treatment verification and household income documentation.

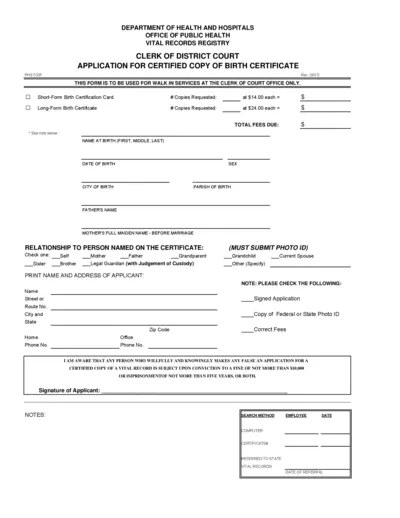

Application for Certified Copy of Birth Certificate

This form is used to request a certified copy of a birth certificate from the Clerk of Court Office. It includes details about the applicant, the person named on the certificate, and requires a photo ID and the correct fee. This form is only for walk-in services.

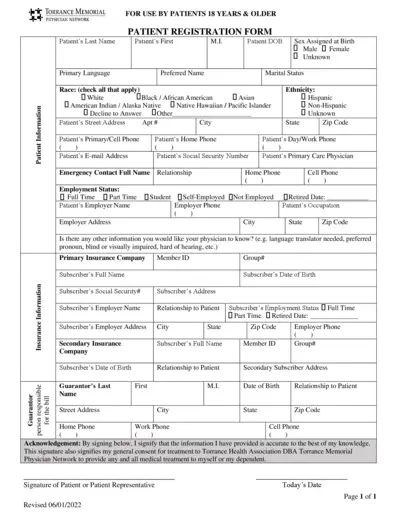

Torrance Memorial Physician Network Forms for Patients 18+

This file contains important forms for patients 18 years and older registered with Torrance Memorial Physician Network. It includes patient registration, acknowledgment of receipt of privacy practices, and financial & assignment of benefits policy forms. Complete these forms to ensure your medical records are up-to-date and to understand your financial responsibilities.

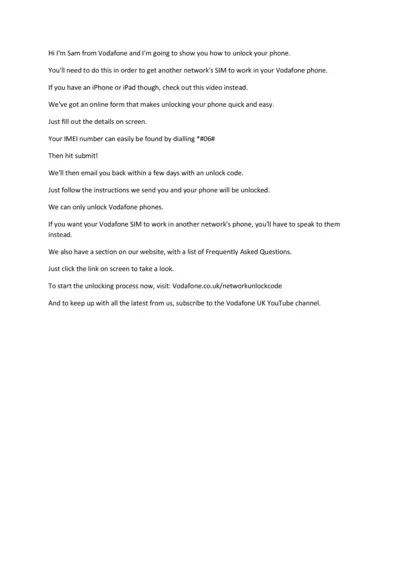

Vodafone Phone Unlocking Guide: Steps to Unlock Your Phone

This guide from Vodafone provides a step-by-step process to unlock your phone. Learn how to obtain your unlock code by filling out an online form. Follow the instructions to complete the unlocking process.

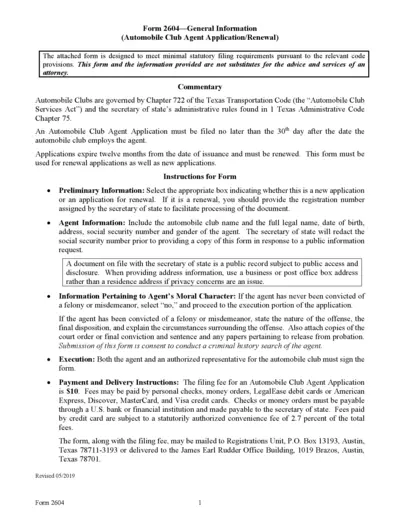

Texas Automobile Club Agent Application Form

This file is the Texas Automobile Club Agent Application or Renewal form, which must be submitted within 30 days after hiring an agent. The form includes fields for agent identification, moral character information, and requires signature from both the agent and an authorized representative of the automobile club. Filing fees and submission instructions are also provided.