Edit, Download, and Sign the Kansas Resale Exemption Certificate Guidelines

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this certificate, gather the necessary information about your business and the items you plan to purchase. Make sure to include your Kansas sales tax registration number. Complete each field accurately to ensure compliance.

How to fill out the Kansas Resale Exemption Certificate Guidelines?

1

Gather your Kansas sales tax registration number.

2

Fill in the seller's information including business name and address.

3

Provide a description of the products you will be purchasing.

4

Complete the purchaser's details including name and signature.

5

Ensure the certificate is signed and dated correctly.

Who needs the Kansas Resale Exemption Certificate Guidelines?

1

Retailers in Kansas need this certificate to purchase inventory without sales tax.

2

Nonprofit organizations exempt from retail sales tax require this certificate for their purchases.

3

Wholesalers buying inventory for resale must use this form to avoid tax.

4

Out-of-state buyers wanting to purchase but needing to show a Kansas tax number should apply this certificate.

5

Contractors purchasing items for resale instead of personal use need to ensure they use the correct form.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Kansas Resale Exemption Certificate Guidelines along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Kansas Resale Exemption Certificate Guidelines online.

On PrintFriendly, you can easily edit your PDF to customize the Resale Exemption Certificate. Use our intuitive PDF editor to input your information directly into the fields. Save your changes and download the updated document effortlessly.

Add your legally-binding signature.

PrintFriendly allows you to add your signature directly to the PDF. Use our signature tool to create a digital signature that can be placed on your certificate. This feature makes signing documents quick and convenient.

Share your form instantly.

Easily share your completed PDF directly from PrintFriendly. Use the share options to send the document via email or social media. Sharing your certificate with colleagues or clients is straightforward with our tools.

How do I edit the Kansas Resale Exemption Certificate Guidelines online?

On PrintFriendly, you can easily edit your PDF to customize the Resale Exemption Certificate. Use our intuitive PDF editor to input your information directly into the fields. Save your changes and download the updated document effortlessly.

1

Open the Resale Exemption Certificate in the PrintFriendly PDF editor.

2

Click on the fields to enter your business and sales information.

3

Use the tools provided to reorganize or delete sections if necessary.

4

Preview the changes to ensure all information is correct.

5

Download the edited PDF to obtain your final document.

What are the instructions for submitting this form?

To submit the completed Resale Exemption Certificate, you may send a physical copy to your seller or fax it directly if allowed. Ensure your Kansas sales tax number is included. For submission inquiries, please reach out via email or contact the seller directly for their submission preferences.

What are the important dates for this form in 2024 and 2025?

As of now, no specific changes to the form have been announced for 2024 and 2025. Users should stay updated for any amendments to the guidelines that may affect future use of the certificate.

What is the purpose of this form?

The Kansas Resale Exemption Certificate serves to allow licensed businesses to make tax-free purchases of inventory that they intend to resell. This is a critical document for retail operations, ensuring compliance with state tax laws while minimizing costs for legitimate business transactions. By utilizing this certificate, businesses can streamline their procurement processes without the burden of upfront sales tax on resalable items.

Tell me about this form and its components and fields line-by-line.

- 1. Seller Information: Details about the seller including business name and address.

- 2. Purchaser Information: Details of the purchaser including name, address, and tax registration number.

- 3. Description of Products: A description of the goods intended for resale.

- 4. Signature and Date: Space for the purchaser's signature and the date of signing.

What happens if I fail to submit this form?

Failing to submit the Resale Exemption Certificate could lead to liability for unpaid sales tax. Sellers may hold the buyer responsible for any tax due if this certificate is not provided when applicable. It's crucial to complete and submit this form to avoid such complications.

- Tax Liability: Potential tax obligations may arise if the certificate is not provided.

- Legal Consequences: Not complying with the requirements may result in fines.

- Operational Delays: Delays in purchasing inventory could impact business operations.

How do I know when to use this form?

- 1. Retail Purchases: When buying inventory directly for resale.

- 2. Nonprofit Transactions: When nonprofits acquire goods for resale or fundraising.

- 3. Out-of-State Buyers: When non-Kansas residents need to purchase for resale in Kansas.

Frequently Asked Questions

What is a Resale Exemption Certificate?

It allows registered businesses to buy goods for resale without paying sales tax.

Who can use this certificate?

Only businesses registered to collect Kansas sales tax can use it.

How long do I need to keep this certificate?

Sellers should retain a copy for at least three years from the date of sale.

Can nonprofits use this certificate?

Yes, nonprofits can use it for items intended for resale.

What happens if I use this certificate incorrectly?

You may be liable for unpaid sales tax if the items are not resold.

How do I fill out this certificate?

Gather your sales tax number, seller info, and product details, then complete the form.

Is there a fee to use this certificate?

No, there is no fee associated with using the certificate.

Where can I find the form?

The form can be accessed and filled out using PrintFriendly.

Can I edit the certificate in PrintFriendly?

Yes, you can edit the PDF easily using our editing tools.

How do I share the completed certificate?

You can share the PDF directly through email or social media options.

