Instructions for Schedule R Form 990

This document provides guidelines for completing Schedule R of Form 990, detailing related organizations and unrelated partnerships. It is essential for tax-exempt organizations to document their relationships and transactions. Ensure compliance with tax regulations by referring to these instructions.

Edit, Download, and Sign the Instructions for Schedule R Form 990

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To effectively fill out Schedule R, first gather all relevant information concerning related organizations and partnerships. Next, follow the structured parts of the form that require specific details. Finally, review your entries for accuracy before submission.

How to fill out the Instructions for Schedule R Form 990?

1

Gather all necessary information about related organizations.

2

Complete the relevant sections of Schedule R based on the gathered data.

3

Ensure all required information is accurate and complete.

4

Review the completed form for any errors or omissions.

5

Submit the form along with Form 990 before the deadline.

Who needs the Instructions for Schedule R Form 990?

1

Nonprofit organizations must document their related entities for IRS compliance.

2

Tax-exempt entities need to report transactions with related organizations.

3

Organizations filing Form 990 for the first time may require guidance on Schedule R.

4

Certain partnerships require details on related organizations for transparency.

5

Financial institutions involved with nonprofit organizations need clarity on their partnerships.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Instructions for Schedule R Form 990 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Instructions for Schedule R Form 990 online.

Editing this PDF on PrintFriendly is quick and efficient. You can modify text and fields directly within the document through our intuitive editor. It allows for seamless updates to your information before finalizing the form.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is straightforward. Use our signature tool to add your electronic signature effortlessly. This ensures that your document is signed and ready for submission.

Share your form instantly.

Sharing your PDF on PrintFriendly is easy and efficient. Utilize our sharing options to send your document directly via email or through social media. This feature ensures that your important documents reach the right audience quickly.

How do I edit the Instructions for Schedule R Form 990 online?

Editing this PDF on PrintFriendly is quick and efficient. You can modify text and fields directly within the document through our intuitive editor. It allows for seamless updates to your information before finalizing the form.

1

Open the PDF file in PrintFriendly's editor.

2

Click on the text fields to insert or modify your information.

3

Adjust any other items according to your needs.

4

Review the changes made to ensure accuracy.

5

Download or share the edited PDF once completed.

What are the instructions for submitting this form?

Submit Schedule R alongside your Form 990 to the IRS via mail or electronically through the IRS e-file system. If mailing, send to the respective IRS location based on your organization's location. Ensure to keep a copy for your records and consider consulting a tax professional if needed.

What are the important dates for this form in 2024 and 2025?

For 2024, organizations must file Schedule R by May 15, 2024, if on a calendar year basis. For those on a fiscal year, the due date is the 15th day of the 5th month after the end of the fiscal year. Ensure timely submission to avoid penalties.

What is the purpose of this form?

Schedule R of Form 990 is a critical component that helps tax-exempt organizations disclose their relationships with related entities. This form is used to report related organizations and specific transactions with these entities. By providing clarity and transparency in operations, organizations can maintain their tax-exempt status and comply with federal requirements.

Tell me about this form and its components and fields line-by-line.

- 1. Part I: Identification of disregarded entities of the filing organization.

- 2. Part II: Information about related tax-exempt organizations.

- 3. Part III: Details on related organizations treated as partnerships.

- 4. Part IV: Identification of related organizations as C or S corporations.

- 5. Part V: Transactions between the organization and related organizations.

- 6. Part VI: Data on unrelated organizations treated as partnerships.

- 7. Part VII: Additional information or explanations as necessary.

What happens if I fail to submit this form?

Failure to submit Schedule R may result in penalties and failure of compliance with IRS regulations. Organizations risk losing their tax-exempt status if they do not report related organizations and transactions accurately. It is crucial to maintain proper documentation to avoid such issues.

- Penalties: Organizations might incur penalties for late submission of mandatory forms.

- Tax-Exempt Status Risks: Failing to submit required forms could jeopardize an organization's tax-exempt status.

- Inaccurate Reporting: Incorrect or incomplete information could lead to audits and further complications.

How do I know when to use this form?

- 1. Filing Form 990: Use Schedule R as part of the comprehensive Form 990 filing.

- 2. Documenting Relationships: Disclose relationships with related organizations for transparency.

- 3. Maintaining Compliance: Ensure adherence to IRS regulations about tax-exempt entities.

Frequently Asked Questions

How can I edit the Schedule R PDF?

Simply open the document in our PrintFriendly editor and modify the fields as needed.

Is it possible to share my edited PDF?

Yes, you can use the sharing options to send your document to others easily.

Can I sign the Schedule R PDF?

Absolutely! Use our signature tool to add your signature before submitting.

What do I do if I make a mistake while editing?

You can easily revert changes or edit any text until you're satisfied with the document.

Is this service free to use?

Yes, editing and sharing PDFs on PrintFriendly is completely free.

Can I download the completed Schedule R form?

Yes, once edited, you can download the completed PDF directly to your device.

What types of PDFs can I edit?

You can edit a variety of PDF forms, including official tax documents like Schedule R.

How do I know if my edits were saved?

You can download the PDF to ensure all your modifications have been correctly saved.

What happens after I edit and download my PDF?

You can submit it directly to the IRS or relevant authority as needed.

Can I access my edited PDF later?

Currently, edits are made during the session, and you must download the document to keep it.

Related Documents - Schedule R Form 990 Instructions

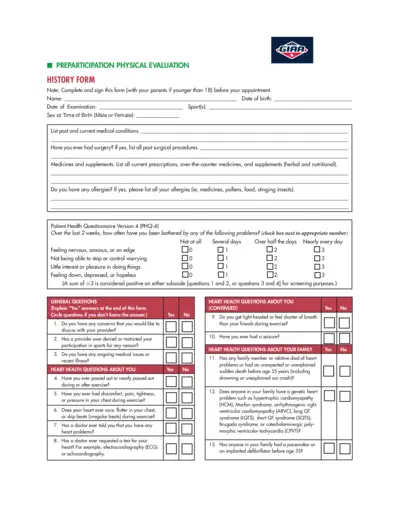

Preparticipation Physical Evaluation Form

The Preparticipation Physical Evaluation Form is used to assess the physical health and fitness of individuals before they participate in sports activities. It covers medical history, heart health, bone and joint health, and other relevant medical questions.

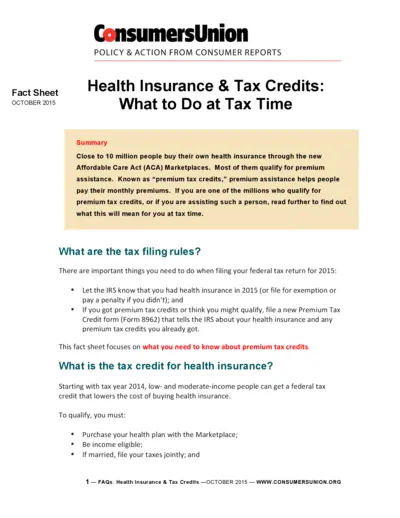

Health Insurance Tax Credits Guide 2015

This document provides a comprehensive guide on health insurance and premium tax credits for the 2015 tax year. It explains the tax filing rules, eligibility criteria, and detailed instructions for claiming and reporting premium tax credits. Essential for individuals who bought health insurance through the ACA Marketplaces.

TSP-77 Partial Withdrawal Request for Separated Employees

The TSP-77 form is used by separated employees to request a partial withdrawal from their Thrift Savings Plan account. It includes instructions for completing the form, certification, and notarization requirements. The form must be filled out completely and submitted along with necessary supporting documents.

Ray's Food Place Donation Request Form Details

This file contains the donation request form for Ray's Food Place. Complete the general information section and follow the guidelines to submit your donation request at least 30 days in advance. The form includes fields for organization details and donation specifics.

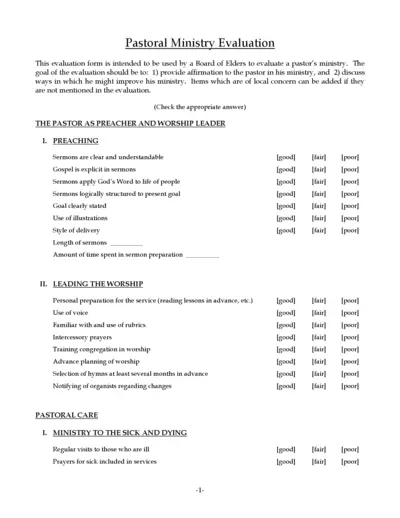

Pastoral Ministry Evaluation Form for Board of Elders

This evaluation form is designed for the Board of Elders to assess and provide feedback on a pastor's ministry. It aims to offer affirmation and identify areas for improvement. The form covers preaching, worship leading, pastoral care, administration, and more.

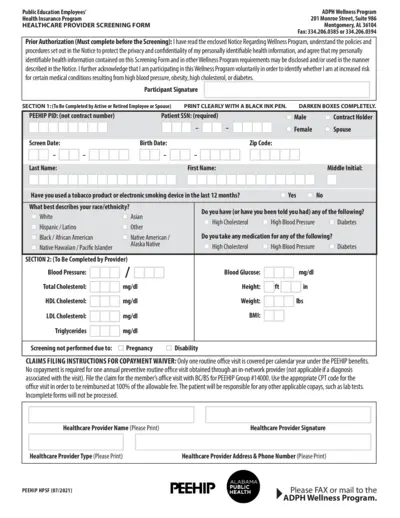

Health Provider Screening Form for PEEHIP Healthcare

This file contains the Health Provider Screening Form for PEEHIP public education employees and spouses. It includes instructions on how to fill out the form for wellness program participation. The form collects personal, medical, and screening details to assess wellness.