Related Documents - Kansas Resale Cert

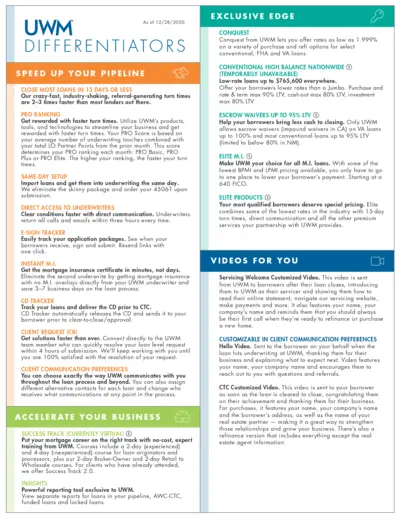

UWM File Details and Instructions

This file provides detailed information and instructions on the services and products offered by UWM. It highlights various features such as turn times, direct access to underwriters, E-sign tracker, and more. Users can find guidance on how to accelerate their business practices.

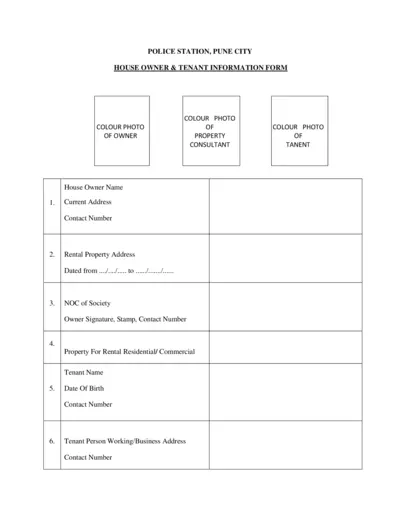

Police Station Pune City House Owner & Tenant Information Form

This form is for house owners in Pune City to provide necessary information about their tenants to the police station. It includes details about the owner, tenant, and rental property. It ensures proper verification and record-keeping.

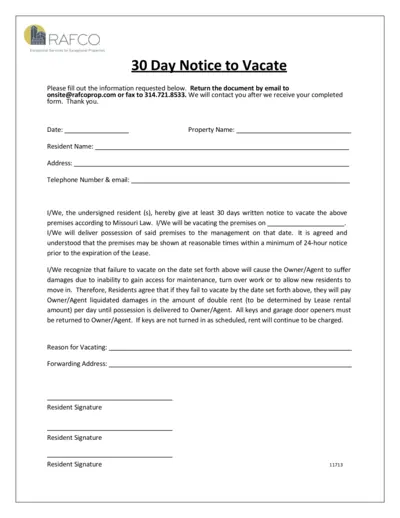

RAFCO 30 Day Notice to Vacate Form for Properties

This file is a 30-day notice to vacate form from RAFCO. It includes fields for property and resident information, as well as instructions for vacating the premises. It is intended to be submitted via email or fax.

Bubble Map Worksheet Template for Visual Learning

This Bubble Map file is a worksheet template designed for visual learning. It helps users organize thoughts and ideas through bubbles and connections. Ideal for students, educators, and professionals.

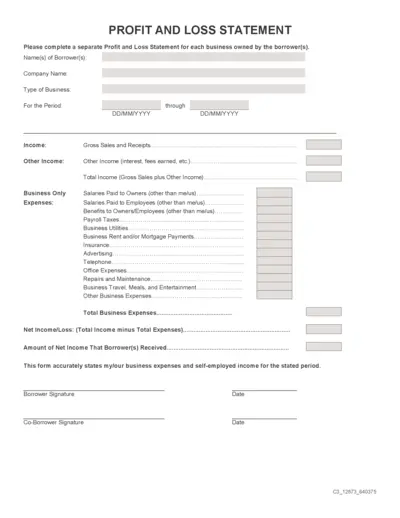

Profit and Loss Statement for Business Owners

This file is a Profit and Loss Statement that needs to be filled out for each business owned by the borrower(s). It includes sections for income, expenses, and net income or loss. The form requires signatures from the borrower(s) to verify the accuracy of the information.

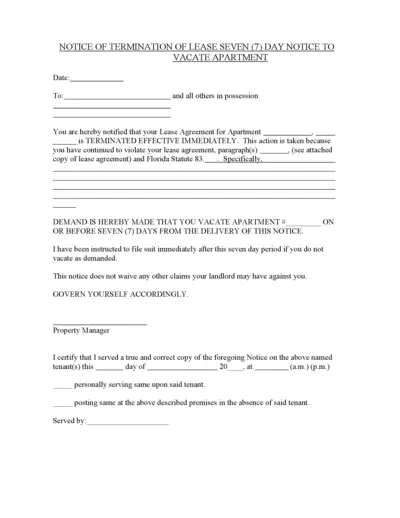

Notice of Termination of Lease - Seven Day Notice

This document serves as a Notice of Termination of Lease. It is used to notify tenants that their lease agreement is terminated immediately. The tenant is required to vacate the premises within seven days.

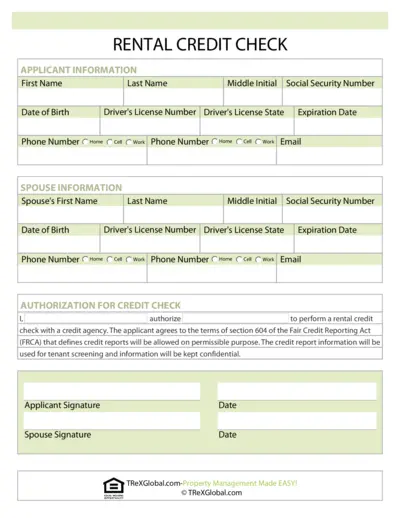

Rental Credit Check Authorization Form

This document is used to authorize a rental credit check for potential tenants. It requires personal information for both the applicant and their spouse. It ensures compliance with the Fair Credit Reporting Act (FCRA) for tenant screening purposes.

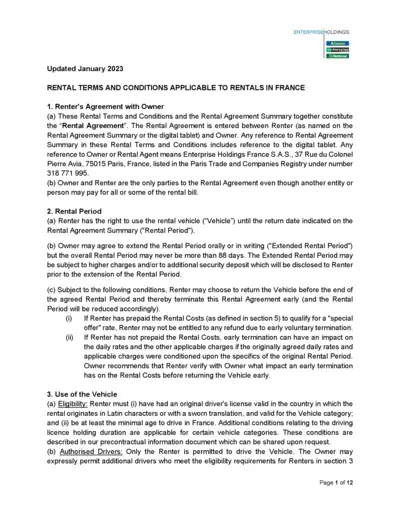

Rental Terms and Conditions for France Rentals - January 2023

This document outlines the rental terms and conditions applicable to car rentals in France with Enterprise Holdings, Alamo, and National. It includes details about the rental agreement, rental period, vehicle usage, main obligations, and more. It is essential for anyone renting a vehicle in France with these companies to understand their rights and responsibilities.

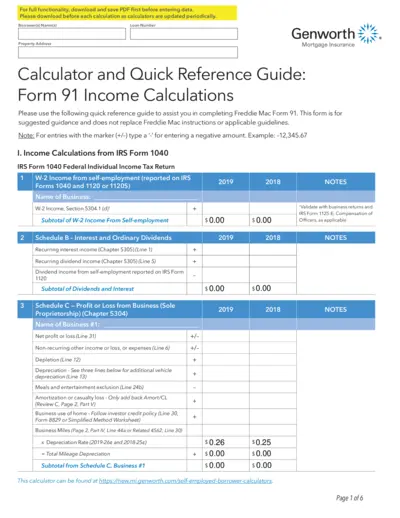

Freddie Mac Form 91 Mortgage Insurance Calculation Tool

This PDF is a guide for completing Freddie Mac Form 91. It includes instructions for calculating income from various sources. The guide also details how to use the Genworth Mortgage Insurance Calculator.

Health Informatics Practicum Thank You Letter Template

This file is a thank you letter template for a practicum experience in Health Informatics. It helps users express their gratitude for the opportunity and the learnings gained. The letter highlights the user's appreciation for the staff and the professional experience.

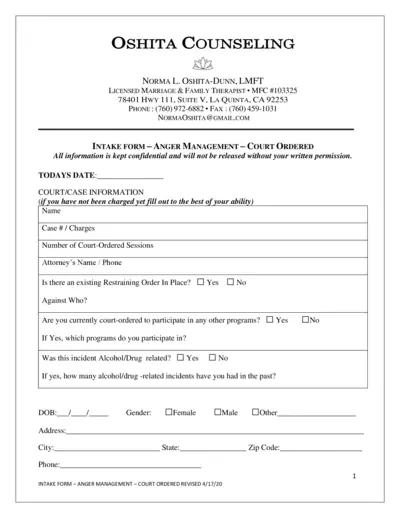

Court-Ordered Anger Management Intake Form

This intake form is designed for individuals required to complete anger management sessions by court order. It collects personal, legal, and psychological information to help therapists provide appropriate therapy. Confidentiality is ensured.

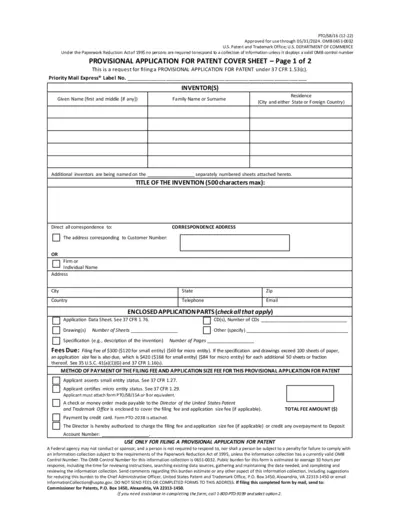

Provisional Patent Application Cover Sheet - Instructions

This file is a cover sheet for a provisional patent application under 37 CFR 1.53(c). It includes inventor details, invention title, correspondence address, fees due, and payment methods.