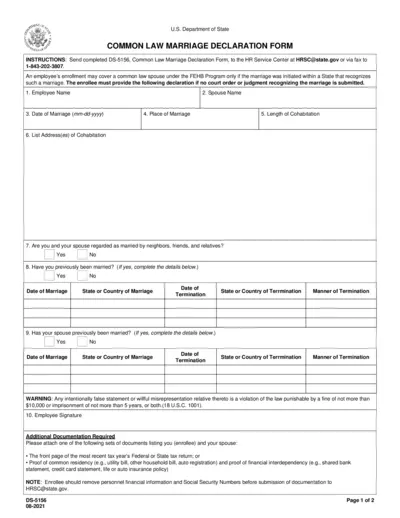

Common Law Marriage Declaration Form for FEHB Program

This form is used to declare a common law marriage for the purpose of enrolling a spouse under the Federal Employees Health Benefits (FEHB) Program. It requires personal details, marriage information, and additional documentation. Submission instructions and legal implications are included.

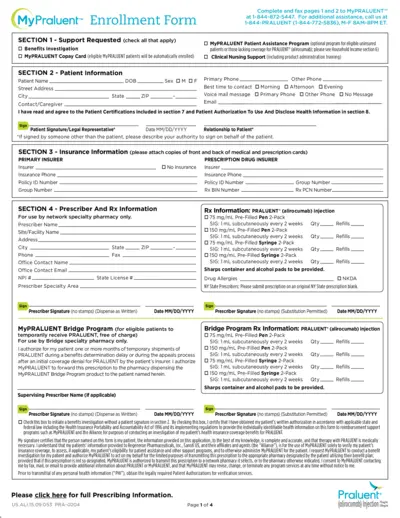

MyPRALUENT™ Enrollment Form Instructions and Details

This document provides comprehensive instructions and details for enrolling in the MyPRALUENT™ program, including benefits, patient assistance, and clinical support. It outlines the required patient, insurance, and prescriber information, as well as the steps for treatment verification and household income documentation.

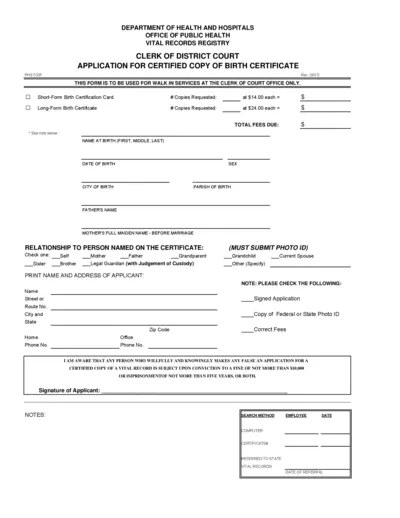

Application for Certified Copy of Birth Certificate

This form is used to request a certified copy of a birth certificate from the Clerk of Court Office. It includes details about the applicant, the person named on the certificate, and requires a photo ID and the correct fee. This form is only for walk-in services.

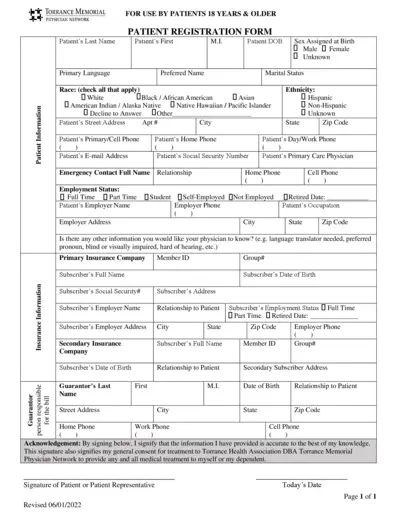

Torrance Memorial Physician Network Forms for Patients 18+

This file contains important forms for patients 18 years and older registered with Torrance Memorial Physician Network. It includes patient registration, acknowledgment of receipt of privacy practices, and financial & assignment of benefits policy forms. Complete these forms to ensure your medical records are up-to-date and to understand your financial responsibilities.

Vodafone Phone Unlocking Guide: Steps to Unlock Your Phone

This guide from Vodafone provides a step-by-step process to unlock your phone. Learn how to obtain your unlock code by filling out an online form. Follow the instructions to complete the unlocking process.

Texas Automobile Club Agent Application Form

This file is the Texas Automobile Club Agent Application or Renewal form, which must be submitted within 30 days after hiring an agent. The form includes fields for agent identification, moral character information, and requires signature from both the agent and an authorized representative of the automobile club. Filing fees and submission instructions are also provided.